-

Sort By

-

Newest

-

Newest

-

Oldest

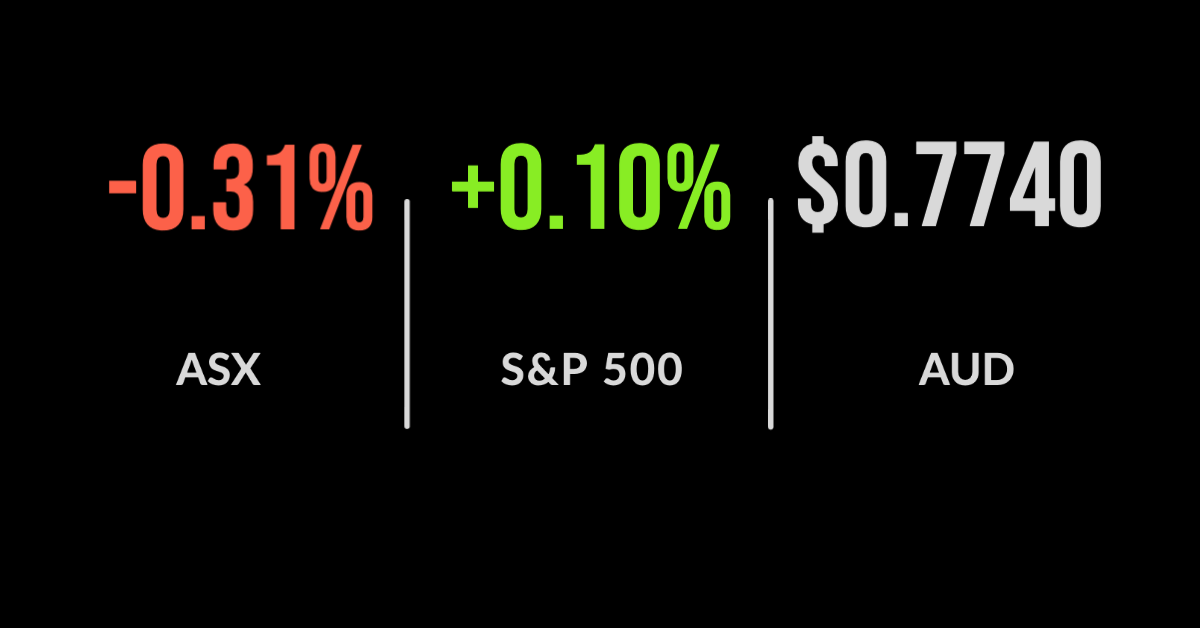

ASX falls on grocery retailers, Chinese business inflation hits record, Brickworks jumps on property The ASX 200 (ASX: XJO) fell 0.3% on Wednesday, driven lower by the consumer staples sector, which was down 1.4%. The majority of the weakness came from Coles (ASX: COL) and Woolworths (ASX: WOW), with the latter down 1.9% as the rotation away from defensives continued. Only…

ASX breaches 7,000, record highs all around, Westpac hit with ASIC case The ASX200 (ASX:XJO) delivered another positive day, finishing 1.0% higher spurred on by an improving global economic outlook. Market sentiment is overcoming growing issues with the vaccine rollout and risk of mutations, with materials the biggest beneficiary jumping 1.8% behind BHP (ASX:BHP) and Rio Tinto (ASX:RIO) both of which…

Brisbane lockdown hits ASX, Afterpay (ASX:APT) falls to three month low, travel stocks struggle The ASX200 (ASX:XJO) gave up a strong opening on US stimulus, ultimately finishing 0.1% lower after the Queensland Government announced a three-day lockdown of the city after community transmission of the UK COVID-19 variant was confirmed. The retail sector fell on the news, with Webjet (ASX:WEB)…

ASX200 lower on bond rates, Crown (ASX:CWN) to face commission, Costa Group (ASX:CGC) boosted by avocados The ASX200 finished 0.2% lower on a mixed day for the market, with resources and materials leading the way adding 2.6% ahead of a bumper dividend season. Most of the weakness came from the healthcare and IT sectors as the 10-year…

ASX 200 falls 0.4%, China flags iron ore concerns, Vicinity (ASX:VCX) confirms dividend A weak global lead pushed the ASX200 (ASX:XJO) down 0.4% today, with the China Iron and Steel Association flagging concerns about the ballooning iron ore price at the same time that maintenance hit export volumes in November. BHP (ASX:BHP) and Fortescue (ASX:FMG) bore the brunt down 2.3% and 3.1% respectively. Yet…

Longest winning streak since July, go slow at Transurban (ASX:TCL), Zip (ASX:Z1P) up 9%, US markets continue to creep higher The ASX 200 (ASX:XJO) has delivered its longest winning streak since July, finishing 1.1% higher as the budget stimulus continues to reverberate through markets. The announcements have been well received by the corporate sector, despite several shortcomings….

ASX budget bounce, a long list of winners, IPOs closing in, US markets hit one month high The ASX 200 (ASX:XJO) overcame a weak lead form the US to deliver its strongest budget bounce since 2002, jumping 1.3%. It will likely take several weeks to digest the true implications of this budget, particularly those sectors that…

One of the great investment success stories of the last 25 years has been the exchange-traded fund (ETF), which got under way in the early 1990s as a vehicle offering access in one listed stock, to the entire stock market through tracking an index. Gone were the worries of paying “active” management fees and failing…

ASX opens weaker, travel rallies on Tasman bubble, strong open ahead The ASX 200 (ASX:XJO) finished 0.2% lower to open the week, increasing the likelihood of the first negative month since March. The real estate of A-REIT sector was among the few positives, with Scentre Group (ASX:SCG) and GPT Group (ASX:GPT) finished over 2% higher…

Another fintech is heading for the ASX screens, with online mortgage provider Lendi poised to push “go” on an initial public offering (IPO) that could see it list at a market capitalisation of between $500 million-$550 million. Lendi specialises in the home loan market: its software platform matches borrowers with more than 35 lenders. The…