ASX sinks to another loss, Link tanks on competition concerns, NZ contracts

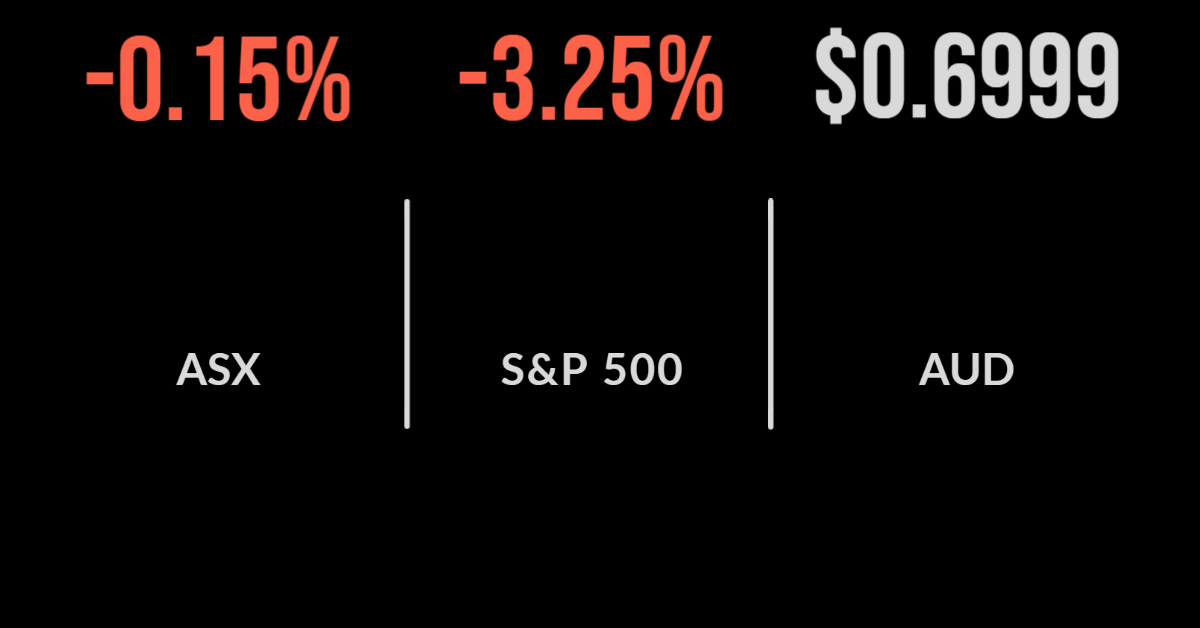

Australian shares were as much as 1.1 per cent higher during Thursday’s session following the Federal Reserve decision to hike interest rates by 0.75 per cent, but ultimately finished 0.1 per cent lower.

The major detractors were the consumer staples and utilities sectors, falling 1 and 1.6 per cent with the latter hit by the nationalisation of the energy system.

Woolworths (ASX: WOW) fell 1 per cent after announcing they would hold the prices on a number of staple products like flour, reducing profit margins, but easing the stress on consumers.

The energy and property sectors were the standouts up 0.5 and 1.5 per cent with Whitehaven Coal (ASX: WHC) a key contributor as the outlook in China improved.

The unemployment rate hit a 48-year low of 3.9 per cent after 69,000 more people found jobs in May, with the participation rate also increasing to 66.7 per cent.

But in a sign of the challenges to come, the New Zealand economy, which was early on rate hikes, reported a 0.2 per cent contraction and annual growth of just 1.2 per cent as inflation and the wealth effect started to bite.

Link sued, deal under pressure, China outperforms, Australian Ethical issues guidance

It was a rough day for Link Administration (ASX: LNK), the majority owner of the Pexa (ASX: PXA) platform used for property settlements.

The company announced they had been targeted in a lawsuit by a UK-based legal firm over their administration of the collapsed Woodford Fund.

The fund was frozen, leading to losses for thousands of investors, with Link denying the claims.

But the 10 per cent fall in the share price was primarily due to the ACCC’s announcement that they had competition concerns about the sale of the company to local legal player Dye & Durham.

They flagged potential issues with the acquirer’s role in the property settlement sector and potential dominance of the market through Pexa. The risk that the takeover is pulled likely grows.

Australian Ethical (ASX: AEF) fell 2.4 per cent after management guided to profit growth of $9.8 to $10.2 million for the financial year, around 9 per cent higher than 2021.

This comes after a 3 per cent fall in the group’s assets under management to $6.6 billion after the loss of an institutional mandate.

US market drops sharply on recession concerns, Revlon enters bankruptcy

Global markets moved lower once again as the relentless pace of central bank policy changes have raised the risk of a deep recession.

Fed Chair Jerome Powell flagged another potential 75 basis point hike in July, with the Swiss and UK central banks also hiking this week in an effort to combat inflation.

The risk, of course, is that they reverse a decade of job gains and send millions into unemployment once again, particularly given news that a number of economies are already slowing.

The Dow Jones fell 2.6 per cent, Nasdaq 4.5 and the S&P500 3.6 with the tech sector continuing to bear the brunt of the pressure.

US new home sales fell by 14.4 per cent in May, much more than economists predicted.

Tesla (NYSE: TSLAO) shares fell more than 8 per cent after announcing they would increase the price of their cars due to higher input costs, whilst Revlon (NYSE: REV) shares gained 4 per cent despite the company filing for bankruptcy.