Local market gains on earnings, Tassal gets a bid, BWX slumps

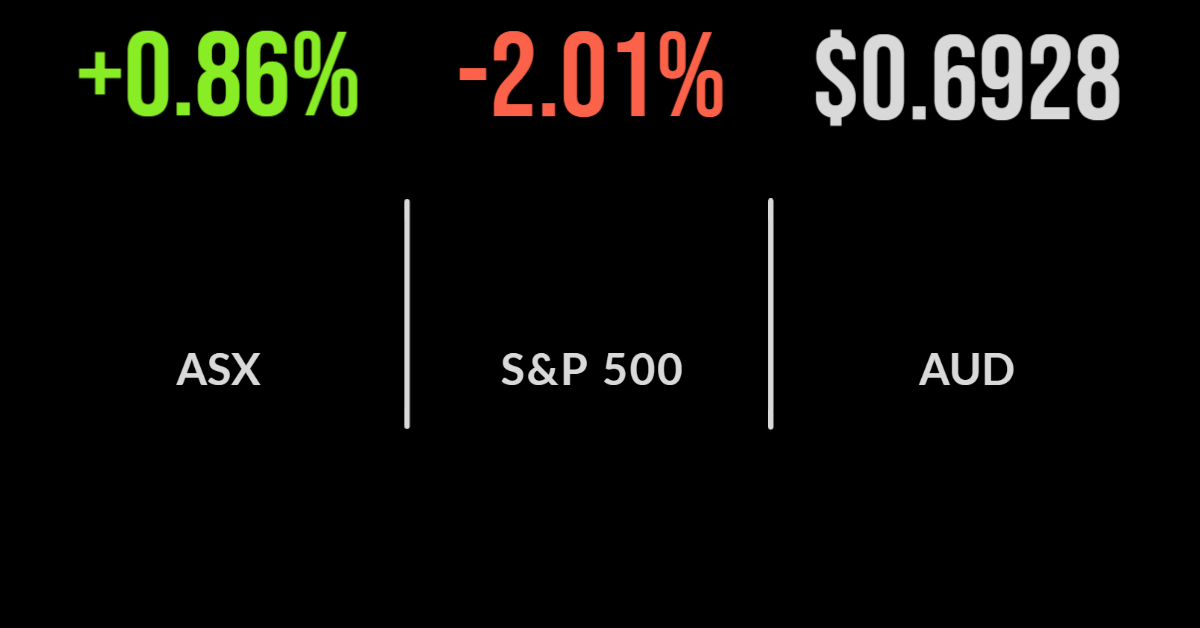

The local market managed to deliver another strong day, the S&P/ASX200 finishing 0.9 per cent higher.

Five sectors were lower, albeit only slightly, with consumer discretionary the biggest detractor on concerns that higher interest rates will cut disposable incomes.

This sent the likes of JB Hi-Fi (ASX: JBH) and Zip Co (ASX: ZIP) down 3.9 and 7.8 per cent respectively.

On the positive side were the energy, materials and utilities sectors, all of which gained more than 3 per cent amid news that OPEC was unlikely to increase production.

Shares in Tassal Group (ASX: TGR) added more than 16 per cent after management confirmed they had received a takeover bid from Canadian aquaculture group Cooke.

The deal values the company at $1.04 billion or $4.85 per share with the board suggesting this undervalued the business as it stands.

There was positive news for the economy with consumer confidence increasing 3.7 per cent last week, with pundits suggesting this was driven by positive budget announcements in NSW and Queensland, while Victoria remains flat.

Collins Food upgrades, KFC prices to rise, BWX slides, will need fresh capital, BHP jumps

KFC franchiser Collins Foods (ASX: CKF) delivered a positive update before reporting season, announcing an 11 per cent increase in revenue to $1.18 billion for the year.

The result contributed to a 12 per cent improvement in earnings and a 47 per cent jump in profit to $54 million as the benefits of scale spread through the business.

Management highlighted the challenges they faced including wage inflation and supply chain issues that saw lettuce replaced with cabbage, while also announcing a third price increase. The dividend was increased by 17 per cent to 15 cents per share.

Moisturiser and beauty product retailer BWX (ASX: BWX) was at the other end of the spectrum falling by more than 40 per cent after downgrading earnings.

The company expects a loss of between $10 and $14 million, despite revenue growth of 6 per cent to $206 million, with earnings set to fall 76 per cent.

Guidance for FY23 was also reduced with management responding by announcing a $23 million capital raising to sure up their cash and funding in the short term.

Stocks sink on economic data, dividend bonanza, Nike flags weakness

US markets struggled on Tuesday with the Nasdaq leading the market lower, falling 3 per cent. The primary driver was a series of economic data that has analysts concerned about the threat of earnings downgrades in the coming reporting season.

Both consumer confidence and the manufacturing index have fallen to levels not seen since the middle of the pandemic in 2020, both of which are increasing the risk of recession.

The growing data set has meant utilities and healthcare have outperformed with the Dow Jones falling just 1.5 and the S&P500 2 per cent.

In more positive news, the financial sector outperformed after a suite of banks announced an increase in dividends after passing their central bank stress test.

Wells Fargo (NYSE: WFC) and Goldman Sachs (NYSE: GS) said they would increase dividends by 20 per cent and Morgan Stanley (NYSE: MS) by 11 per cent.

Nike (NYSE: NIKE) was the major detractor falling more than 6 per cent after beating earnings guidance by flagging cautiousness about margins going forward.v