ASX back near 14-month high with 0.6% gain

RBA holds rates, property lending boom, Seek upgrades guidance, retail recovery on track

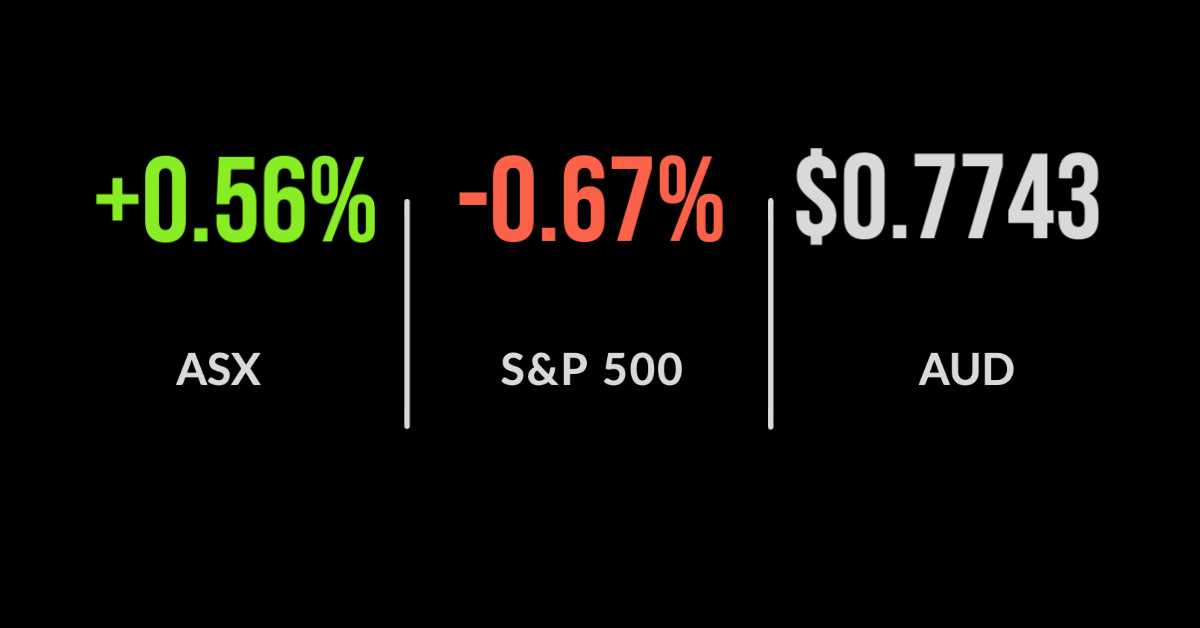

It was another green day on the market with the ASX200 (ASX:XJO) adding 0.5% on the back of the materials sector, with the gold price jumping significantly.

Silverlake Resources (ASX:SLR) and Northern Star (ASX:NST) were among the biggest beneficiaries adding 7.9% and 4.0% respectively.

The trigger appears to have been a weaker AUD after the RBA kept rates on hold at 0.1% once again but flagged hope that the unemployment rate will drop to 4.5% by the end of next year.

The governor noted the growing heat in the property market with the ABS reporting new mortgages hit a record $30.2 billion in March with investors adding 12.7%, the fastest pace since 2003.

Seek Ltd (ASX:SEK) appears to be benefitting from the economic recovery, moving 1.9% higher after upgrading guidance as operating conditions in both Australia and Asia continue to improve.

They now expect $1.59 billion in revenue and a net profit of $140 million, an improvement on expectations.

Investors cheered the announcement that a portion of the $697 million to be received from the sell-down of SEK’s investment in Zhaopin would be returned in the form of a dividend.

Vicinity Centres (ASX:VCX) fell 1.0% despite confirming that both centre visitation and retail sales were improving.

Supermarkets grew 1.5% on pre-COVID levels whilst discount department centres remain the focus of more conservative consumers, with sales in the sector adding 11.7% as traditional department store sales collapsed by 22.4%.

Vicinity said that strong spend per visit in conjunction with increasing centre visitation may be a positive lead indicator for continued recovery.

Travellers taking flight, niche retail, furniture shows no signs of slowing

Struggling travel agency Flight Centre (ASX:FLT) has confirmed its recovery is still on track, reporting record sales in the COVID impacted environment. Sales turnover was $100 million, 32.7% better than February with further growth expected in April.

With that said, second-half losses are expected to be broadly in line with the first half as revenue gains are offset by JobKeeper losses; shares fell 4.6% on the news.

The struggling media sector is benefitting from the value rotation, with Nine Entertainment (ASX:NEC) reporting revenue growth in their broadcasting business had improved 6% and closer to 50% for the June quarter just one month in.

Costs have fallen 3% with a number of sports rights falling away, the stock jumped 2.5% on the news.

Niche retailer Super Retail (ASX:SUL) delivered another strong upgrade, sales growth up 28% across the group for the first 44 weeks of the trading year; this is 22% better than 2019 figures.

Boating Camping Fishing is benefitting from the travel at home trend, sales jumped 57% on 2020 levels and 49% on 2019.

Rebel Sports saw 20% growth and Super Cheap Auto 21%, which sent the share price 0.7% higher.

Tech sell-off spreads, rates heading higher, Zillow reports

The tech sell-off continued in the US on the back of dovish comments from Treasury Secretary Yellen, with the likes of Apple, Amazon, and Tesla sending the Nasdaq down 1.9%.

The S&P500 and Dow Jones, down 0.7% and up 0.1%, were more resilient, supported by the continued surge in commodities prices.

The sell-off came as Janet Yellen commented that rates were likely to rise as government spending ramps up, before noting she was not predicting or recommending when this should happen.

It would seem the focus on narrative rather than data has returned. America’s version of Realestate.com.au, Zillow Group (NASDAQ:ZG) reported an 8% increase in revenue to US$1.2 billion powered by their Premier Agent business, up 35%, the service used by real estate agents to assist in selling their properties.