ASX gains 0.2%; Collins Foods, Orocobre’s record highs

Market posts positive finish, AMP jumps, Westpac sued

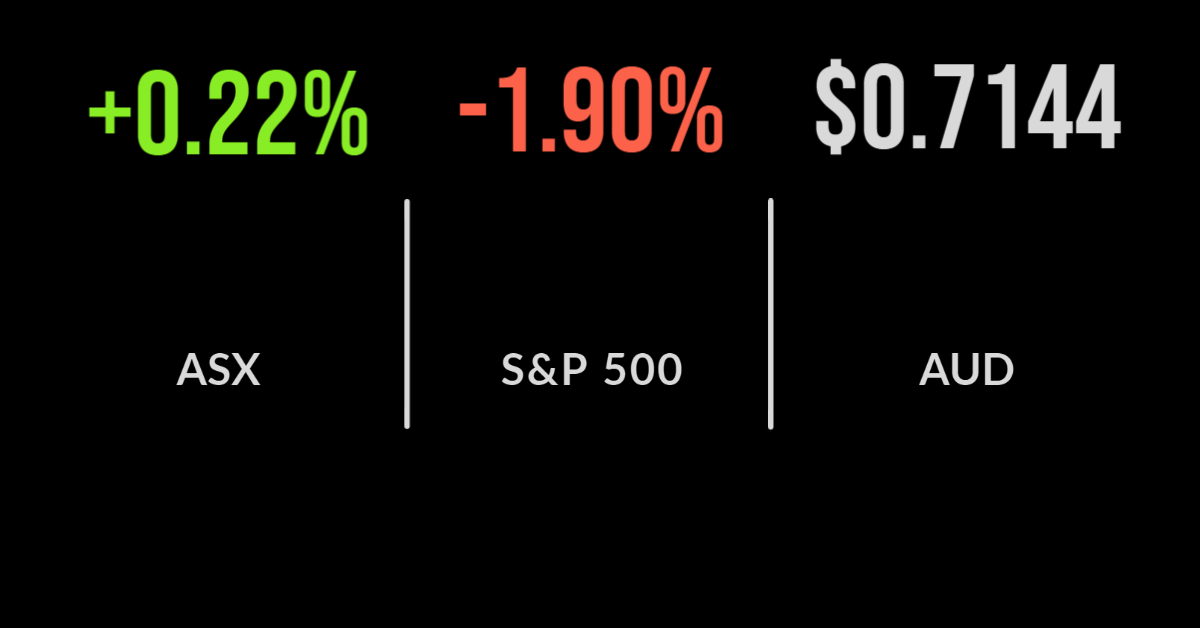

The S&P/ASX200 (ASX: XJO) managed to deliver another positive day, finishing 0.2 per cent higher despite giving back gains of over 1.5 per cent at the open.

Weaker US futures hit confidence in the afternoon, with defensive earnings streams among the worst hit as the utilities and consumer sectors dropped 1.2 and 0.8 per cent respectively.

The top performers were the communications and property sector, up 1.8 and 1 per cent respectively with most recouping Friday’s losses.

AMP (ASX: AMP) was among the leaders as more detail was delivered around the demerge of their AMP Capital Private Markets business.

Shares finished 3 per cent higher after management confirmed it would go ahead in the first half of 2022 with the CEO seeking to cut another $100 plus million in costs from the slimmed down by loss making wealth management and challenger bank businesses.

Westpac (ASX: WBC) underperformed the market falling 1.9 per cent after the corporate regulator launch ‘unprecedented’ legal cases alleging that the company had engaged in “widespread compliance failures” including charging dead people in excess of $10 million.

KFC pays off, record surplus, GUD goes global

Domestic KFC distributor Collins Foods (ASX: CKF) led the market, gaining over 12 per cent after delivering record revenues in their Australian business.

Revenue jumped 4.4 per cent domestically, but it was the overseas expansion that is clearly paying off with KFC Europe reporting 31 per cent growth.

Total revenue was 8.5 per cent higher than the prior period, with the store rollout supporting expanded margins and earnings growth of 13.1 per cent; this despite strong 2020 comparables.

Australia achieved another record trade surplus hitting $23.9 billion as surging coal and other fuel prices delivered price gains.

The news came as it appears recent steel mill shutdowns in China are coming to an end, which is boosting the iron ore price, sending BHP (ASX: BHP) 2.1 per cent higher.

Credit Corp (ASX: CCP) gained 8.6 per cent after announcing the purchase of Thorn Group’s (ASX: TGA) Radio Rentals business and lease book for $60 million.

GUD Holdings entered a trading halt to announce the significant purchase of AutoPacific group, one of the largest suppliers of towing and trailer accessories in the Australian market, for $745 million.

Apple stands out as US markets sold off, Powell flags faster tapering

Attention has returned to the virus and central bank policy following a strong earnings season, with the market resuming the selloff overnight.

This time it was driven by a more hawkish tone from Federal Reserve Chair Jerome Powell, who flags a speeding up of the bond tapering program ahead of the mid-December meeting.

The news immediately sent yields higher as it suggests rates may also need to be increased, with Powell’s statement that also redefined ‘transitory’ inflation which roiled markets.

The result was more than 1 per cent loss across the board, the Dow Jones the worst hit, falling 1.9 per cent, the S&P500 down 1.9 and Nasdaq 1.6 per cent.

Oil futures fell by close to five per cent sending the likes of Chevron (NYSE: CVX) and Royal Dutch Shell Lower (AMS: RDSA).

Travel stocks were also hit on worsening news around the virus variant, with United Airlines (NYSE: UAL) down nearly.1 per cent.

The standout, however, was Apple Inc (NYSE: AAPL) which surged over 3 per cent into record territory as investors once again flooded to quality in the biggest company in the world.