Where’s the sense in a useless YFYS test?

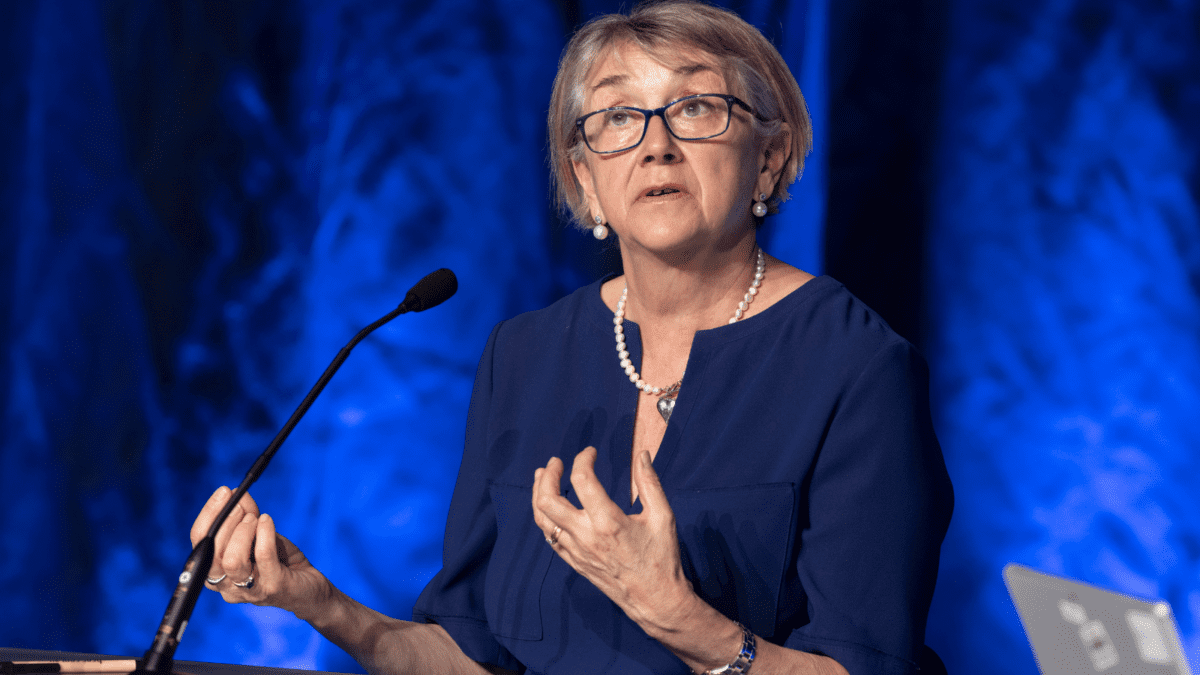

Last week, APRA deputy chair Margaret Cole announced a “pleasing” development in the long and troubled history of the Your Future, Your Super (YFYS) performance test: for the first time no MySuper products failed it. In fact, it’s likely that no MySuper product will fail it ever again. That’s because super funds are investing to the test parameters. That would be fine if those parameters were aligned with the interests of members.

But they (probably) aren’t. They encourage crowding – or rather, make it impossible not to crowd. They force long-term investors to adopt a short-term mindset, kneecapping their ability to invest in themes like the energy transition. They make it hard to implement discrete risk management strategies. And they wildly skew the incentives, so that funds are effectively rewarded – labelled ‘performing’ – for not adding value, or much of it, above the benchmark.

And nobody seems particularly keen for that to change. No politician wants to unwind consumer protections; the test has been beneficial for very big funds; and who’s to say a redesign would get it right? The fact that the original performance test was mad, bad policy doesn’t exactly inspire confidence in the people who designed it.

YFYS, then, is like a landmine from an old war. Everybody knows exactly where it is, and they aren’t going to step on it, but nobody wants to actually go over there and disarm the damn thing. They might get blown up – and it’s occasionally useful for keeping undesirables out.

That doesn’t mean funds can’t add value for members within YFYS’ constraints. The growing movement towards lifecycle investing – and belief in the concept of “temporal diversification” – shows that it’s possible to improve member outcomes without treading on the landmine.

But all of the arguments about YFYS and what should be done with it can be boiled down to a simple question with a hard answer: what does the superannuation industry – and its regulators and policy makers – owe members?

If it owes them low fees and an index-like return (and John Bogle would tell you there’s nothing wrong with that) then YFYS is fit for purpose, though that would call into question what these many thousands of superannuation investment professionals are doing all day and why we aren’t all in a single national default fund with the same largely passive structure adopted by Norway’s Government Pension Fund. But if it owes them more – a superannuation system that is innovative and can take risks, adopt more value accretive investment strategies like the total portfolio approach, or think further than the next 12 months – then the test must function differently.

But even if that question were to be answered, a fulsome YFYS redesign would still be up against industry inertia, political short-termism, and design risk. Not to mention plain old self-interest – and you should never bet against that.