New post-COVID peak as ASX breaks through 7000

ASX200 breaches 7,000 points, Zip Co raising $400m, Woodside gets new CEO

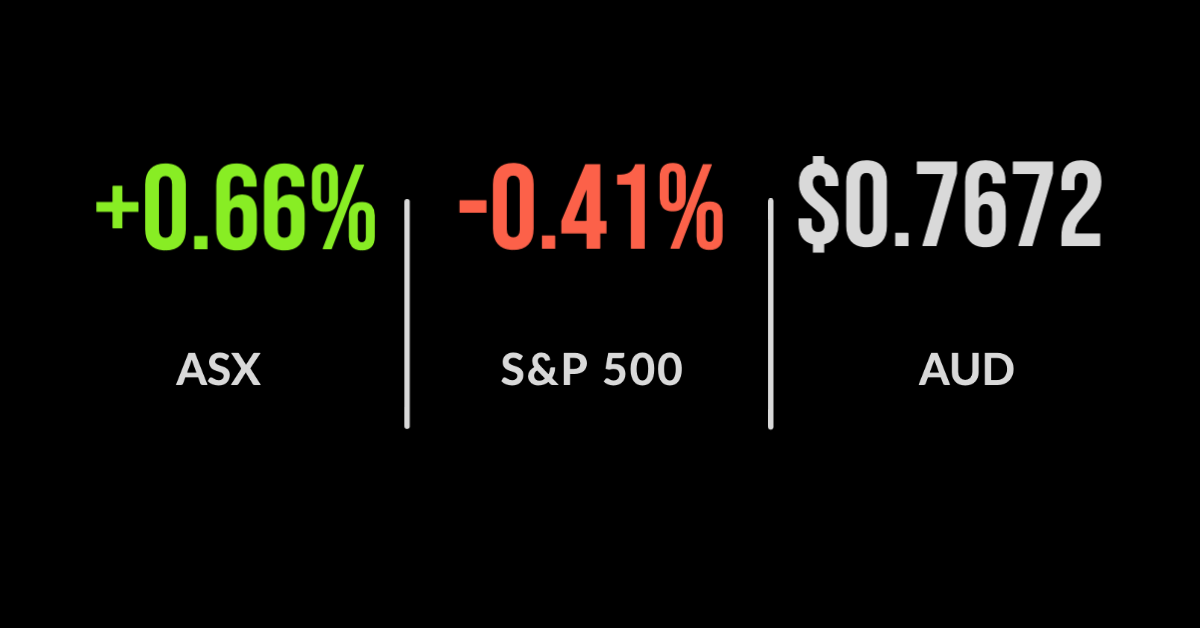

The ASX200 (ASX:XJO) finally breached the 7,000 point mark, adding 0.7% in today’s session with IT, healthcare, and materials once again the leaders adding 2.1%, 1.3%, and 1.2% respectively.

The iron ore sector gained despite an apparent slowdown in Chinese demand, with gold miners taking off following news of a higher-than-expected inflation result in the US.

Resolute Mining (ASX:RSG) was the standout jumping 14.9% after the Ghanaian Government reversed its decision and reissued the company’s mining license.

Newcrest (ASX:NCM) was another beneficiary, up 4.1%, as the gold price rose and the AUD weakened.

Ramsay Healthcare (ASX:RHC) is said to be on the lookout for acquisitions, reportedly partnering with private equity firm Pacific Equity Partners in a bid for Healthe Care’s private hospital portfolio, shares added 0.5%.

Woodside (ASX:WPL) shares fell after announcing that head of development and marketing, Meg O’Neill would be acting CEO after the incumbent Peter Coleman brought forward his retirement date.

Origin green hydrogen takes another step, consumer confidence on high

Consumer confidence followed yesterday’s business confidence result, hitting an 11-year high according to the Westpac-MI survey.

The result was 188.8 points up from a trough of just 75.6 in April 2020. The strong recovery and economic support have clearly been key to confidence, the question is whether savings rates will be converted to retail spending in the second half of the year.

Zip Co (ASX:Z1P) entered a trading halt late in the day, ultimately announcing a $400 million convertible note issue.

The group is seeking to welcome new strategic institutional investors onto the balance sheet, with the founders selling down.

Convertible loans are quite popular in the US for tech companies as they allow management to retain control without the servicing costs and restrictions associated with long-term debt.

Origin Energy (ASX:ORG) added 0.6% after announcing a deal with Townsville to expand and develop a plant to support the export of green hydrogen.

Markets fall from highs as reporting season ramps up, Louis Vuitton, investment banks smash expectations

US sharemarkets fell from record highs, the Dow Jones up just 0.2% on the back of strength in the investment banks with the Nasdaq and S&P500 falling 1.0% and 0.4% respectively.

Overnight the long-awaited IPO of crypto trading platform Coinbase(NYSE:COIN) finally occurred with the company initially jumping ahead of its listing price but ultimately finishing lower 10% lower.

France’s Louis Vuitton Moet Hennessy (EPA:MC) smashed expectations with revenues jumping 9% on the previous year on the back of strong US and Chinese demand.

The company is still digesting the purchase of Tiffany and Co, but their fashion and leather goods division, and key product lines, grew sales by 52% compared to 2020 and 37% on the pre-pandemic quarter; shares jumped 2.9%.

Both investment banks smashed expectations, delivering record profits on the back of huge growth in their investment banking or transactional income.

Goldman Sachs (NYSE:GS) reported a 73% increase and JP Morgan (NYSE:JPM) 46%. This supported a 14% increase in total revenue for the latter and quarterly profits of US$6.71 billion and US$14.2 billion respectively.