ASX closes on breakeven, Telstra CEO steps down, lithium, technology surge

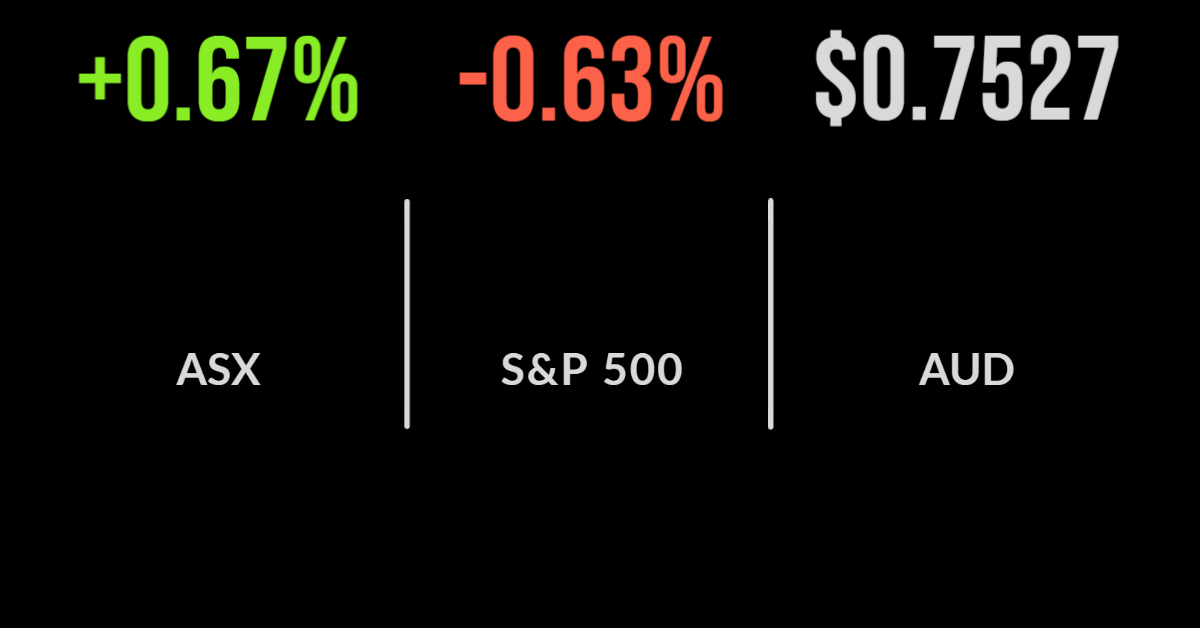

In what can only be described as a remarkable turnaround, the domestic sharemarket is closing in on breakeven for 2022, with the S&P/ASX200 gaining another 0.7 per cent on Wednesday.

A positive lead from the US and signs of a ceasefire in Ukraine saw every sector barring energy and materials rally, with technology the standout, gaining 3.8 per cent.

Block (ASX: SQ2) reached another record high up 6.1 per cent, whilst Magellan (ASX: MFG) gained another 8.5 per cent on the strong performance of a number of key holdings within their global equity funds.

Xero (ASX: XRO) and Megaport (ASX: MP1) also gained more than 5 per cent each despite bond yields hitting the highest point since 2014.

Everyone was focused on Telstra (ASX: TLS) today with the share price falling 0.8 per cent after CEO Andy Penn announced he would be stepping down from September this year.

He will be replaced by Vicki Brady, who occupies his previous role as CFO and will embark on a new era for the simplified and restructured group.

Retailers win from budget, healthcare stocks to benefit, Charter Hall, Regal, Star in the headlines

JB HiFi (ASX: JBH) appears to have caught a post Budget rally with investors believing that the additional payments to low and middle-income Australians will be directed into their coffers; shares gained more than 1 per cent to a new 12 month high.

RBC Capital Markets has suggested the likes of Sonic (ASX: SHL), Healius (ASX: HLS) and Australian Clinical Labs could be underappreciated winners from the Budget after the government allocated another $546 million in Medicare funding towards COVID-19 testing.

Property fund manager Charter Hall (ASX: CHC) gained 1.1 per cent after announcing they had agreed to purchase Irongate Group, a $1.6 billion property manager in a partnership with the Dutch pension fund PGGM for a cost of $1.90 per share; the group appears set on gaining more diversification.

Regal Funds has managed to extract a stronger price out of the embattled hedge fund manager VGI Partners, with the latter agreeing to give up another 6.7 per cent ownership in the company as part of a merger.

The news for Star (ASX: SGR) is going from bad to worse with a class action launched in Victoria following the CEO’s decision to quit this week.

Shares of the casino operator fell 1.8 per cent and are down 15 per cent this year with allegations that they failed to comply with continuous disclosure requirements regarding their systems and management of regulatory risks.

US weakens on Ukraine, oil price increases, Lulu Lemon delivers

Global markets reversed their four day run of positive finishes, with the Nasdaq leading the market down 1.2 per cent on Wednesday.

Among the key drivers was a lack of progress on the ceasefire in Ukraine and a ramping up of hostilities.

The result was an increase in the oil price and both the Dow Jones, down 0.2, and S&P500, down 0.6 per cent also falling.

US economic data remains strong with GDP revised down to 6.9 per cent for the quarter and another 455,000 private-sector jobs added in March.

The meme stock popularity is back with GameStop (NYSE: GME) and AMC (NYSE: AMC) both falling heavily despite a surge in trading volumes once again.

Athleisurewear retailer Lululemon (NYSE: LULU) jumped close to 10 per cent after reporting that annual sales had reached US$6 billion for the first time and are expected to grow to US$7.5 billion in 2022. The company reported US$434 million first-quarter profit.