Super’s looming showdown with ‘big dumb money’

Pointing out that superannuation has been through a period of tremendous change has become trite. That doesn’t mean it’s not true. Following the upheaval of Your Future Your Super (YFYS) and early release, the running battle over increases to the superannuation guarantee, and Scott Morrison’s abortive “Home First, Super Second” policy, things are just starting to settle down.

But it’s “pretty fair to say that the super wars are not over”, according to Cbus chairman and former federal Treasurer Wayne Swan.

“If you followed the coverage in the Financial Review over the last fortnight, and you’ve seen the attacks on the industry by David Murray, the distortions of (Treasurer Jim Chalmer’s) statement at that session they had with Paul Keating and others, it’s pretty fair to say that we’ve got a breather from the super wars but that they’re not over,” Swan told CMSF on Wednesday (September 7).

Regardless of which side of politics is in power, attacks on structural reforms like superannuation – “one of the most successful in a hundred years” – will persist.

“When big changes are made – like Medicare, and the industrial umpire, and superannuation, which is based on wage policy and tax policy, they will always be attacked from the right or for that matter from the left,” Swan said. “And I think we are seeing those attacks from the right and the left at the moment, against the very core of our nation’s superannuation policy – being universal, being compulsory, being preserved. We’ve got a fight on our hands as we go forward.”

And what a fight it is – not just with homegrown political opponents, but with offshore managers and the same funds that once “lined up together like a football side and went out to battle each day”, to use the words of AustralianSuper CIO Mark Delaney.

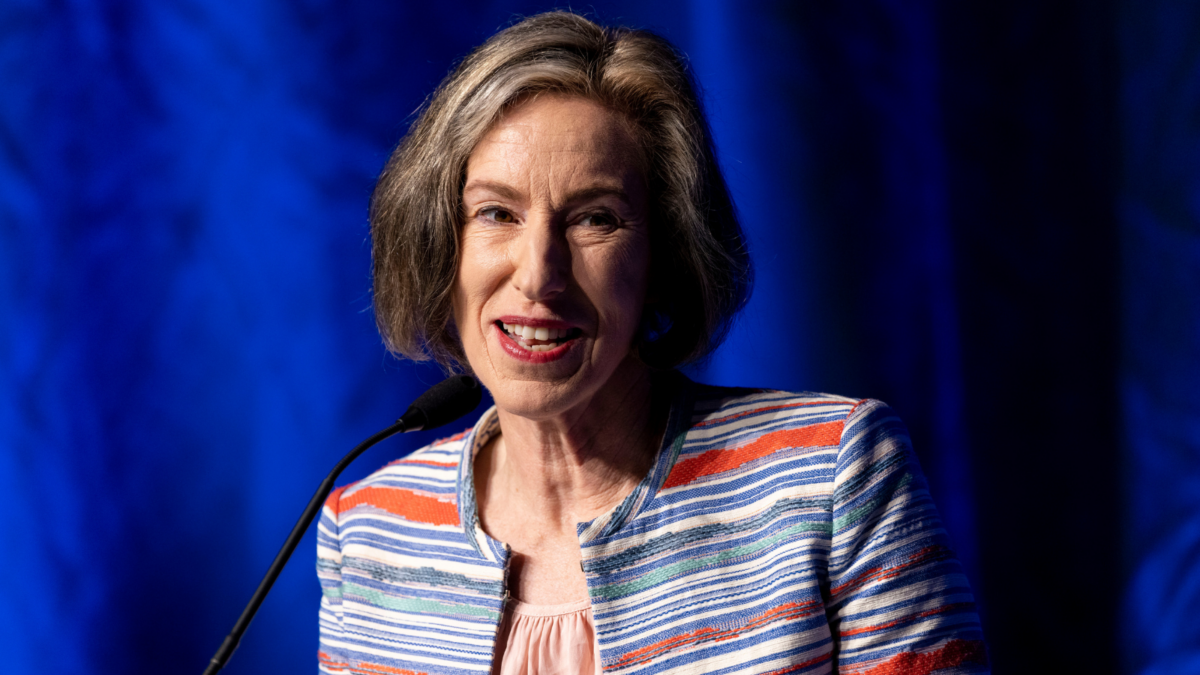

“The competition isn’t primarily of industry super funds versus retail funds – I think we’re now, and this might not be a popular view, we’re now frenemies,” said Naomi Edwards, chair of Spirit Super. “We’re not swimming in our lanes. Many funds, nationally, are swimming across a lot of lanes.

“And I think that for many of us, finding how we succeed and define ourselves, let alone with new competitive threats that are coming from outside – in a big way, what I call big dumb money – I think that will be the terrifying thing. But it’s nice to have a break from the regulatory terror of the last nine years.”

But on the political front, resisting further attacks will mean “reinvigorating the collaborative model”, Swan said, by finding the next generation of CFOs, CIOs and trustees to breathe new life into the industry. The super wars have, after all, come with a real cost – the fractured pathway to the legislated 12 per cent, which has been frozen by previous governments.

“I was really impressed by the contribution that came from our pioneers, and it was appropriate that people who were there 30 years ago make those sort of comments to remind us of the purpose of super,” Swan said. And having been outside the system from a policy point of view – I was in the Parliament when we started the SG – I have been a participant, looking at it from without rather than within.”

“And what I’ve found now, from within, is that I now more fully understand just how important the collaborative model is – the model of employers and unions getting together as trustees on a profit-to-member basis. We’ve got to decide now how we reinvigorate the profit-to-member model, reinvigorate the collaborative model, so we can beat the attacks that are going to continue to come over the next 30 years.”