ASX closes 0.4% lower as miners drag on the bourse

ASX falters, oil hits multi-year high, Domain’s record, central banks dominate

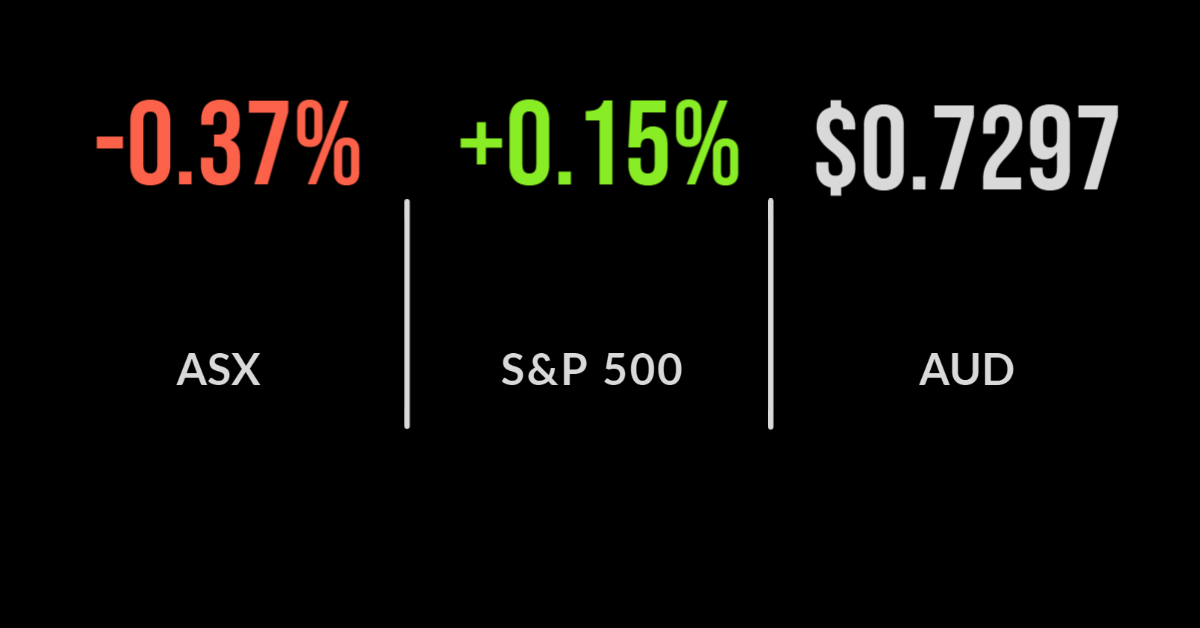

The S&P/ASX200 (ASX: XJO) finished the week on a negative note, falling 0.4% dragged lower by the real estate sector, which fell 2.1%.

The materials sector continued its recent weakness, down 1.3% behind another 1.7% fall in BHP (ASX: BHP) despite the iron ore price finally settling.

The real estate sector sold off heavily seemingly on the threat of central bank intervention into the property market.

Gold miners were also hit, with Silverlake Resources (ASX: SLR) down 5.1% as the gold price dropped on news of a rate hike in the US, which suggests an increasing opportunity cost of holding non-yielding assets; yet only time will tell.

Domain Group (ASX: DHG) hit a record high as predictions that property prices would increase 20% in the next 12 months grew.

Similarly, the oil price hit the highest level since 2019, sending Santos (ASX: STO) 1.9% higher.

The market finished the week down 0.8% despite the rough start on Monday, with the biggest highlight being AusNet (ASX: AST) jumping 28.8% as a bidding warappears to be on the cards.

Markets tended to look beyond the Chinese property market issues, backing in traditional energy companies, including Beach (ASX: BPT) and Whitehaven Coal (ASX: WHC) on signs of a strong global recovery.

The lesser known, lower quality miners bore the brunt of the sell off, with Lynas (ASX: LYC) falling 8% and Nickel (ASX: NIC) down 12.8% over the five days.

Stocks overcome wall of worry, Crypto banned in China, Nike, Cost Co report

Global markets overcame a growing wall of worries to post a positive end to the week. The Dow Jones and S&P 500 both finished higher Friday, up 0.1 and 0.2%, with the Nasdaq falling only slightly.

Similarly, to Australian markets the returns were powered by the energy and financial sectors as positive comments from the Federal Reserve suggest a strong outlook for the economy.

Tech underperformed as higher bond rates are likely to hit their valuations most.

The ‘wall of worry’ grew this week with the US debt ceiling, Evergrande’s potential default and the Federal Reserve flagging higher interest rates likely enough to send the market into a tailspin in any other week.

Yet with very few palatable alternatives, ‘buy the dip’ remained the strategy of the day with all three US indices posting positive results for the week, up 0.6, 0.5 and 0.02%.

The biggest news came from crypto markets with the Chinese Government deeming crypto transactions ‘illicit’ and seemingly banning them in the country, this is a big hit to the mainstream transition given the long-term support in China.

Shares in Nike (NYSE: NIKE) fell over 6% after reporting a slightly lower quarterly revenue result of US$1.9 billion, this was a 16% improvement on 2020 but selling cost increased 20% in a hit to margins. Both wages and digital investment were behind the increase.

Costco (NYSE: COST) delivered record quarterly profit topping US$60 billion for the three month period up from US$53 billion in the prior year.

This represented 17% growth for the full year, besting 1992’s record year. Shares were over 3% higher.

Takeaways

The IMF is the latest group to flag concerns for the Australian economy. The international agency flagged the growing risk in Australia’s property market, which has the potential to be systemic.

Prices are expected to rise another 20% in 2021 as cheap debt and a lack of supply force the market higher.

They also flagged a ‘reckoning’ for zombie companies, but particularly small business, once pandemic supports are withdrawn. They expect a significant jump in insolvencies and a difficult economic recovery.

Rates hikes appear to be the talk of the week, with no less than three central banks confirming their intentions to move higher.

Norway, the UK and the US look set to be among the first to raise rates as they seek to stave off the threat of inflation. The big question is whether this is another misstep in a long history of ‘too soon’ moves by central banks.

The pandemic is making it incredibly difficult to obtain a true read on the economy, with everything from inflation to unemployment clouded by global restrictions and supply chain issues.

There appears just as much risk of deflation as there is sustained inflation given the state of the economy before the pandemic.

Perhaps this is why the likes of Brookfield and APA are willing to pay huge multiples for traditional bond proxy assets like AusNet (ASX: AST).

Spending up and borrowing big to buy long-term, slow growing assets suggests they expect rates to remain lower for longer.

The Japanese are well aware of this environment having dealt with it since the 1970’s.