ASX drops 1.8% as heat goes out of reflation trade

ASX dragged down by US sell off, CBA sells general insurance arm, Boral out of the US

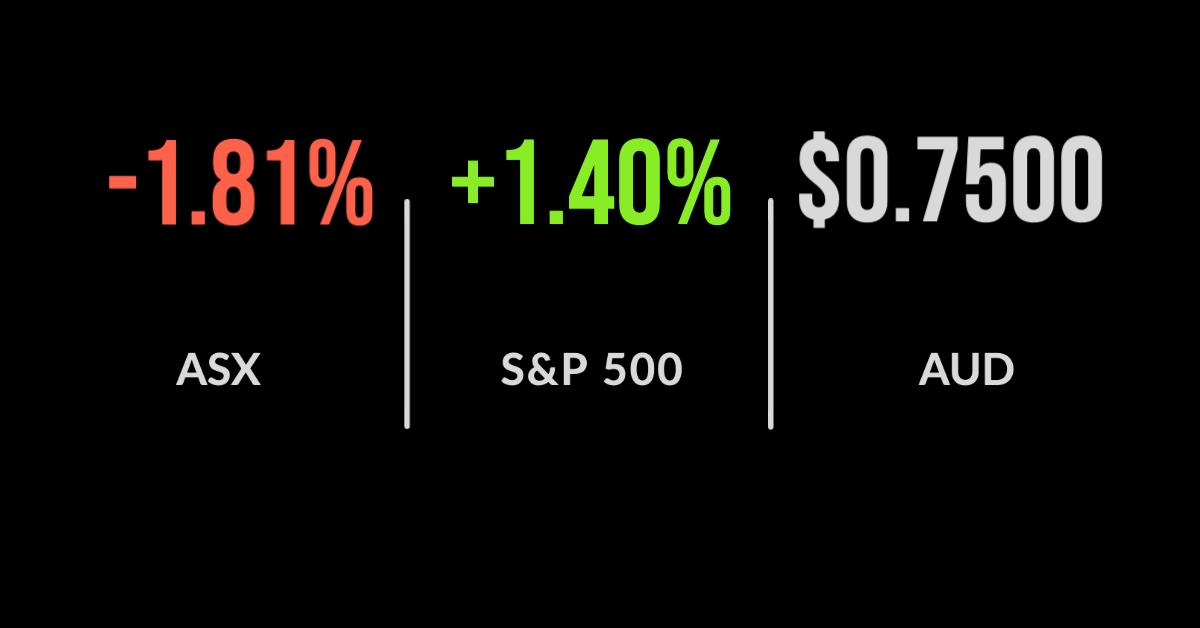

The ASX 200 (ASX: XJO) followed global markets lower to begin the week, falling 1.8% after being as much as 2% lower during the session.

Among the most significant detractors was the Commonwealth Bank of Australia (ASX: CBA), with Australia’s largest company falling over 5%.

The sell off was primarily due to the about-turn of the Federal Reserve, with banks amongst the biggest winners of the vaccine recovery. However, CBA management also announced the sale of their general insurance business, CommInsure.

The group agreed to a sale price of $625 million for the massive insurer to South African based Hollard Group, with commissions to continue for many years.

The sale will represent a profit of around $90 million and marks the final step in Matt Comyn’s simplification strategy.

Insurance was the 13th divestment the company has made since 2017 and opens the opportunity for a $5 billion return of capital to investors.

The value recovery may well be over before it began, with key defensive names Woolworths Group Ltd (ASX: WOW) and CSL Limited (ASX: CSL) among the only stocks to hold their ground on the basis of their strong, consistent, and less cyclical earnings.

Consumer staples and IT were the only sectors to deliver positive returns, up 0.2% each.

Retail trade bit by Victorian lockdown, Boral sells US products, Vocus, ME Bank deals approved

Retail sales came in well below expectations in May, delivering growth of just 0.1% compared to the 0.4% expected.

The culprit was the ‘snap’ Victorian lockdowns, which sent retail spending down 1.5% in the state for the month alone.

Outside of Victoria, growth was stronger but by no means the buoyant level predicted by economists in 2020.

Boral Limited (ASX: BLD) was another rare winner, jumping over 1.3% after agreeing to sell its North American building products business to Westlake Chemical Corp for $2.9 billion.

This was well ahead of the $1.9 billion that domestic analysts had valued the company and an unexpected event for predatory Seven Group Holdings Ltd (ASX: SVW) which continues with their low ball $6.50 offer.

Finally, recent deals have been closed with the Foreign Investment Review Board approving the acquisition of telecommunications group Vocus (ASX: VOC) by Aware Super and Macquarie’s Infrastructure and Real Assets division, and Bank of Queensland (ASX: BOQ) receiving the Treasurer’s approval for the merger with ME Bank.

Value trade returns, US stocks recover losses, Netflix signs massive deal

The value or reflation trade continued at full steam overnight, with the Dow Jones jumping 1.8% on little news outside of another member of the Federal Reserve noting that the economic recovery is likely to be varied and uneven.

The S&P 500 also added 1.4%, with the Nasdaq underperforming, jumping 0.8% as investors flocked back to the financials and energy sectors.

The oil price rallied once again sending energy stocks higher, however, it was the banks that drove the market, with the sector having a strong session as a combination of lower short-term bond yields and higher longer-term yields is expected to boost profitability.

Billionaire Ray Dalio of Bridgewater was the latest to throw their hat in the ring suggesting the Fed will find it difficult to increase rates without creating significant volatility in markets.

Netflix Inc (NASDAQ: NFLX) was lower despite announcing a high-profile deal with Steven Spielberg to produce a number of movies each year.