-

Sort By

-

Newest

-

Newest

-

Oldest

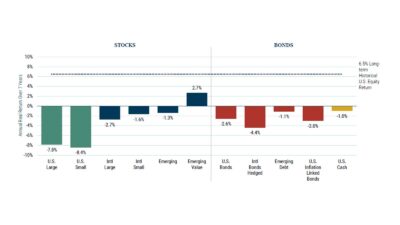

GMO has released its latest borderline-apocalyptic seven-year forecast for stocks and bonds as it warns clients to “concentrate assets where the bubble ain’t”. GMO’s extraordinarily bearish forecasts predict a negative annual real return over seven years across the majority of both stocks and bonds, with only emerging markets value stocks getting a positive, if slim,…

GMO has hit back at critics of its bearish seven-year forecasts, saying “great companies with great narratives can still experience price movements that are too great”. GMO compared asset class forecasts from the seven-year period leading up to March 2000 with forecasts from 2014 onwards, noting that asset prices have both grown around 70 per…

Index operators could face tighter regulatory controls in the US after a major provider copped a multi-million dollar fine last week. In a settlement announced last Monday (May 17), the Securities and Exchange Commission (SEC) fined S&P Dow Jones Indices (S&P DJI) US$9 million (A$11.6 million), alleging a hidden feature in one of the firm’s…

Value managers are hopeful that, following the second consecutive quarter of the factor’s outperformance, their world has returned to normal. Value may well be back. For the March quarter, for Australian shares, the S&P/ASX 200 value factor index was up 8.50 per cent, making a 12-month return of 42.71 per cent. The S&P/ASX 200 growth…

State Street Global Advisors will sharpen its ESG efforts on climate change and corporate racial diversity in 2021, adopting a more activist approach with investee companies. In a letter to major global corporations this month (January 11), Cyrus Taraporevala, SSGA chief, says the US$3.1 trillion manager will use its financial clout to pressure companies to…

ASX struggles higher, rates on hold, giant gold merger, US stocks fall The ASX 200 (ASX:XJO) struggled to a 0.3% gain on Tuesday, the energy, +2.3%, and materials sector, +1.1%, the key contributors. The biggest news was the ‘merger of equals’ between Australian gold miners Saracen Minerals (ASX:SAR) and Northern Star Mining (ASX:NST). The merger…

The S&P 500 Index reached a historic high on February 19th of this year, only to break that record less than six months later. On its face this sounds reasonable, however when considering the unprecedented nature of the events that transpired in-between, this is downright shocking. Over this six-month period the S&P 500 realised its…

While the active versus passive debate rolls on, and on, across the investment world, some active managers have gone to the ‘dark side’, at least partially, by adding more quantitative inputs for new strategies, such as thematic investing. The concept of ‘thematic’ investing, which describes the strategy of identifying sectors of the economy expected to…

Financials, miners hit as the second wave hits Europe, RBA guidance, strong open ahead The ASX 200 (ASX:XJO) fell to a three month low on Tuesday, down 0.7%. The sustained sell off has been driven by signs of a second wave engulfing Europe and the potential for another round of economic restrictions. Materials (-0.2%) was…

ASX 200 ekes out a gain, tech profit taking continues, Trump bans WeChat Global markets continued their negative trend on Friday, the ASX 200 (ASX:XJO) falling 0.3%, but managing to finish the week up a solitary 5 points; outperforming most global markets. It was a similar story in the US, with both the Nasdaq and…