ASX closes 0.6% lower as RBA dumps yield curve control

ASX weakens on RBA announcement, Netwealth lobs Praemium offer, Goodman upgrades

Outside of the Melbourne Cup, the Reserve Bank of Australia garnered all the attention today with a range of ‘experts’ predicting rate hikes may be brought forward and yield curve control would be abandoned.

As usual, they were only partially right, with the Board keeping rates on hold at 0.1 per cent, reiterating they may raise in 2023 or 2023 should inflation be sustainably within their target range, but they did discontinue the yield curve control strategy.

This has been central to supporting the balance sheets of the major banks during the pandemic.

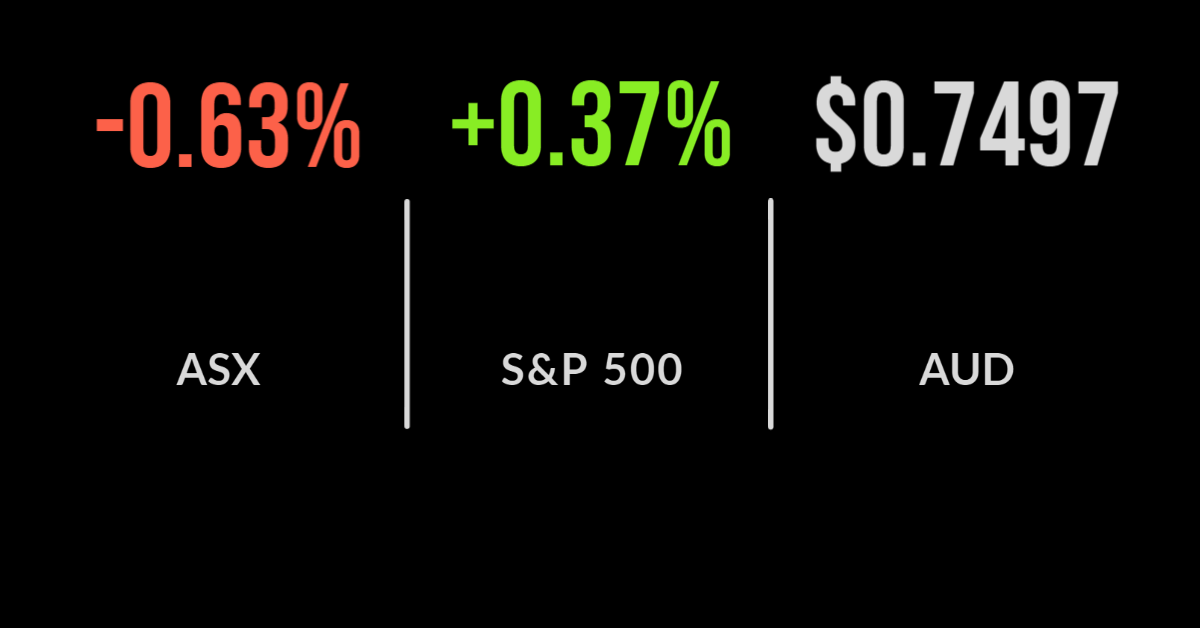

The result was a mixed market which opened stronger only to fall as much as 0.7 per cent during the session and ultimately finish 0.6 per cent lower.

The materials and financials sectors were the biggest detractors with Westpac (ASX: WBC) falling another 2.7 per cent and the Commonwealth Bank (ASX: CBA) 0.5 per cent.

The energy sector remains under pressure, Whitehaven (ASX: WHC) tanking another 9 per cent along with Insurance Australia Group (ASX: IAG) which fell 7 per cent after announcing their insurance profit margins would fall by around 20 per cent due to ballooning costs and claims.

Praemium says bid ‘undervalues’ company, e-commerce powers Goodman

Outside of the RBA decision the platform space dominated headlines today after Netwealth (ASX: NWL) made a widely expected move, proposing a takeover of its smaller rival Praemium (ASX: PPS) for $785 million.

Praemium has long been known as the platform with the best technology and Netwealth with first mover advantage, with any tie up creating a $94 billion superannuation and investment administration giant.

The deal is an all-scrip offer, with Netwealth using its lofty valuation and the synergistic nature of the acquisition to provide 1 NWL share for every 11.96 PPS shares held.

Management of PPS quickly hoses down the offer, it wouldn’t be surprising if a bidding war breaks out.

Goodman Group (ASX: GMG), Australia’s largest property trust, gained 5.8 per cent sending the entire real estate sector higher after announcing earnings growth was expected to be a full 30 per cent higher than previously flagged.

The company has benefitted from a partnership with Amazon and its specialisation in industrial and logistics property to hit a $42 billion valuation.

The development pipeline has grown 19 per cent to $12.7 billion with assets under management now exceeding $70 billion.

Markets at records, RBA move sends global bond yields lower, Avis the ‘meme stock’

US markets pushed further into record territory on Tuesday, with the Dow Jones and S&P 500 both gaining 0.4 per cent and the Nasdaq outperforming, just 0.3 per cent higher.

Shares in Tesla (NYSE: TSLA) fell another 2 per cent after Elon Musk announced that the deal for Hertz to buy 100,000 cars was not yet signed, despite the company begging to differ, Hertz shares were over 6 per cent higher.

Competitor AVIS Group (NYSE: CAR) became the latest meme stock to light up message boards and social media with shares gaining over 100 per cent in less than two hours of trading after the company reported a 96 per cent increase in revenue and a record quarterly profit of US$674 million.

Shares in Pfizer (NYSE: PFE) have remained strong, gaining close to 4 per cent after the company beat analyst expectations in the quarter.

Profit was up sixfold as last year’s fall in demand filtered through with revenue more than doubling to US$24 billion.

Vaccine revenue reached US$14 billion from US$1 billion in the prior year before it was released, of which 75 per cent of sales are coming from outside the US.

The Federal Reserve is expected to taper bond purchases as part of its current two-day meeting.