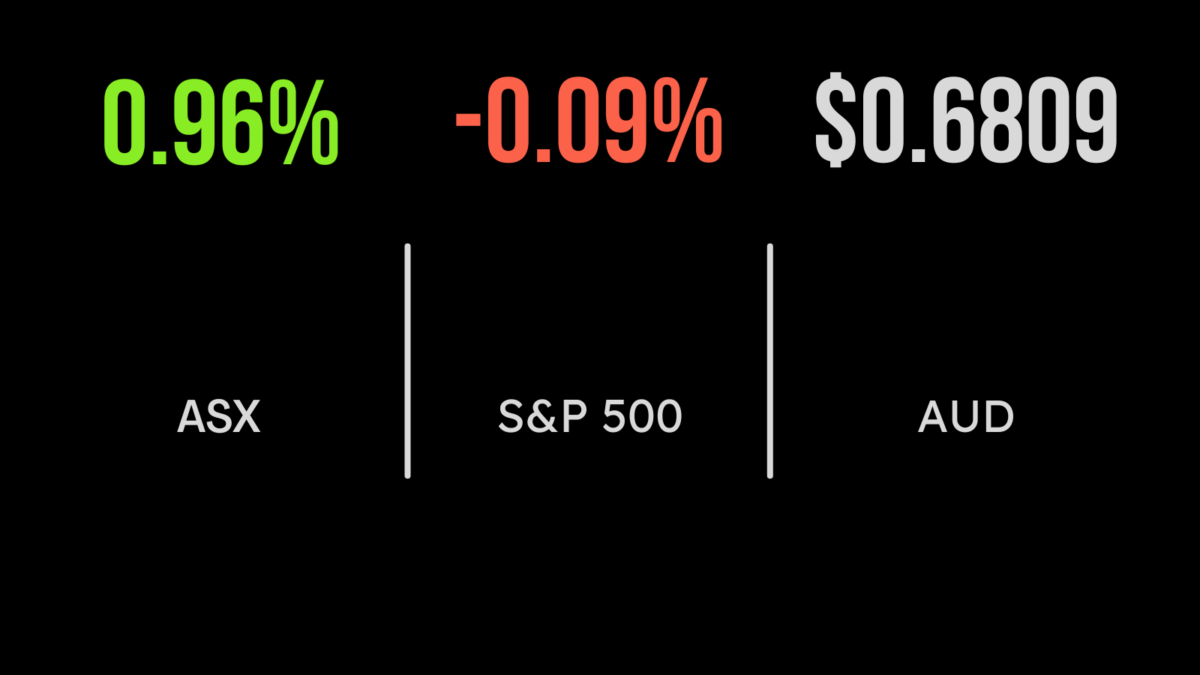

ASX jumps on Fed policy, Cochlear competition concerns, return forecasts upgraded

The biggest beneficiaries were the materials and utilities sectors, which gained 2.7 and 1.2 per cent, while only the energy and healthcare sectors finished lower, down 0.8 and 0.4 per cent respectively. Among the highlights were gold miner Ramelius Resources (ASX: RML) and Block (ASX: SQ2) which gained 10.5 and 7.4 per cent each. Cochlear (ASX: COH) shares fell slightly after the ACCC flagged concerns about the acquisition of small Danish hearing loss device maker Oticon Medical, they are worried about Cochlear‘s dominant market position being further expanded. Cosmos Asset Management, the prior issuer of two crypto ETFs has entered administration after previously delisting their ETFs and returning funds to investors.

Dominos to raise capital, new CEO at Downer, Warrego considers offer

Shares in Domino’s (ASX: DMP) were placed into a trading halt after management flagged a capital raising for $165 million in fresh funds. The proceeds will be used to take full ownership of the group’s pizza business in Germany where it has some 412 individual stores and is seeking continued expansion. Downers (ASX: DOW) dropped by 2.3 per cent after the company announced that CEO Grant Fenn would be replaced by current COO Peter Tompkins as the company continues to transition away from the mining sector. Shares in Warrego (ASX: WGO) gained 2 per cent after the company announced it would consider a takeover offer from Hancock Prospecting at 23 cents per share, the price is now at $0.26 after a prior offer from Beach Energy (ASX: BPT) was lobbed at $0.20. Private capital expenditure fell by 0.6 per cent unexpectedly with economists predicting a 1.5 per cent increase, the likely driver was a lack of available product and the higher cost of capital. In positive news, global asset manager JP Morgan increased their return expectations for a traditional 40 / 60 portfolio of bonds and equities from 4.3 per cent per annum for the next decade, to 7.2 per cent.

Market weakens as economy slows, Salesforce CEO departs, Costco sinks

All three US benchmarks finished weaker overnight as traders await another important piece of the economic puzzle; the latest jobs data. The Dow Jones fell 0.6 per cent, the S&P500 0.1 and the Nasdaq gained 0.1 per cent after the Manufacturing ISM report showed the US economy had entered a contraction, falling to 49 per cent from 50.2 per cent in the prior month. The news was accompanied by a 0.3 per cent increase in prices according to the Fed’s preferred Personal Consumption Expenditures index, further confirming that inflation may be retreating. Gold delivered one of its strong days since 2020, with futures gaining more than 3 per cent while co-CEO of Salesforce (NYSE: CRM) Bret Taylor unexpectedly stepped down, leaving Marc Benioff as the sole CEO of the company. Shares in Costco (NYSE: COST) were down more than 6 per cent after the company reported a slowing of sales growth November, hitting 5.7 per cent, down from 7.7 per cent in the prior month as e-commerce sales sunk by double figures.