ASX closes 0.1% higher despite Fortescue fall

Market rallies on China hopes, Fortescue goes ex-dividend, Healthco spikes

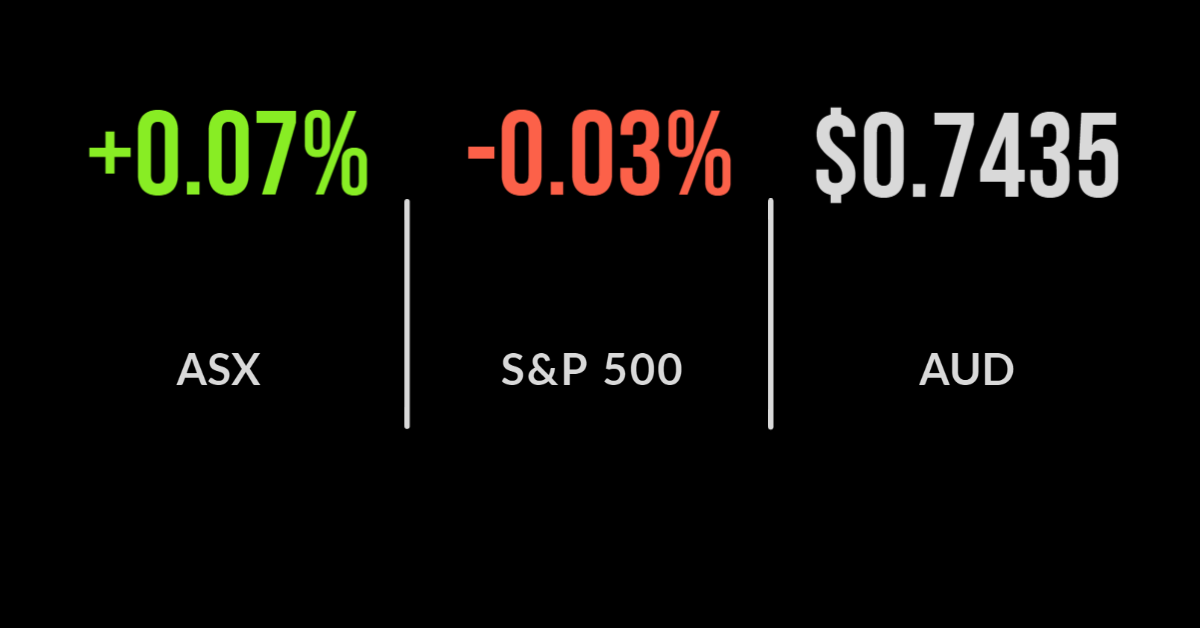

The ASX 200 (ASX: XJO) recovered from a loss of as much as 1% to register a five-point gain on Monday.

Fortescue Metals Group (ASX: FMG) was the biggest drag on the market, falling $2.28 or 11% after paying out $2.11 in cash as a special dividend.

A broader market rally with every sector but materials and energy finishing higher was enough to send the market into positive territory.

The afternoon bump came from news that the Chinese Government may be considering loosening monetary policy in response to signs of their slowing economy as the Delta variant hit growth and manufacturing.

Gold was a major winner, with Newcrest (ASX: NCM) adding 2.4%. Telstra Corporation (ASX: TLS) also added 1.3% after news emerged that CEO Andy Penn was visiting the PNG Government to discuss the acquisition of Digicel.

In a somewhat unexpected result shares in Home Co’s new Wellness Property Trust (ASX: HCW) jumped 16% on listing, which given it owns a diverse portfolio of property assets suggests they may have been undervalued in the float price.

Santos merger extended, Magellan assets up, BGH cuts Hansen bid, Soul Pats to double profit

Both Santos (ASX: STO) and Oil Search (ASX: OSH) fell by around 2% after announcing the extension of their exclusive due diligence discussions around a potential merger.

A slowing global economy continues to push the oil price lower. Magellan Group (ASX: MFG) saw retail assets under management increased just 0.3% in August on the back of stronger global markets, with institutional assets 1% higher, shares were still down 0.6%.

Aggressive private equity group BGH Capital pulled their offer for Hansen Technologies (ASX: HST) which provides billing and other software support to a diverse range of major businesses.

Shares fell 9.2% on the news. Washington H Soul Pattison (ASX:SOL) fell another 1.8% despite indicating they expect 2021 profit to double once again, based on the strong performance of a number of underlying investments.

Specifically, they highlighted the strong coal price as benefitting New Hope (ASX: NHC), along with copper miner Round Oak and Brickworks (ASX: BKW) which is benefitting from the Home Builder renovation boom.

US markets closed for Labour Day, Europe delivers best day in months

US market futures rallied on what was a strong day for European markets, with last week’s weaker than expected payroll data increasing hope that the Federal Reserve will be forced to delay tapering.

The Euro Stoxx was the strongest in six weeks buoyed by technology shares, whilst alumina miners are set to benefit from a price spike as unrest grows in Guinea.