Another 0.25 per cent hike, market rallies, the end is near

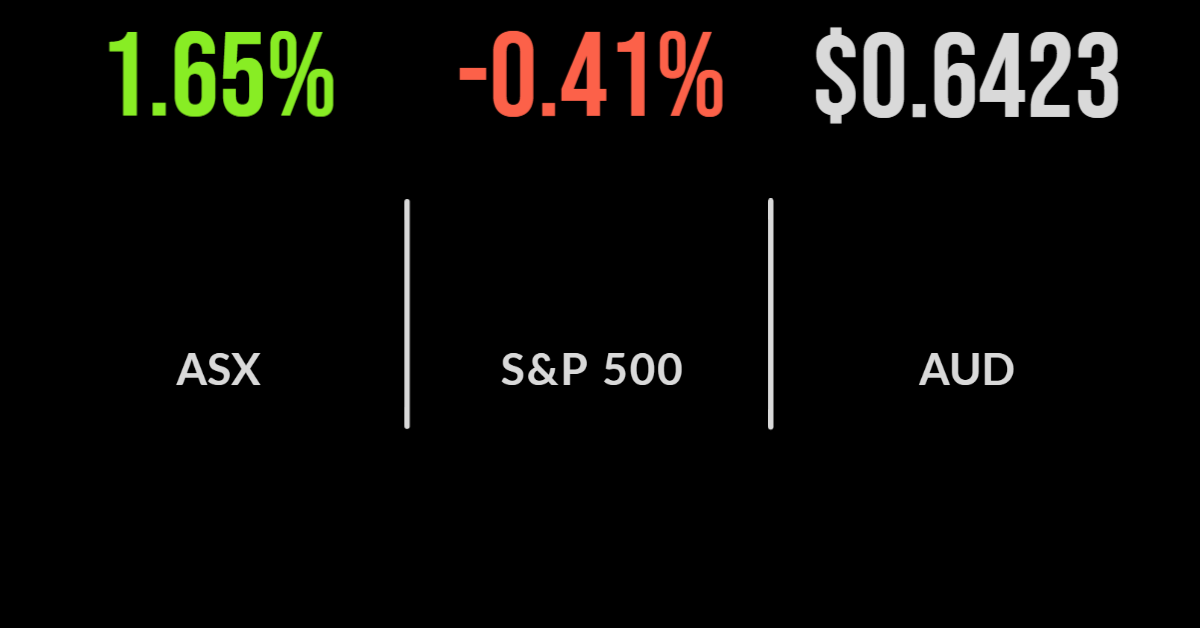

The local market was spurred on by a smaller than expected cash rate increased by the Reserve Bank of Australia. The 25 basis point increase once again proved that what the market ‘prices in’ isn’t always correct, quite the opposite. As early as this morning the National Australia Bank (ASX:NAB) suggested that there was a real risk of a 0.5 per cent hike despite clear signs of a weakening economy. One such piece of evidence was the fall in Brisbane houses prices in October, down 2 per cent, the largest decline on record and faster than every other capital city. The rate hike was seen as good news by the market, with the S&P/ASX200 gaining 1.7 per cent as every sector contributed. The standouts were materials and utilities, up 2.6 and 2.5 per cent respectively, with Fortescue (ASX:FMG) and Origin Energy (ASX:ORG) among the largest contributors gaining 5.4 and 4 per cent each.

EML Payments jumps, oil adds first gain in months, Genworth jumps on premiums

Shares in EML Payments (ASX:EML) gained more than 30 per cent, partially offsetting the prior day’s losses, despite the company indicating they would not be taking on new clients in Ireland as they dealt with significant regulatory issues. GrainCorp (ASX:GNC) continues to benefit from war in Ukraine, with the share price surging 6.1 per cent while President Putin suggested that the grain deal with Ukraine was simply paused, and not over. Mortgage insurer Genworth (ASX:GMA) gained 5.2 per cent on hopes of a better than expected performance from residential property. The group confirmed earned premium would be at the top end of prior guidance, while also widening their expectation to include potential insurance claims of $25 million. Private equity groups remain busy, with PEP lobbing a $4.50 per share bid for ReadyTech (ASX:RDY), an IT business whose shares jumped 28 per cent on the news.

Market weakens, China recovers, Uber jumps

The local market will feel negative sentiment this morning after the US benchmarks weakened overnight on news that job openings had surged back about 10 million. The Dow Jones finished down 0.3, the S&P500 0.2 and the Nasdaq 0.8 as good news for the economy once again became bad news for stocks. This follows one of the top ten October results in the history of the benchmark. Not unexpectedly, the US manufacturing PMI has continued to slip, falling to 50.2 points, while construction spending increased, albeit slightly. On the positive side, Chinese equities may be nearing a bottom, with the likes of Alibaba (NYSE:BABA) and JD.com (NYSE:JD) all surging on news that the government may be relenting on their strict COVID-19 policies finally. Shares in Uber (NYSE:UBER) jumped by more than 10 per cent after the company reported a 50 per cent narrowing of it’s quarterly loss on a near doubling of revenue. Fintech SoFi Technologies (NYSE:SOFI) also gained close to 10 per cent with the company gaining 424,000 new members during eh quarter, contributing to a doubling of revenue.