-

Sort By

-

Newest

-

Newest

-

Oldest

Index providers should face the same regulatory hurdles as investment managers, a new US legal paper argues. In the US, plain-vanilla indexers are regarded as information ‘publishers’. The University of Virginia School of Law (UVS) report says most index providers are de facto ‘investment advisers’ – a term under US law that includes fund managers…

Interim Mercer NZ chief investment officer, Ronan McCabe, has been upgraded to permanent following a long recruitment process to replace, Philip Houghton-Brown. The Sydney-based McCabe stepped into the breach last September when Houghton-Brown departed for the head of investment solutions role at BT Funds. Post the official internal promotion, he continues to hold his previous…

FNZ has won a last-ditch bid to relitigate the looming forced sale of Australian software firm GBST after the UK competition authority flagged possible mistakes in figures underpinning its earlier decision. In a notice published late last year, the Competition and Markets Authority (CMA) said it would refer the case back for a rethink after…

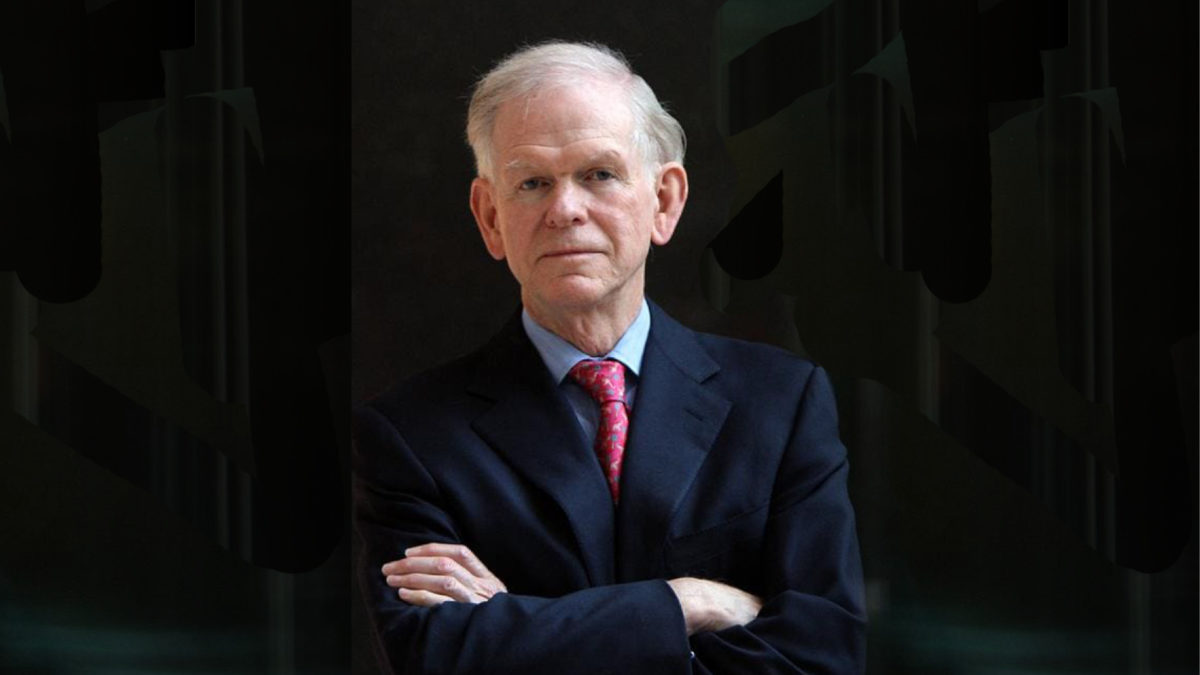

Legendary investor Jeremy Grantham has called bubble on the longest bull market in history. In a searing client newsletter, ‘Waiting for the Last Dance’, Grantham says current market conditions that feature “extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior” bear all the hallmarks of a last-gasp bubble expansion. The founder of…