‘The gloves are off’: UniSuper, Jarden veterans launch one-stop investment shop

New superannuation-focused manager Playfair Asset Management was set up in response to the increasing competitive pressures created by Your Future, Your Super (YFYS) and the consolidation it’s wrought, and the fact that while internalisation turns super funds into better investors it’s sometimes a good idea to get a second pair of hands.

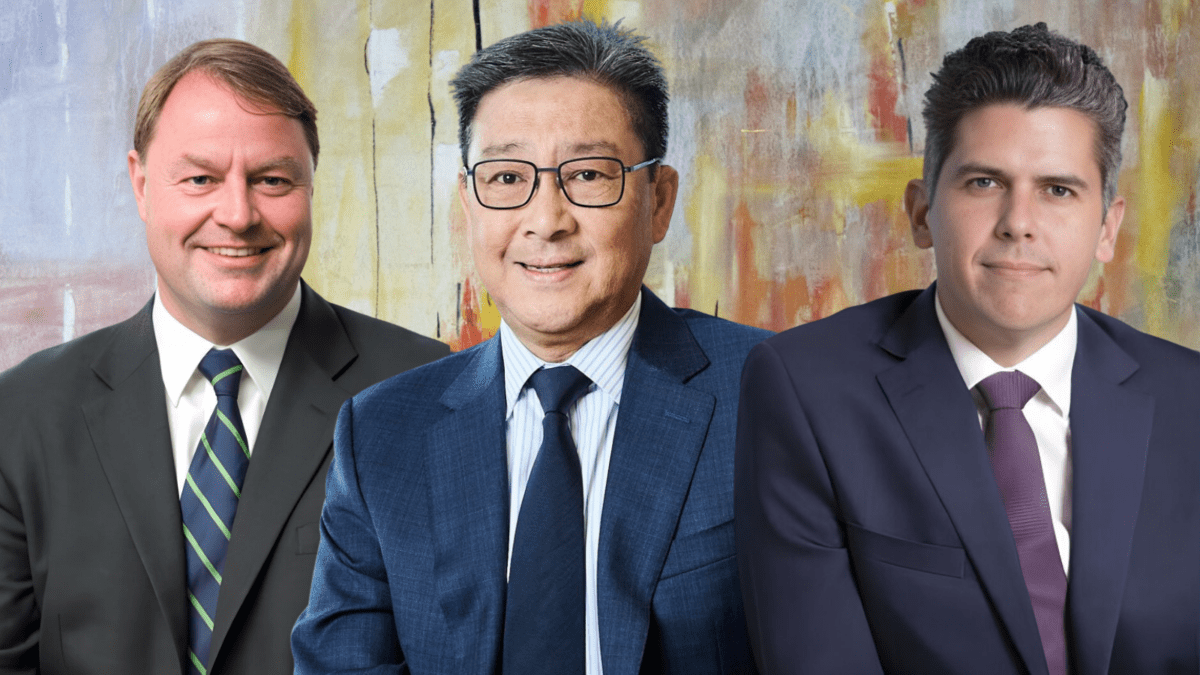

“The current environment is obviously evolving, and nobody is looking five or 10 years forward and seeing how the industry looks then,” Playfair co-CIO Mark Himpoo (top centre) told ISN. “Whether it’s megafunds or a handful of mid-cap funds, there’s capacity issues, and with all due respect there’s capability issues because everybody is competing. What YFYS is about is better outcomes for members, and that’s what we’re trying to align ourselves to.”

Himpoo and co-CIO Simon Hudson (top left) worked together at UniSuper for over a decade – Himpoo as senior manager for equities, Hudson as head of equities – and spearheaded the fund’s internalisation program before jumping ship to investment bank Jarden where, feeling increasingly “constrained”, they decided to cut the cord and set up their own shop with Jarden managing director Dane FitzGibbon (top right) as CEO and Stephen Ross as head of portfolio construction and risk.

“The gloves are off, and that’s putting a huge amount of pressure on investment committees and teams and boards,” Hudson says. “The whole world has become a lot more competitive and a lot more challenging, and that flows through to every part of a super fund.

“How do they stay competitive with performance? How do they keep their fees low? Most of them haven’t changed their model for 30 years. They’ve still got the same model, and a lot of them are coming up to capacity and scalability issues. There’s a real possibility that the industry will bifurcate into winners and losers.”

Key offerings will be domestic and international equities, with the team also in discussions with two senior portfolio managers. If funds do want to internalise, Playfair will help them down the path and eventually hand funds back over time as they build up their capabilities, while funds that are already heavily internalised can be provided with niche strategies that aren’t on offer in the market and which they’d find difficult to do themselves.

“We can tailor it by risk, we can tailor it by style, geography,” Himpoo said. “And more importantly we’ve structured our products to take the scale that a lot of external managers are unable to take. The reason we can do that is because we have the experience of what the buy-side offerings into super funds are and why they’re somewhat limited in their value.”

Playfair has so far been funded out of the principals’ pockets, but they’re in the process of lining up investors from the broader financial services world to take minority stakes in the business. Having spent the last six months sounding out the market, they’re also in discussions with a number of potential cornerstone clients, with several particularly interested in their capabilities in strategic stakes.

“That’s something that requires a lot of corporate engagement, potentially a different relationship and partnership between the super fund and the corporate itself, and that’s where we want to provide capital markets advice,” Himpoo said.

“That’s something UniSuper used to do that was a strong advantage over a lot of their competitors and where Simon and I had the experience from our buy-side years, where we did a lot of capital market transactions. But with the asset owner this transforms to a totally different level. If you look at the model today investment banks represent corporates and go to super funds to seek funding; what we believe is that at times super funds require representation outward to the corporates.”

While only a relatively small number of super funds have pursued investment internalisation, most are heading towards it in a move that Hudson believes will make them more agile and better at risk and liquidity management.

“The reality is that funds that internalise become better investors,” Hudson said. “Funds that internalise say that it’s not just about saving money – you’re so much more efficient when you internalise. But the bottom line is that you can become a better investor. There’s lots of different analogies, but think of any industry; you have your own IT department but you’ll get external advice. You have your own legal department but you’ll get external advice. That’s the best model, particularly as you get larger.”