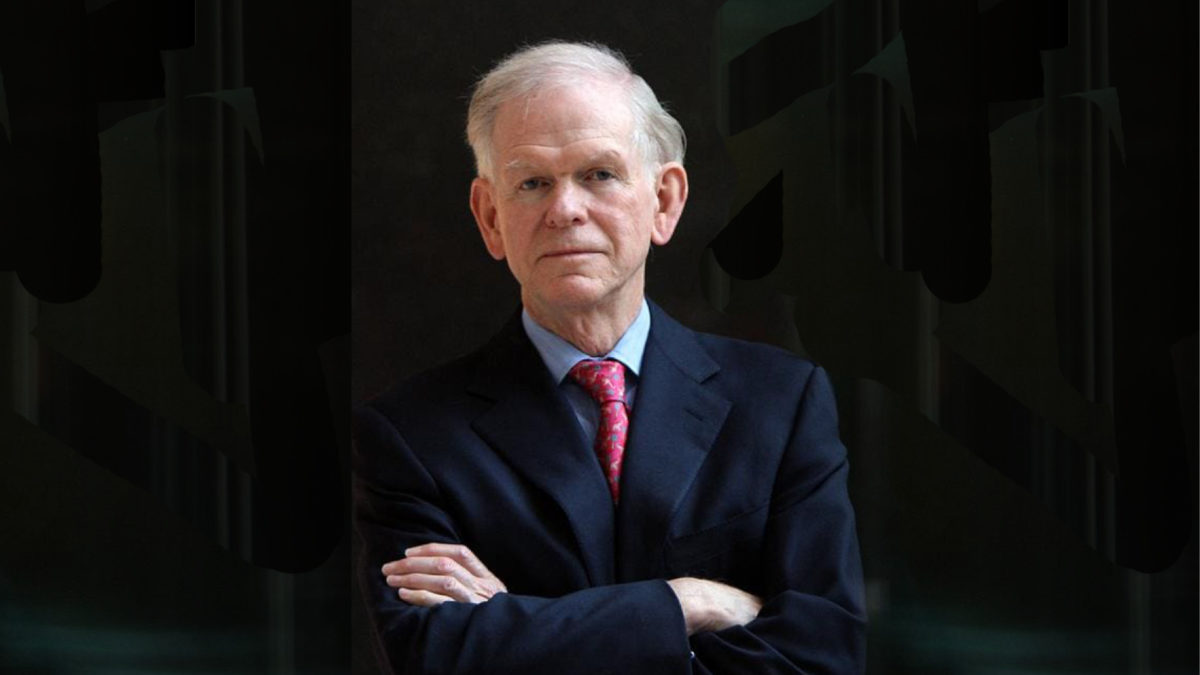

… as Grantham calls last dance on market’s bubble

Legendary investor Jeremy Grantham has called bubble on the longest bull market in history. In a searing client newsletter, ‘Waiting for the Last Dance’, Grantham says current market conditions that feature “extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior” bear all the hallmarks of a last-gasp bubble expansion.

The founder of value manager GMO said last week: “I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.”

According to Grantham, while the bull market in equities has raged since 2009 the “most dependable” tell-tale sign of late-stage bubbling – “really crazy investor behavior, especially on the part of individuals” – only appeared in 2020.

He says a wide range of other gauges including the ‘Buffet indicator’ of stock market value to GDP and the SPAC (special purpose acquisition company) craze in the US are also flashing bubble warnings.

“So, I am not at all surprised that since the [northern hemisphere] summer the market has advanced at an accelerating rate and with increasing speculative excesses,” Grantham says. “It is precisely what you should expect from a late-stage bubble: an accelerating, nearly vertical stage of unknowable length – but typically short. Even if it is short, this stage at the end of a bubble is shockingly painful and full of career risk for bears.”

However, he says unlike all previous bubbles the 2020/21 version is inflating at time when underlying economic conditions look weak.

“Today the P/E ratio of the market is in the top few percent of the historical range and the economy is in the worst few percent,” Grantham says. “This is completely without precedent and may even be a better measure of speculative intensity than any SPAC.”

Of course, identifying bubbles is easier than timing the pop, which he says could happen in days or months.

“But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives,” Grantham says. “Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.”

Investors can avoid the worst of any bubble blow-back, he says, by allocating to value shares, emerging markets and “the greatest avoidance of U.S. Growth stocks that your career and business risk will allow”.

– David Chaplin is publisher of Investment News NZ