ASX down 0.3% despite Lithium miners surge

ASX falls, AGL hits record low, IRESS deal slowed, Pilbara hits record

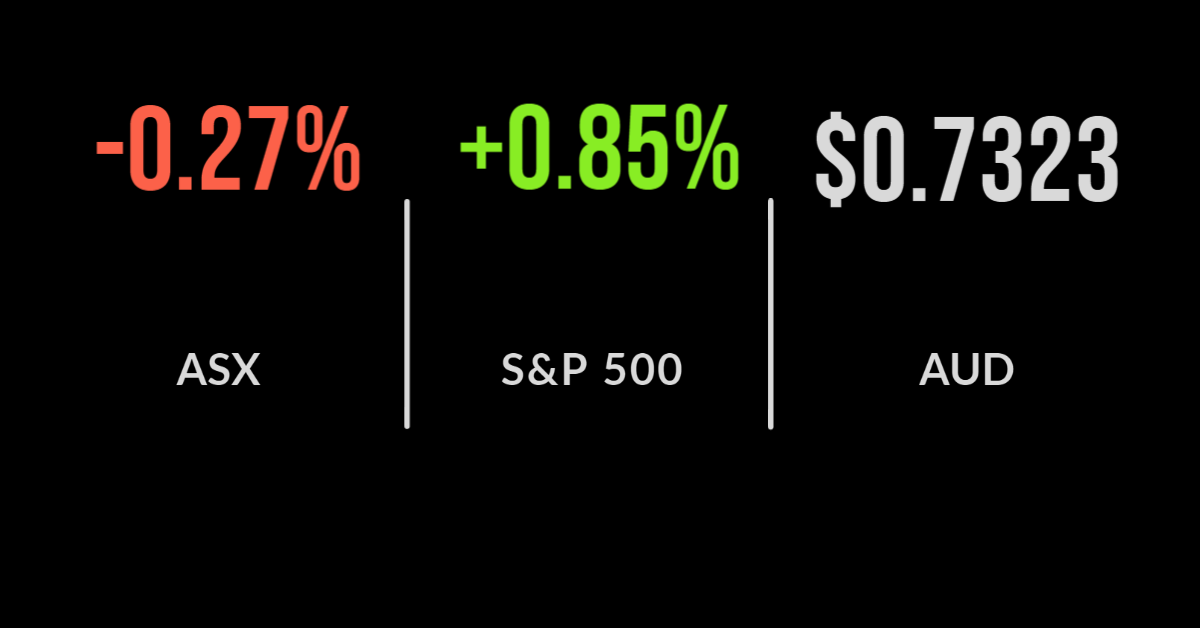

The S&P/ASX200 (ASX: XJO) dropped another 0.3% on Wednesday as the rally in the energy sector reverse, dropping 2.2%.

The key driver was an announcement that OPEC+ expects the oil market to balance earlier than expected.

Every major company fell with Santos (ASX: STO) and BHP (ASX: BHP) both falling 3.5%.

AGL Energy (ASX: AGL) sent the utilities sector lower, falling 7.4% to an all-time market after a tumultuous few years. The selloff comes ahead of the groups AGM at which they are seeking to split the company into two divisions.

Origin Energy (ASX: ORG) outperformed in comparison falling 3.5% given its larger gas exposure.

Shares in technology software provider Iress (ASX: IRE) fell 3.9% as rumours spread that its potential buyer EQT may be seeking to reduce their offer or even pull out of the deal following due diligence.

Qantas (ASX: QAN) shares were flat despite announcing the resumption of international travel from Australia in December, beginning with the US, London and Singapore.

OECD calls out RBA, lithium demand spark, BT announces new CEO

All the attention returned to the lithium sector with Pilbara (ASX: PLS) jumping 8.4% and pacing the market after announcing the results of their second ever auction on the BMX of Battery Metal Exchange.

The platform is used to sell unallocated concentrate from its Australia mine with the group achieving a price of US$1,420 per tonne, a long way from the US$400 received in September, explaining the incredible rally in the sector.

Orocobre (ASX: ORE) was also 2.3% higher. Westpac (ASX: WBC) added 0.3% after announcing the new CEO of BT Financial Group, with Matthew Rady to take the reins of this business that remains on the selling block.

Healthcare and real estate continue to outperform on weaker days with CSL (ASX: CSL) and Charter Hall (ASX: CHC) both adding 1.4%.

In macroeconomic news, the OECD has called for an independent review of the Reserve Bank of Australia, questioning why they have consistently failed to meet their economic targets of stable inflation and low unemployment.

Quite an interesting suggestion given Australia’s relative success by comparison to the rest of the world.

US markets rise strongly, Microsoft ups dividend, casinos in China’s sight

All three US indices posted strong recoveries in what has been a confused week of trading. The Nasdaq and S&P 500 were both 0.8% higher with the Dow Jones adding 0.7%.

Oil remains a key contributor, albeit extremely volatile on a daily basis. The casino sector was sold off in late trading with Wynn Resorts (NYSE: WYNN) down over 6% after the Chinese government flagged further regular pressure on the world’s largest gambling hub in Macau.

The action continues the Environmental, Social and Governance approach of the government after pushing back on high pressure teaching, gaming, social media and now gambling.

Apple’s (NYSE: AAPL) new iPhone 13 didn’t shock the world, delivering slight improvements however, Microsoft (NYSE:MSFT) boosted their dividend by 11% for the quarter and increase its buyback sending shares close to 2% higher.