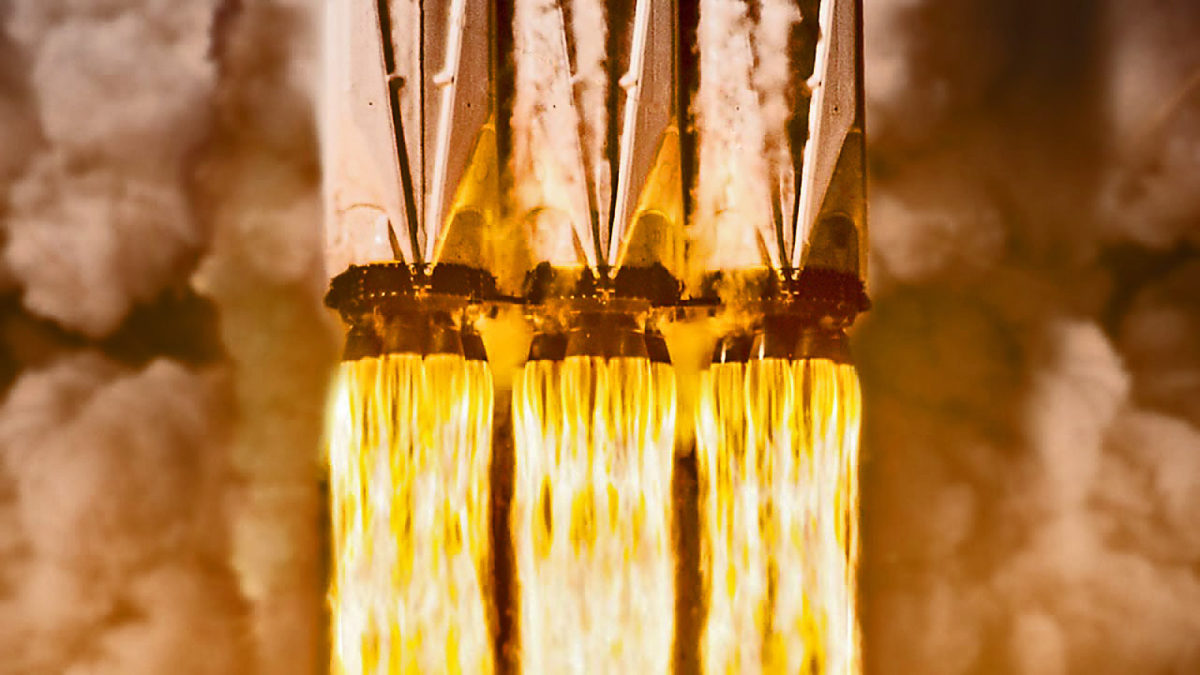

Lendi Listing Looks for Loan Liftoff

Another fintech is heading for the ASX screens, with online mortgage provider Lendi poised to push “go” on an initial public offering (IPO) that could see it list at a market capitalisation of between $500 million-$550 million.

Lendi specialises in the home loan market: its software platform matches borrowers with more than 35 lenders. The Lendi platform combines an application system with the services of a mortgage broker, processing your details and matching you with loan options from its panel. If you’re willing to enter information about your income, debts, liabilities, credit cards, and expenses – for example, payslips and bank statements – plus verify the deposit amount you have saved, Lendi can essentially pre-qualify you for a home loan.

Lendi’s technology looks at your preferences and chooses the “right” home loan for you. Its “approval confidence technology” shows in real-time the loan options for which you are likely to be approved, further saving you time.

That’s the pitch. It’s an end-to-end online property search and finance platform, with an application process that uses data inputs and algorithms to provide consumers with loan options, and also facilitates online advice, phone calls, web chats or customer visits.

All of this is free to the user – Lendi gets paid by lenders, so it does not charge the borrowers that use its platform.

The company competes with traditional mortgage brokers, direct lending by banks and newer non-bank lenders and online brokers such as the Westpac-backed uno.

However, on the other side of the platform, mortgage brokers can join Lendi and get access to its customer base across Australia; the brokers can have Lendi’s sales and marketing team take care of customer pre-qualification and appointment setting, and its “back-office” team of client solutions experts take the brokers’ deals all the way from submission to settlement, allowing them to focus on building their loan “books” and better managing the customer journey.

Lendi has become the online mortgage market leader, with a market share of about 90%.

The company has recently been reported as having been pitched to fund managers as a $4 billion revenue opportunity, based on the $346 billion Australian annual mortgage market and commission rates, and being well-placed to digitise and integrate everything to do with home loans.

Lendi told fund managers it had settled more than $12 billion of loans since inception and had $7.5 billion under management, with revenue from its core business climbing above $40 million.

It said its typical customer had a $452,000 loan for an owner-occupied home, was geared at a 64.8% on a loan-to-value ratio (LVR) basis and was based in NSW, Victoria or Queensland.

Lendi said its transactions were also much more likely to be taken-out to refinance an existing loan (82%) than purchase a property, and it was likely that refinancing was replacing a loan taken out directly with a bank. Its customers were also most likely to be in the 40-to-50 age-bracket.

While Lendi is the company’s core business, the group also has stakes in two joint ventures; Domain Home Loans, which integrates Lendi’s digitised home loan platform with Domain’s digital property search engine – which gives it access to Domain’s 3 million-plus property audience – and OneTwo, which is in conjunction with Lendi shareholder ANZ Banking Group.

Lendi’s shareholders include its founders, Macquarie, ANZ and a group of institutions such as UniSuper, LHC Capital, Regal, Bailador, Tribeca and Perennial.

The Lendi business is often compared with non-bank lender Plenti, which had an underwhelming debut on the stock market last week when its shares, which had been issued at $1.66, tumbled to $1.30 on the first day of trading (Wednesday), and traded at $1.17 on Thursday before recovering: PLT now trades at $1.28.

But Plenti (the former RateSetter) had a government investigation into its relationship with the Clean Energy Finance Corporation (CEFC), under which it funded consumers into the cost of the battery component of solar and battery installations, hanging over it – the report has been received by the federal Energy Minister, but not yet released – and it is a different business, actually making loans, whereas Lendi is merely a platform that connects borrowers with lenders.

Plenti is targeting growth in the markets for car loans, renewable energy loans, and personal loans. Car financing is the fastest-growing part of its new lending: the automotive finance market is worth more than $30 billion a year in new loans, and is bigger than the credit card market.

Until we see concrete numbers from Lendi’s prospectus, we can’t say too much on its prospects, except to make the general point that its business will benefit from the government’s lending reforms announced last week, which are designed to make it easier for consumers and small business owners to get bank loans. To do so, the government effectively ditched the “responsible lending” laws introduced after the GFC, to get credit flowing, so that more individuals can buy their own homes, and more businesses can spend more money, to stimulate the economic recovery that the nation needs.

This is great news for the newer, smaller companies that are aiming to beat the banks at their own game and offer competitively priced loans, that are faster, cheaper, and more accessible than those from traditional banks. Lendi benefits by linking borrowers with these, as well as the traditional banks, in what is a borrower’s market for the digitally savvy.