-

Sort By

-

Newest

-

Newest

-

Oldest

The first day of a new interest-rate environment was a slight downer for the Australian share market, with the benchmark S&P/ASX 200 easing 11.5 points, or 0.2 per cent, to 7304.7 points. The gauge has lost 1.8 per cent this week, to be down 1.9 per cent since the start of the year. The S&P/All…

The first interest rate hike in Australia in 11-and-a-half years took centre stage on the Australian markets yesterday. The Reserve Bank of Australia (RBA) lifted the cash rate by 25 basis points, or 0.25 percentage points, taking it to 0.35 per cent, and signalled that more rate rises were ahead, as the central bank seeks…

The domestic market continues to outperform our global peers, with the S&P/ASX200 gaining 1.1 per cent on Friday, but still finishing the week 0.5 per cent lower. Every sector was higher, led by technology and communications which gained 2.2 and 1.9 per cent, and nine of the market’s 11 sectors gained more than 1 per…

The local sharemarket followed a weak global lead, falling 0.8 per cent on Wednesday but with the fear spreading to broader sectors of the market. In the opposite to yesterday’s trade, energy and utilities outperformed gaining 1 and 0.6 per cent respectively, with the materials sector also benefitting from a breather on Chinese selling. Whitehaven…

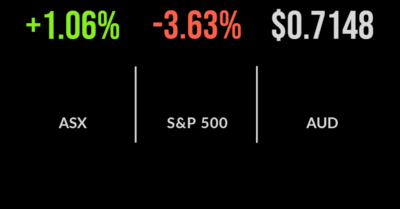

News that Beijing was set to follow Shanghai into massive lockdowns to avert the threat of Omicron sent global share markets into a shockwave in this shortened week. The S&P/ASX200 fell another 2.1 per cent with every sector lower, led by the materials and energy sectors which fell 5.1 and 4 per cent respectively. The…

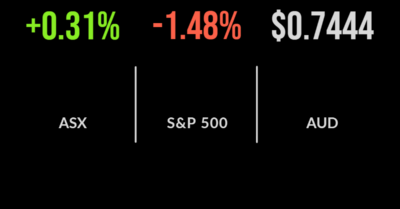

It was another positive day for the local sharemarket with retreating bond yields and more positive stock-specific news sending the S&P/ASX200 another 0.3 per cent higher. In a surprising turn, both the materials and technology sectors underperformed, down 2.6 and 1.6 per cent respectively, while the real estate and industrial sectors added over 2 per…

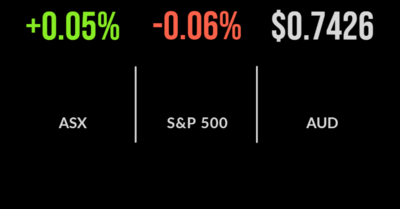

It was a flat day for the local bourse, with the S&P/ASX200 managing to deliver a gain of just four points or 0.05 per cent as the dualling pull of falling commodity prices and a surge in healthcare offset each other. The materials sector was down 1.5 per cent and energy 0.6, with every other…

The shortened week has begun positively with the S&P/ASX200 gaining 0.6 per cent despite lower-than-normal volumes. The release of the RBA’s policy meeting minutes dominated the conversation with commentary around the proximity of rate hikes now suggesting they will come sooner rather than later. The result was the perceived ‘inflation hedges’ within the market outperforming,…

It was another weak day for the local market with every major sector falling on Tuesday and dragging the S&P/ASX200 down another 0.4 per cent. The primary driver remains the oil price, which fell by 4 per cent, and the surging bond yields impacting valuations. This trend has benefitted the gold mining sector which contributed…

It was another volatile day for the S&P/ASX200, with the market trading significantly higher before reversing gains to finish up just 0.1 per cent. The market and individual sectors continue to diverge on a daily basis as the pressure of the 10-year Australian government bond yield impacts valuations very differently. The financial and banking sector…