ASX closes lower as ex-div BHP drops 7%

Dividends drag market lower, record trade balance on commodities

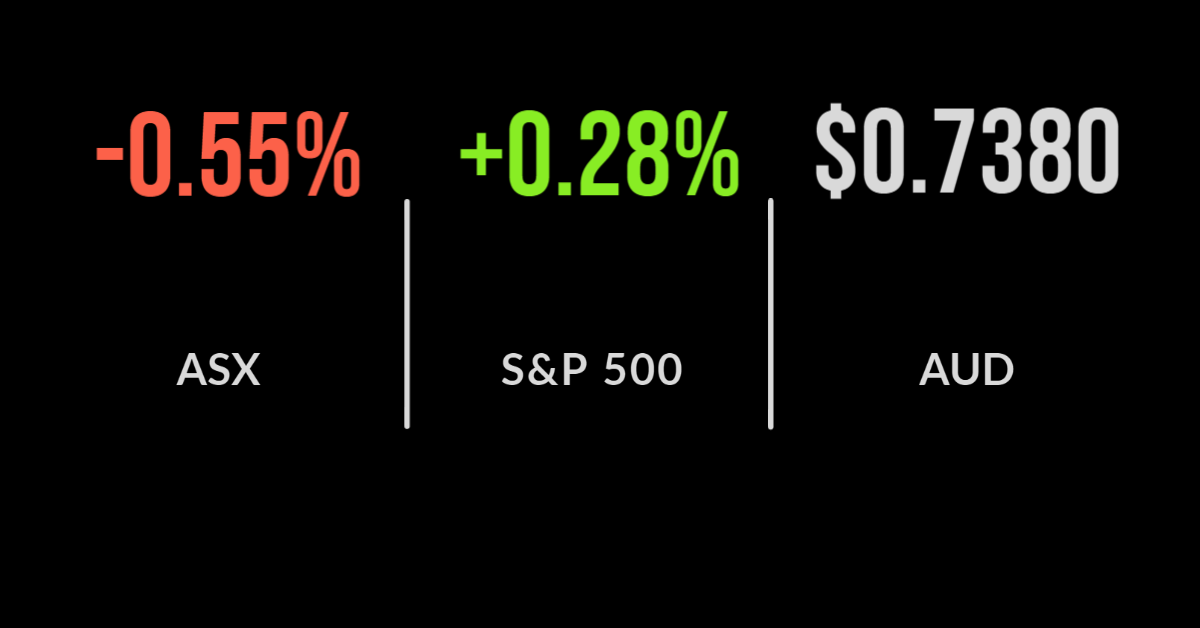

The ASX200 (ASX: XJO) finished around 0.6% lower as a swathe of dividend payments were extracted from the market.

On a second level it was broadly mixed with materials and mining falling 2.5%, whilst staples and healthcare were both down similarly, around 1% each.

The impact of dividend payments and ex-dividend dates remains widely misunderstood by many investors, with today the perfect example.

Shares in BHP Group (ASX: BHP) fell by 6.9% which equated to $3.09 cents per share, which naturally attracted headlines.

Yet the company was trading ex-dividend for a payment of $2.74 cents per share, which shareholders will receive in a few months’ time excluding, meaning the actual fall was just 35 cents per share or 0.7%.

It was the same story for Woolworths (ASX: WOW), down 63 cents with a dividend of 55 cents, and AGL Energy (ASX:AGL) falling 3%, which was less than the dividend payment.

The same story goes for managed and exchange traded funds which all distribute in June. There are rumours this week that GQG Partners, a $100 billion fund manager and one of the leading investors in the world may be listing their company via IPO on the ASX before the year is out.

Trade balance, Flight Centre turns to Japan, refinancing boom

Australia saw a record trade balance in July, hitting $12.1 billion with iron ore, coal and LNG powering the exports leaving our shores.

Behind the strength were two key themes, the first being the weakness in imports as borders remain closed and secondly, the boom in iron ore and coal prices in recent months.

This is set to come to an end though with the iron ore price down over 30% in just a few weeks, which is likely to put growing pressure on the economy.

Exacerbating this price fall was the Chinese Government’s well flagged decision to curb steel output as is typically the case around this time of the year.

Mortgage refinancing reached an all-time high in June, with $17.2 billion of loans refinanced, 60% month on month growth.

Consumers are clearly seeking to lock in lower interest rates or alternative release additional funds to support their lifestyle and business operations.

Flight Centre (ASX: FLT) was a rare winner, up 0.5%, after announcing an agreement with NSF Engagement Corp, a Japanese real estate agent who will support their entry into the domestic corporate travel market.

Management noted that there are green shoots in travel in both Europe and the US, but little positive news in Australia.

US markets at records, jobs data ahead, Apple jumps on App Store changes

All three US markets finished higher on Thursday, the Dow Jones up 0.4%, S&P 500 0.3 and the Nasdaq only slightly at 0.1%.

Apple (NYSE: AAPL) was a key contributor to the rally given it is the US’ largest public company. Shares finished around 1% higher after the group announced a loosening of restrictions on its App Store that will allow third party apps to avoid paying commissions to Apple for some in-app subscriptions.

It was a great day for the likes of Spotify (NYSE: SPOT) and Netflix (NYSE: NFLX) which were up over 6 and 1% respectively.

Sticking with the FANGS, Facebook (NYSE: FB) has been levied a US$267 million fine by the Ireland Government for breaking data protection rules, sending shares close to 2% lower.

Finally, Bill Gross, founder of PIMCO, has suggested those funds buying long-term US Government bonds today belong in the “investment garbage can”.