-

Sort By

-

Newest

-

Newest

-

Oldest

The association of Superannuation Funds of Australia is still on the hunt for a chief executive to replace Martin Fahy, but has turned to the former CEO of Spirit Super to shoulder the load in the meantime.

The prudential regulator is “rigorously targeting” areas of non-compliance it identifies during its massive study of cyber resilience among banks, insurers and superannuation trustees.

Active Super and Vision Super will press ahead with a merger that will “lower costs and improve member services” in a sign of the times for smaller super funds.

Rest has brought on former Colonial First State executive director for investments Scott Tully and Spirit Super’s Paul Docherty to get a “fresh set of eyes” on its investment options.

As homegrown competition intensifies and offshore players eye Australia’s retirement savings, the industry funds are now “frenemies”. Reinvigorating the collaborative model will be the key to their survival.

The first thing funds usually consider in a merger is cost to member – but that won’t necessarily be what leaves them better off. The trick is getting the alignment right. According to David Carruthers, senior consultant and head of the members solutions group at Frontier, the top priority for any fund considering a merger…

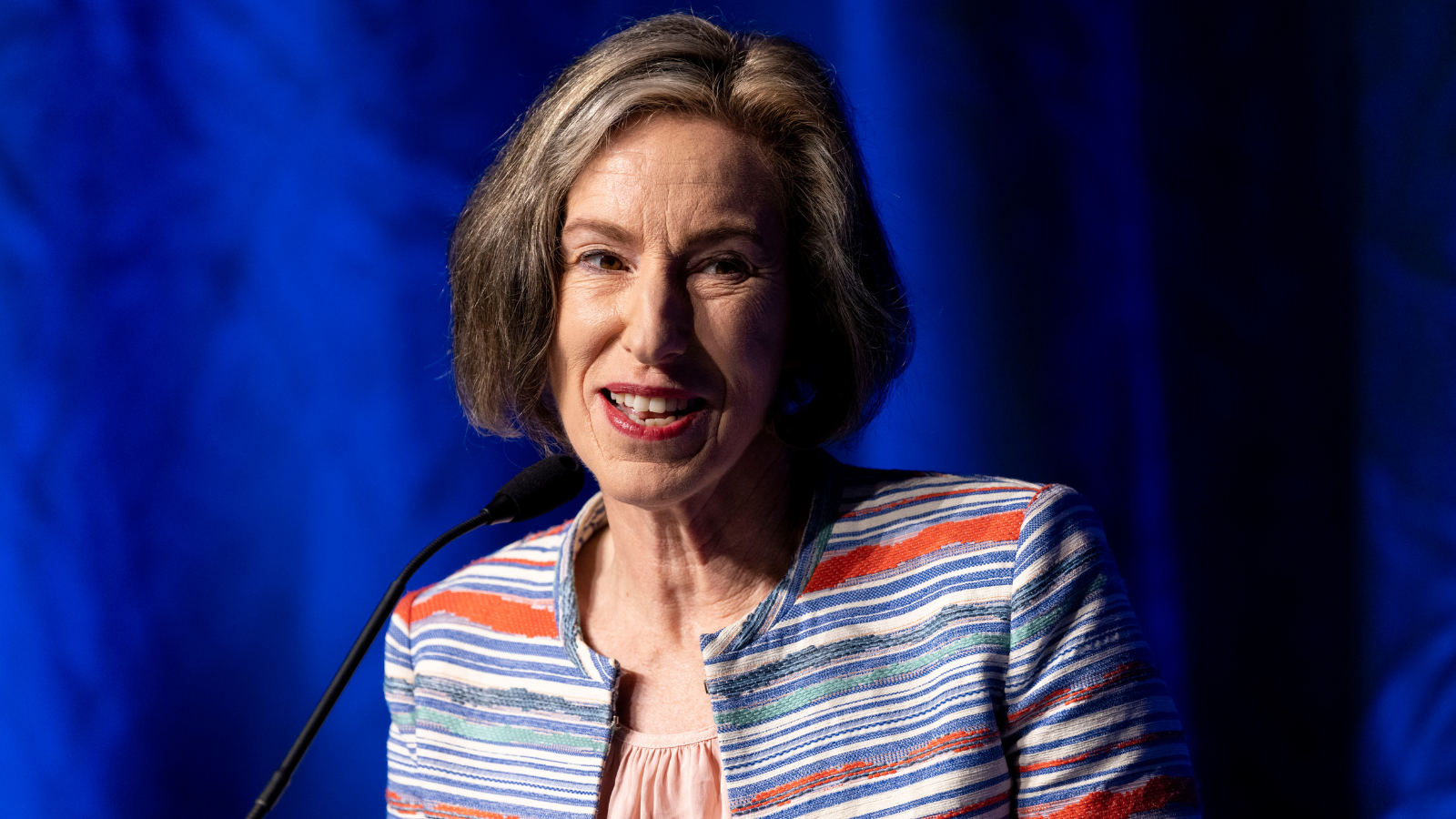

It’s approaching orthodoxy that a merger is always in the best interests of members. But is bigger always better? What is the true price of scale? Leeanne Turner, Spirit Super’s inaugural chief executive, told a CMSF audience in May: “If you’re not considering a merger then you either have your head in the sand or…

KPMG believes $50 billion is about the minimum size for an APRA-regulated fund when the dust settles. Helen Rowell, the retiring deputy chair of APRA, believes it should be $30 billion. The figures were bandied about at the CMSF conference where mergers were discussed in some detail. Leeanne Turner, who has just been through one…

If APRA wants to continue to encourage super fund mergers the regulator needs to make some changes to how it goes about its approvals process, according to one chief executive who is going through the process of having a successor fund transfer (TFR). Speaking at last weeks’ annual ASFA conference (on February 11), Leeanne Turner,…