Financials push market higher, Fed meeting ahead, Gor leaves Pendal

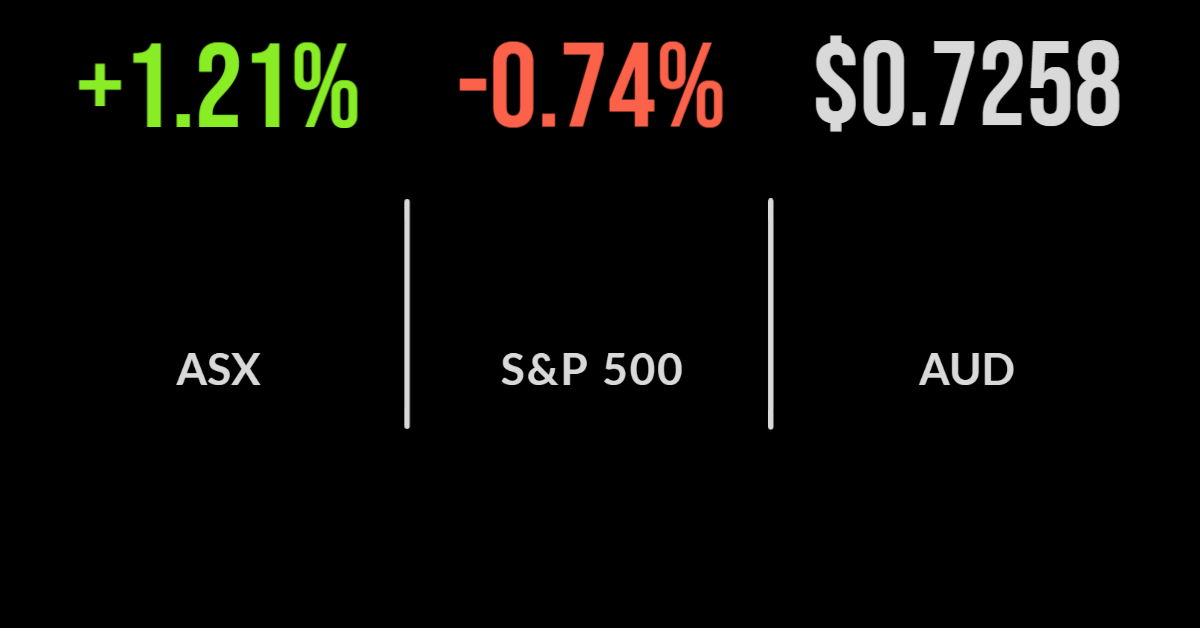

The Australian share market has remained remarkably resilient despite the broadening sanctions against Russia and greater economic implications, with the S&P/ASX200 finishing 1.2 per cent higher on Monday, a public holiday in Melbourne.

All eyes were on the financials sector which was the standout, gaining 2.5 per cent behind a rally in ANZ (ASX: ANZ) and Commonwealth Bank (ASX: CBA) shares which added 2.8 and 2.6 per cent respectively.

The driver appears to be an increasing bond yield and growing expectations or a rate hike.

Every sector but materials finished higher, with healthcare and staples both rallying strongly up 2.2 and 1.7 per cent showing the support is across both defensive and cyclical businesses.

Shares in Magellan (ASX: MFG) continue to fall, unable to overcome weak sentiment, with the group losing another $5 billion in assets in February as their global funds continued to underperform.

Surprisingly, value-focused competitor Pendal (ASX: PDL) gained 6.6 per cent despite news that one of their highest-profile investment managers, Vimal Gor, was leaving to join the crypto space.

Elders outperforms, Nickel struggles, Virtus surges on takeover

Farming supplies and retailer Elders (ASX: ELD) have been a massive beneficiary of supply chain issues and the events in Russia, with the company flagging a financial year profit at least 20 per cent ahead of 2020 levels.

They highlighted strong conditions in the rural sector, particular fertiliser and other farm products which are seeing massive price rises and surging demand.

Bolt-on acquisitions were also seen as positive along with a pivot into private label herbicides in 2018; shares gained 11 per cent to a decade high.

Virtus Health (ASX: VTH) shares gained another 7.5 per cent after management announced they had accepted CapVest’s $706 million bid for the company whilst Independence Group’s (ASX: IGO) planned acquisition of nickel miner Western Areas (ASX: WSA) is under review following the massive surge in the price of the commodity as Russian supplies disappear.

Shares in Ampol (ASX: ALD) finished 2.6 per cent higher after announcing the sale of a Gull NZ for NZ$572 million.

The group operates 112 unmanned fuel service stations and an import terminal and comes ahead of the impending acquisition of Z Energy.

Markets mixed on peace talks, falling share price, Deltacron variant identified

Global markets were mixed overnight following the resumption of peace talks between Ukraine and Russia, the fourth such round of talks.

The news saw oil futures decline towards US$100 and will likely send energy stocks lower.

The result was a flat finish for the Dow Jones, 0.7 per cent fall in the S&P500 and 2 per cent fall in the Nasdaq; the latter likely hit by expectations of a rate hike this week.

Chinese stocks saw another broad selloff after the central government announced a lockdown across the Shenzen province, a manufacturing hub to the world.

This will likely result in a hit to global demand for many inputs and send shares in Alibaba (NYSE: BABA) 10 per cent lower.

Pfizer (NYSE: PFI) shares gained 4 per cent after announcing that most people would need a second booster shot whilst highlighting that a vaccine for children under 5 should be available by May.

Shares in Nike also fell over 4 per cent towards 2020 lows on signs of weak demand and difficult supply.