ASX surges on Chinese outlook, Ukraine talks, tech rally continues

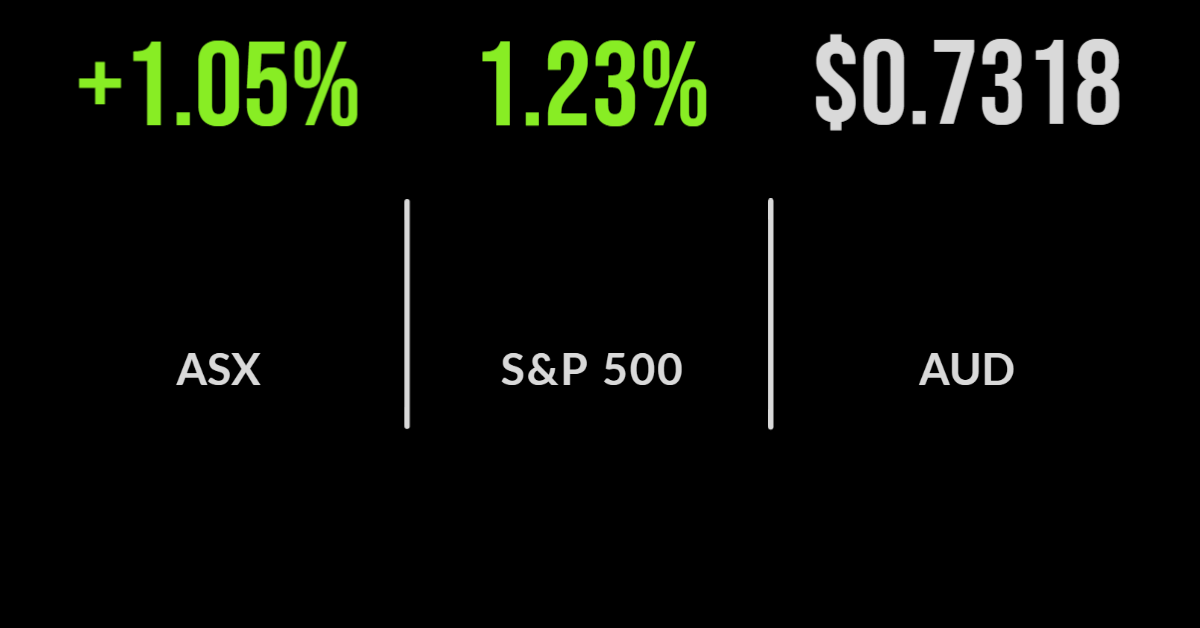

It was another strong day for the local market with the S&P/ASX200 gaining 1.1 per cent primarily due to a strong global lead.

The Chinese Hang Seng continued its strong recovery gaining close to 6 per cent in a single session, further boosting the domestic technology sector which gained 3.6 per cent.

Industrials were next best up 1.2 per cent with the likes of Block (ASX: SQ2) and Zip Co (ASX: Z1P) gaining around 10 per cent each and Magellan (ASX: MFG) adding another 6.6 per cent due to its significant fund investments in Alibaba (NYSE: BABA) which gained another 30 per cent overnight.

The only detractors were the more stable defensive sectors, including utilities and non-discretionary retail with GrainCorp (ASX: GNC) and Metcash (ASX: MTS) reversing by 2.8 and 1.3 per cent.

Shares in defence contractor Electro Optic Systems (ASX: EOS) were 6.8 per cent higher after management confirmed they were considering funding and strategic options, potentially the sale of parts of their business, following a difficult few years for the share price.

Ampol (ASX: ALD) has received positive news on their acquisition of Z Energy in New Zealand, with shares gaining 3.6 per cent after the domestic competition watchdog approved the deal following confirmation of their sale of the Gull business.

Transurban not exposed to fuel prices, unemployment falls to a decade low,

Macquarie’s research team has allayed fears that Transurban (ASX: TCL) may be exposed to a higher fuel price sending drivers onto public transport suggesting the evidence of a reduction was ‘scant’.

Their research highlighted a negligible correlation between fuel prices and traffic, albeit the fuel price has rarely risen by 40 per cent in such a short period of time; shares gained 2.1 per cent.

Australia’s unemployment rate has reached a 14 year low of 4 per cent in February with another 77 new jobs created; the last time unemployment reached this level was in 2008 amid the Global Financial Crisis.

It remains to be seen what will happen when international workers return and whether wage increases are sustained within businesses rather than for those just changing roles.

The CEO of salary packaging provider McMillan Shakespeare has retired after eight years in charge, shares gained 3.8 per cent on the news.

Market rebound continues, oil above US$100, Bank of England hikes rates

The Federal Reserve led rally this week has continued into Thursday with all three benchmarks finishing higher once again.

The Nasdaq continues to outperform despite the threat of higher rates, up 1.3 per cent, with the S&P500 and Dow Jones up 1.2 and 1 per cent respectively.

The energy and financials sectors, traditional beneficiaries from higher rates, were key drivers whilst Occidental Petroleum (NYSE: OXY) jumped nearly 10 per cent after Berkshire Hathaway (NYSE: BRK.A) increased their investment in the company.

Shares in Alibaba (NYSE: BABA) weakened after a torrid short-term run, down 4 per cent and the oil price surged another 7 per cent to move above US$100 once again.

The Bank of England raised interest rates again, now at 0.75 per cent, in an effort to stave push back on inflation that has remained over 5 per cent.