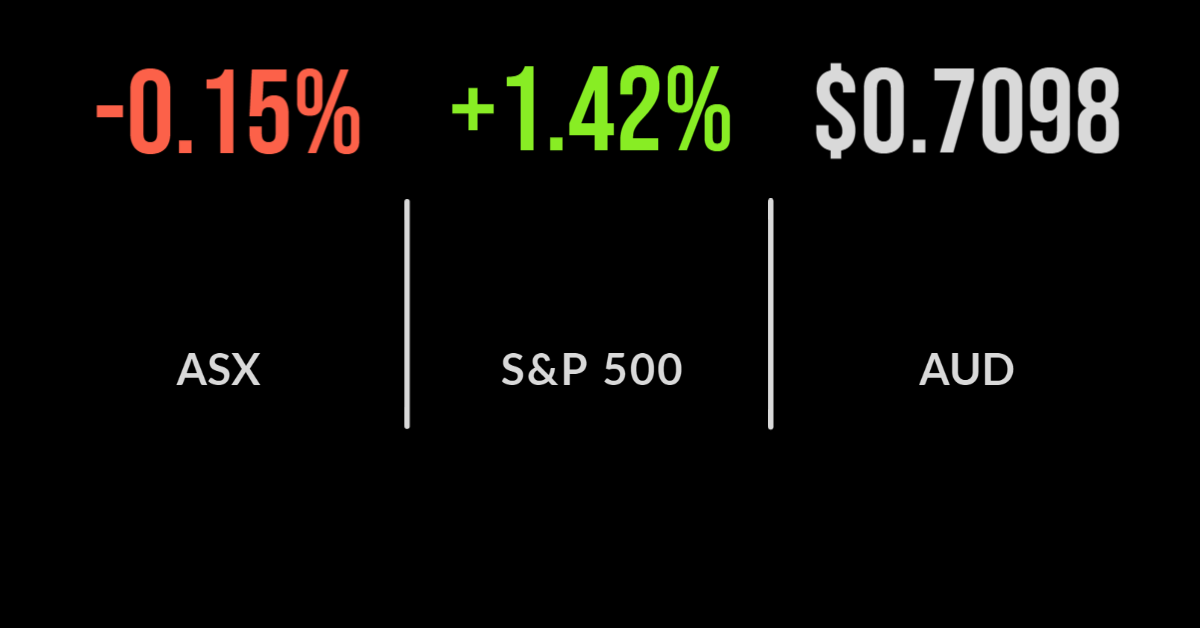

ASX drops 0.1%, tech stocks dive

Market flat despite weak global lead, Woolies trumps Wesfarmer’s, Macquarie’s gain

The S&P/ASX200 (ASX: XJO) continues to oscillate between winners and losers, with the losers directing the market today.

The technology sector dragged the market 0.2 per cent lower as it fell 3.2 per cent during the session.

The biggest detractor was Afterpay (ASX: APT) which is facing a challenge to the Square (NYSE: SQ) takeover in Europe.

Netwealth (ASX: NWL) and Hub 24 (ASX: HUB) were also down 6.5 and 3.6 per cent as attention to turned to valuations.

Both energy and materials took a breather, but the industrials sector was boosted by infrastructure, with Transurban (ASX: TCL) gaining 2 per cent.

Australian Pharmaceutical Industries, which owns the Priceline chain of pharmacies, topped the market gaining 16.1 per cent after Woolworths (ASX: WOW) trumped Wesfarmer’s (ASX: WES) by lobbing a superior 1.75 bid for the company.

Both giants are clearly keen on gaining access to the booming sector and leveraging their significant supply chain efficiencies to boost profits.

Shares in high performing Macquarie Group (ASX: MQG) gained 1.5 per cent after announcing former Reserve Bank Governor Glenn Stevens as their new Chairman.

Coles hit by Fair Work claim, Premier recovery, pension funds seek property

Shares in Coles Group (ASX: COL) fell 0.5 per cent after it was announced that the Fair Work Commission would be initiated court proceedings for underpayments identified in 2020.

The company has already paid back $13 million with a further $12 million expected.

Premier Investments (ASX: PMV) claimed to have lost as many as 42,000 trading days across their massive store network in the current financial year alone.

Retail sales are recovering but remain slow, falling 3.5 per cent in the first 17 weeks of the year compared to 2020 levels.

The fight for infrastructure assets is beginning to move into real assets including commercial property with SCA Property Group (ASX: SCP) announcing a near $300 million partnership with foreign investor GIC.

GIC will own an 80 per cent equity interest in a joint venture with SCA that will see some seven assets transferred into the trust at a capitalisation rate of around 4.84 per cent.

Despite dismissing the takeover offer from Blackstone, Crown Resorts (ASX: CWN) has offered exclusive due diligence to the group, allowing them access to their books to make a real assessment and valuation of the business.

Markets jumps on Omicron, Snowflake revenue doubles, small caps rally on growth

Global markets continued their recent bounce, with all three US benchmarks gaining strongly on Thursday.

The Dow Jones powered ahead on signs that the Omicron variant may be less symptomatic than expected after another case was found in New York; the market finishing 1.8 per cent higher.

Once again, the beneficiaries have been smaller companies and travel-related stocks like Boeing (NYSE: BA) which jumped 7 per cent on the news.

The S&P500 and Nasdaq underperformed, gaining 1.4 and 0.8 per cent respectively with Apple (NYSE: AAPL) a detractor after they reportedly informed their suppliers that product sales were slowing.

Snowflake (NASDAQ: SNOW) was one of the standouts, with the technology company jumping over 15 per cent after reporting that revenue had doubled in the most recent quarter.

It was a ‘breakout’ quarter according to management for the company which provides data warehousing and analysis and is seeing huge demand as customers move away from the likes of Oracle (NYSE: ORCL).