ASX closes 0.2% higher despite Brambles plunge

RBA spurs turnaround, energy sector surprise, Brambles profit hit

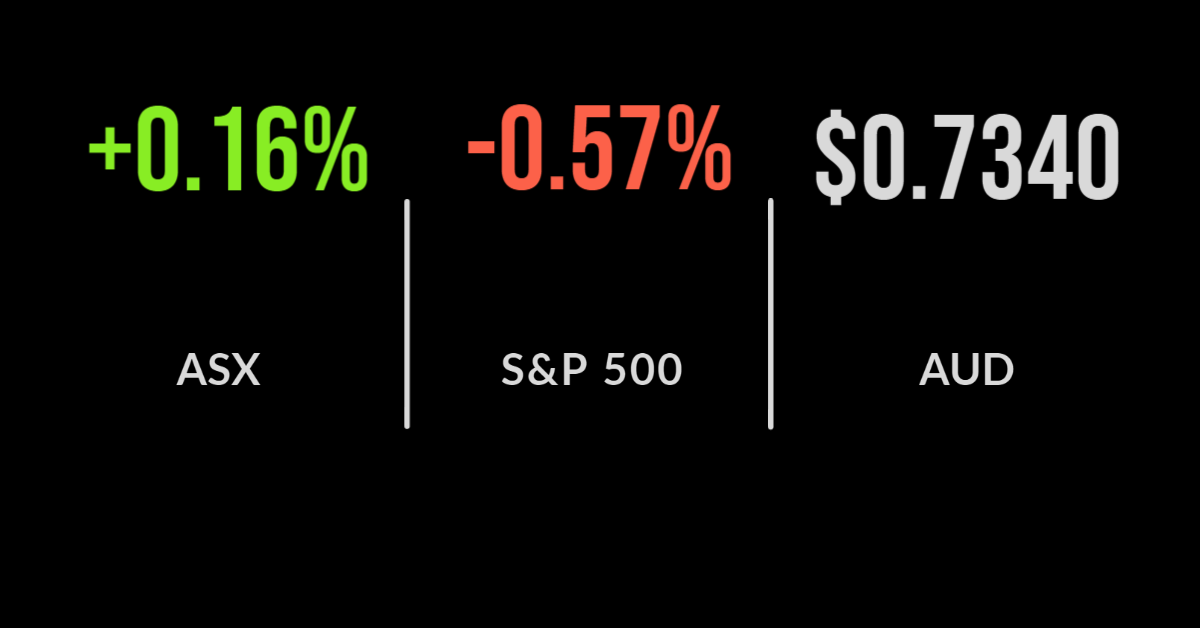

The S&P/ASX200 (ASX: XJO) experienced a choppy session, initially falling 0.4%, before trading 0.5% higher but ultimately closing with a gain of just 12 points.

Six of the 11 major sectors were higher led by energy which had its strongest day in seven months, gaining 4.4%.

An oil price surge above US$70 per barrel was the primary driver with Woodside (ASX: WPL) and Beach (ASX: BPT) adding 6.2 and 7.2% and Origin (ASX: ORG) also gaining 3.2% as it will benefit from the translation into domestic gas prices.

But it was all about the Reserve Bank today after Governor Lowe shocked economists and traders betting on a rate hike to occur earlier than expected.

Lowe outlined some confidence in the economic recovery once vaccination rates are higher but flagged growing concerns of the damage to small businesses as a potential risk.

He highlighted the very different wage and inflation environment in Australia and reiterated that the cash rate will remain on hold at 0.1% until at least 2024.

Amid a growing chorus of ‘experts’ suggesting rates will increase in 2022 or 2023, he commented “these expectations are difficult to reconcile with the picture I just outlined, and I find it difficult to understand why rate rises are being priced in 2022 and 2023”.

The financial sector gained 0.4% on the comments which are likely to support residential property for the foreseeable future.

Zip’s crypto bet, Brambles smashed on downgrade, Uniti halted on insider trading

Zip Co (ASX: Z1P) fell 2.7% despite joining the ‘crypto’ party. The group’s US CEO announced they will embrace the “Millennial Finance Diet” and will begin offering the option for registered users to settle and spend using cryptocurrencies including Bitcoin.

They highlighted surveys suggesting two thirds of customers were more likely to use crypto in their daily lives to justify the inclusion of functionality to allow buying, selling and holding crypto tokens on their US app.

They will also open this functionality to their 15,000 merchants in the country. Pushing back at short sellers, the CEO said, “our growth will ultimately vindicate us”.

Brambles (ASX: BXB) was the worst performing stock on the market falling 8.3% after management reported profit growth would slow to just 1 to 2% in FY22.

He indicated that the company had been “too focused on short-term performance goals” and had been underinvesting in their business.

He flagged US$90 million in transformation costs as they seek to digitise their business like the many other seeking to do the same in 2021, with the likes of SAP and Microsoft likely beneficiaries in my view.

Fast growing roll up Uniti Group (ASX: UWL) fell 5% and entered a trading halt after director Vaughan Bowen of Vocus fame was charged with insider trading relating to 2019.

US shares continue to fall, Japan outperforms, Apple’s launches new iPhone

The Dow Jones fell over 300 points, ending 0.8% lower, with both the S&P 500 and Nasdaq continuing to weaken, down 0.6 and 0.5% respectively.

Another day of falls came despite signs that inflation may actually be receding after the US CPI rose 0.3% in August and just 0.1% when more volatile food and energy prices are excluded from the ‘core’ figure.

This dragged the 12-month rate lower, from 5.3 to 5.0 and 4.3 to 4.0% seemingly as predicted by the Federal Reserve.

Apple Inc. (NYSE: AAPL) shares fell 1% as attention turned to the release of their latest iPhone and a new Apple Watch, the former still being the core of their sales.

Oracle (NYSE: ORCL) shares fell 2.8% as one of the key players in the ‘cloud’ war with the likes of Amazon and Alphabet reported a 9% increase in profit on revenue growth of just 4%.

Their cloud businesses known as Infrastructure as a Service and Software as a Service have now reached an annual recurring level of $10 billion, or around a quarter of revenue.

Finally, shares in Chinese property developer Evergrande continue to tank after the country’s second largest developer saw a run on its ‘wealth management products’ with many expecting a major default to occur.

The groups bonds now trade at a 70% discount with little hope of a Government bailout.