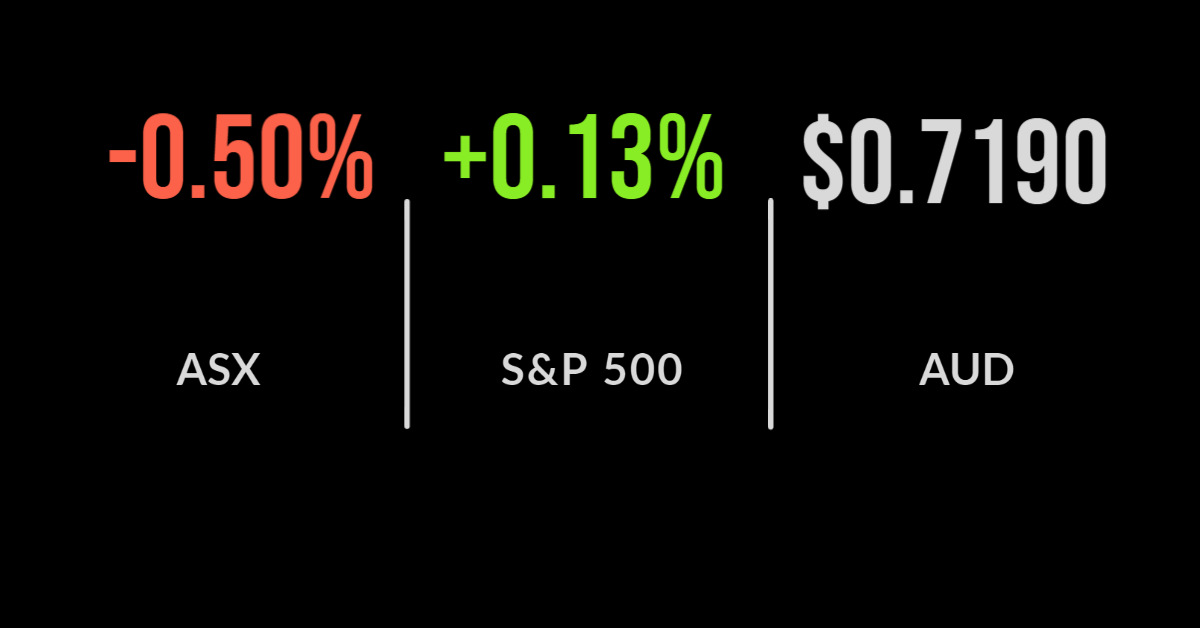

ASX down 0.5% lower as materials, energy underperform

Market falls, unemployment head fake, BHP continues to weaken

The ASX200 (ASX: XJO) continued its recent weakness with reporting season a key drag on performance.

Global investors continue to digest the BHP Group (ASX: BHP) delisting with the share price falling another 6.4% all but closing the premium to their London listed shares.

This is likely a surprise to management who would have expected the opposite. The result was the materials sector falling 3.7% and dragging the ASX200 down 0.5% for another day.

Elsewhere it was a mixed day with consumer discretionary rallying 1.5% behind the likes of Redbubble (ASX: RBL) and healthcare up 2.0% as CSL (ASX: CSL) jumped 3.2%.

Origin Energy (ASX:ORG) delivered a previously flagged $2.3 billion loss behind an 8% contraction in revenue which sent shares down 4.1%.

That said improving energy prices are beginning to feed through which supported a solid if not surprising dividend of 7.5 cents per share.

Redbubble led the market adding 18%, however, it remains down over 50% from its 2020 high. The group reported a 58% increase in marketplace revenue to $533 million and a tenfold increasing in earnings to $53 million.

Profit was just $31 million as margins remain challenged and last year’s fast mask dominated sales growth becomes hard to follow.

Treasury Wine and Snoop Dogg, Newcrest delivers,

Australia’s unemployment rate dropped to its lowest level since 2008, hitting just 4.6% in July. Whilst the headline suggests good news, it couldn’t be further from the truth with the result driven by a 1% fall in the participation rate as more people gave up even looking for work.

The economy is teetering and clearly lacking government support as lockdowns spread across the nation.

Treasury Wine (ASX: TWE) appears to be navigating the year from hell reasonably well, reporting a flat result in 2021 with revenue remaining at $2.68 billion despite a near zero result from China.

Profit actually increased 2% to $250 million with the dividend increase from 8 to 13 cents per share; shares fell 1.5% on the news.

Newcrest Mining (ASX: NCM) has benefitted from strength in the gold price and a falling Australian dollar, seeing profits increase 55% to $1.2 billion.

It was driven by record production of copper and gold, seeing cash flow hit $1.1 billion and moving on from the issues of the 2010’s. Management doubled the dividend to US 40 cents per share.

Stocks under pressure, Big China weakens, strong employment data

US markets weakened once again as the Federal Reserve minutes suggested tapering of bond purchases may go ahead despite a clear weakening of the economy.

The tech sector outperformed with the Nasdaq heading 0.1% higher behind Apple (NYSE: AAPL) and Microsoft (NYSE: MSFT) whilst the Dow Jones dropped 0.2% as the correction in oil prices continued.

A strong unemployment result shocked the market as did news that the Chinese government was seeking to crackdown on the treatment of delivery drivers and look more closely at live streaming.

Alibaba (NYSE: BABA) and Tencent (HKG:0700) were down 7 and 3% respectively. Chip maker NVIDIA (NYSE: NVDA) offered a market update reporting a fourfold increase in quarterly profit to US$2.37 billion, on the back of record revenue of US$6.51 billion, up 68%.

Gaming chip sales continue to drive performance, improving 85% in the quarter, with management noting they have enough supply to meet their fourth quarter growth demands by 2022 may be more difficult; shares were up 4%.