ASX gains 0.5% as miners lift the market

Buyers emerge, base commodities rally, blue chips weaken

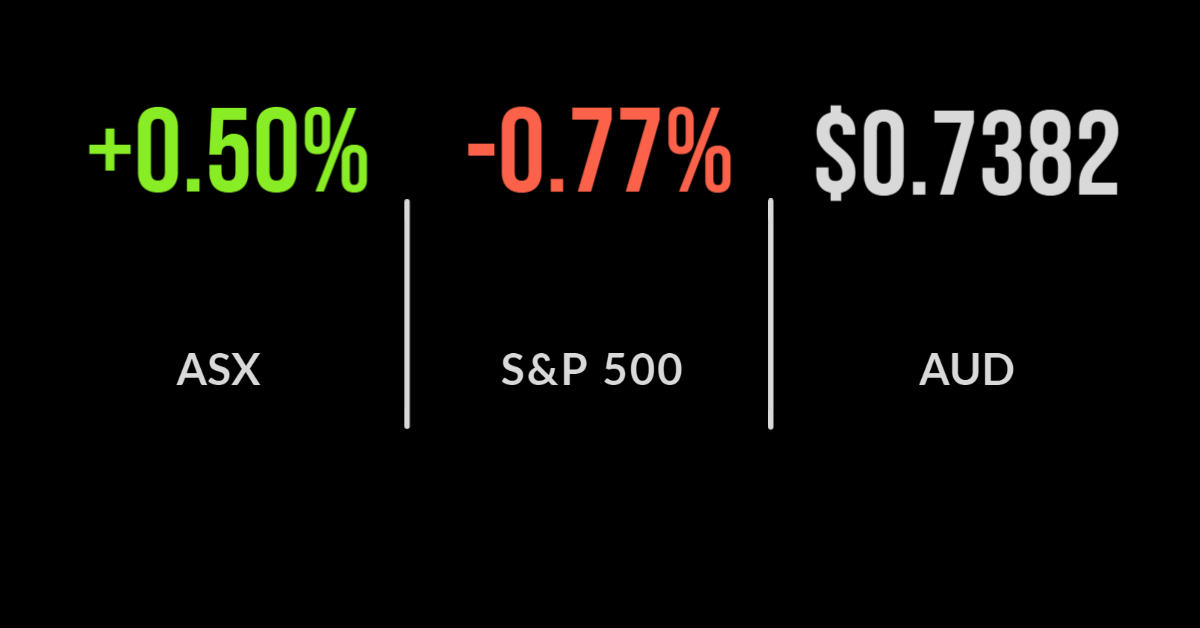

Dip buyers emerged on Friday after the week’s significant sell off with the S&P/ASX200 (ASX: XJO) finishing 0.5% higher.

Almost every sector was higher barring healthcare which fell 0.7% after outperforming on Thursday, but by far the highlight was another rally in base commodity companies.

Everything from aluminium to nickel and even uranium has seen buying pressure in recent months suggesting speculative activity is returning.

Alumina (ASX: AWC) finished 6.3% higher on Friday and 9.3% for the week as the military coup in Guinea sent the price of aluminium skyrocketing; likely a short-term impact.

Both Nickel Mines (ASX: NIC) and South32 (ASX: S32) were also stronger, finished 8.5 and 5.9% to the positive respectively.

The energy sector gained 1% after Oil Search (ASX: OSH) and Santos (ASX: STO) confirmed they had agreed terms on their merger.

Should the PNG Government approve the deal, OSHshareholders will receive 0.6275 STO shares with CEO Kevin Gallagher to remain in charge.

Across the week every sector finishing lower showing the impact of a single day sell off, with materials finishing 2.6% lower, property 2.5 and energy 1.9% down over the five days.

Fortescue (ASX: FMG) was the largest detractor, falling 12%, the majority of which was due to the large dividend payment.

Both BHP (ASX: BHP) and Rio Tinto (ASX: RIO) fell 2.6 and 4.6% respectively as the iron ore price continued to weaken with Technology One (ASX: TNE) the top performer, jumping 11.2%.

US markets weaken on weakening outlook, Apple drags S&P500 lower, cases rocket higher

US markets finished lower on Friday, both the Dow Jones and S&P 500 were 0.8% lower with the tech-focused Nasdaq underperforming again, dropping 0.9%.

Investors continue to tentatively balance the threat of inflation and tapering of bond purchases with the potentially more concerning chance that the US economy will slow significantly.

The country is averaging over 150,000 new cases a day yet only 53% of the population is fully vaccinated according to MarketWatch.

Despite mandates from the President all but forcing the public and private sector to require vaccinations the threat of lockdowns and a further weakening in the ‘reopening’ trade stands out as a significant risk.

All three major indices were lower for the shorter four-day trading week with the Dow Jones weakest, down 2.2% due to its reliance on energy and financial companies.

The S&P500 and Nasdaq both fell 1.7% with Apple (NYSE: AAPL) a major drag. Shares in Apple fell over 3% on Friday after a court delivered a mixed decision following Epic Games complaints about the restrictions placed around their App Store.

The decision removes restrictions on how app developers can be paid but the App Store will remain the only way apps can be downloaded onto Apple phones.

Takeovers aren’t always a given, boring week when bonds are news, commodity prices going crazy

Searching for the next takeover target is a popular past time for brokers and DIY investors alike, but this week offered a warning short confirming it doesn’t always go to plan. Just like the Link and AMP offers in 2020, Hansen shares tanked after their bidder walked away.

The Santos-Oil Search merger is finally going ahead, however the IRESS offer from EQT appears to be stalling.

After a chaotic reporting season, the focus has turned back to both thematic, political and economic events. Yet with central banks not moving anyway, a number of bond issues actually made the news.

The likes of Woolworths, AMA Group, and Qantas all raised significant capital, with Woolies tying theirs to an improvement in their sustainability practices.

Whilst it may reflect a slow news week it is also evidence that boards are taking the opportunity to replace expiring higher cost debt with borrowing near all-time lows, something that bodes well for long-term profitability.

This week was all about commodities, it started with the falling iron ore price, before a number of lesser-known elements spiked in value for multiple reasons.

Whether it was the uranium price jumping on the massive purchases from an exchange traded fund or alumina benefitting from another military coup, the sentiment is there, but is it sustainable or another run in momentum?