ASX caps worst week in two years, Humm deal off, oil falls

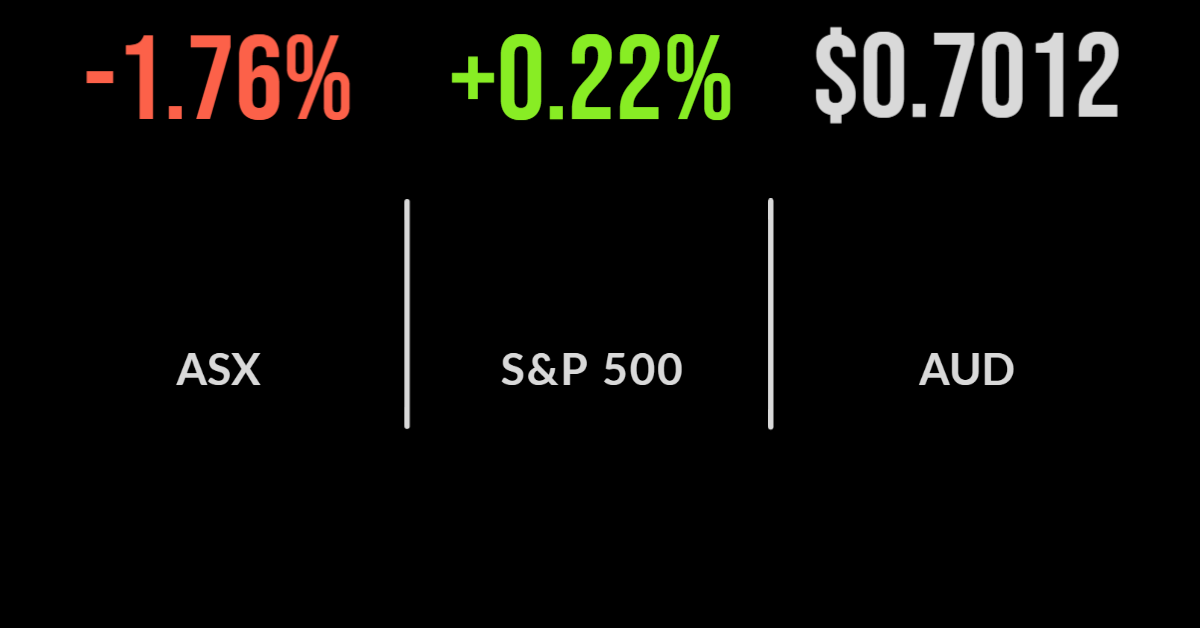

The local market capped its worst week since March 2020 falling 1.8 per cent on Friday and dragging the S&P/ASX200 down 6.6 per cent for the week.

This followed a 4.2 per cent drop in the prior week which now has the index nearing a bear market.

Comments from the RBA Governor this week heightened concerns for the outlook for the economy, with a surging bond rate sending many traders back to safety.

Consumer staples were the only sector able to gain ground on Friday, up 0.6 per cent, while the mining sector was the hardest hit falling 2.8 per cent after another fall in the iron ore price sent

Fortescue (ASX: FMG) down 5.3 per cent.

The majority of the Big Four banks are now trading at 12-month lows, with the Commonwealth Bank (ASX: CBA) falling 3.6 per cent and National Australia Bank (ASX: NAB) down 1.7 per cent on concerns that bad debts may increase in a recessionary environment.

Humm (ASX: HUM) fell by more than 21 per cent after the board announced they would not proceed with the sale of their BNPL business to Latitude Financial while Australian Agricultural Co (ASX: AAC) added 9.9

Global markets finish on a positive note, Reliance to buy Revlon, BoJ on hold

Global markets finished the week strongly, which should bode well for a more positive week as the end of the financial year nears, with the Nasdaq up 1.4 per cent.

The Dow Jones fell slightly after energy prices slid, sending Diamondback Energy (NYSE: FANG) down more than 8 per cent.

The S&P500 moved slightly positive, gaining 0.2 per cent with the likes of Apple (NYSE: AAPL) showing tentative signs of a bottoming.

US industrial output remained positive but continues to fall as spending tightened on the back of higher fuel prices, with the Fed committed to getting inflation back under 2 per cent regardless of the cost to the economy and employment.

Shares in Alibaba (NYSE: BABA) gained 0.8 per cent after China’s central bank approved ANT Financial’s application to set up a financial holding company finally, paving the way for a new round of growth for the fintech.

Revlon (NYSE: REV) gained more than 90 per cent after Indian conglomerate Reliance Industries flagged an interest in acquiring the company out of bankruptcy.

The pain continued over the week with the biggest name companies now dragging on the index, sending the S&P500 down 5.8 per cent and both the Dow Jones and Nasdaq down another 4.8 per cent.

Price increases, the wealth effect and when will something break?

It was a big week for businesses and consumers this week after the increase in the minimum wage was approved.

The impact will be most significant for smaller businesses, but clearly a positive for those facing the challenge of the cost of living.

A more interesting trend is occurring in email inboxes around the world, with news this week that a number of streaming and online services had increased their prices by as much as 10 per cent.

This comes despite what appears to be little in the way of cost increases for many groups, in Australia at least, with companies clearly seeking to increase profit margins.

On the other hand, Woolworths announced they would fix prices on a number of staple items for the remainder of the year, giving up margins rather than contributing to a higher cost of living.

The impact of the wealth effect remains unknown at this stage, with the concept referring to the changing consumption patterns that occur as property or share market values fall.

In many cases, this has been a precursor to recession as consumers tighten their belts. On the central bank front, news of a 75 basis point hike brings the question, what will break first?

Such an aggressive increase in rates has seen mortgage rates double in the US in just a few short months, potentially threatening record employment and eventually triggering a recession.