ASX ekes out another gain as RBA stays the course

Markets flat, RBA expects economy to ‘bounce back’, tech sector hit

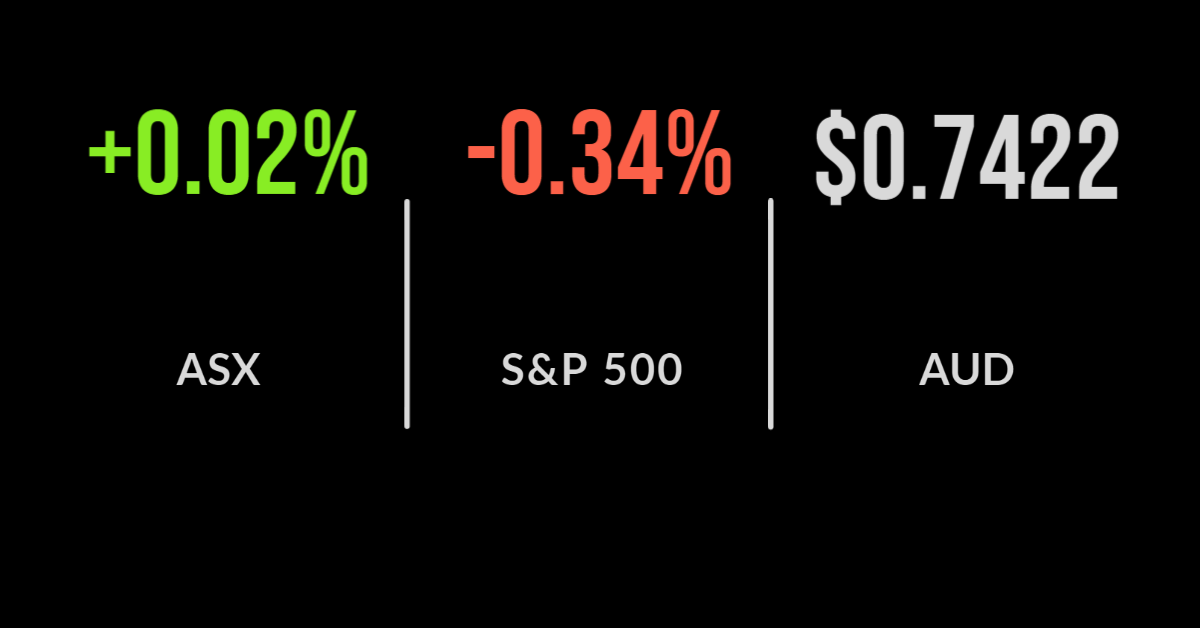

The ASX200 (ASX: XJO) finished broadly flat on Tuesday, struggling to find direction after the long weekend in the US.

Materials remain the biggest drag on the index as steel production curbs in China continue to push shares in Fortescue (ASX: FMG) and Rio Tinto (ASX: RIO) lower by 3 and 2% respectively.

The tech sector also underperformed, with Appen (ASX: APX) and Nearmap (ASX: NEA) both dropping over 3% as inflation expectations continued to increase.

Flight Centre (ASX: FLT) was a standout jumping close to 6% as the NSW Premier continues to outline the way out of COVID lockdowns hinting at their own ‘Freedom Day’.

But it was all about the Reserve Bank of Australia who held their September meeting. Many economists had been predicted a reversal of the $4 billion weekly bond buying that had seen the central bank purchase as much as $200 billion worth of state and commonwealth government bonds since the beginning of the pandemic.

They were proven wrong, with Governor Lowe confident that the economy will bounce back from virus lockdowns afflicting the two most populous states and confirming the ‘tapering’ of purchases would go ahead as expected.

Bond buying to be reassessed, Guinea production continues, active management delivers

The RBA did, however, put the decision around further tapering of purchases on hold until at least February 2022.

They noted some sectors of the economy were booming, those supported by governments, with many others struggling but expects this to “delay” not “derail” the recovery; we can only hope.

The cash rate target was held steady at 0.10%. Guinea is the home of a number of mines central to the production of aluminium, Rio Tinto’s Simandou project is located there.

News this week about a military coup sent the price to decade highs but reports now suggest the mining sector has been exempt from curfews and strict controls.The region is incredibly important producing half of all bauxite consumed by Chinese refineries.

Passively managed, index following strategies have gained in popularity in recent years, benefitting from the strong performance of the benchmark, but the tables may be beginning to turn.

According to Standard & Poor’s research, some 55% of all active equity funds outperformed the benchmark despite it returning 27.8% for the financial year.

US markets mixed, big tech powers on, Bitcoin tanks on El Salvador rollout

US markets began the week on the soft note, with the Dow Jones falling 270 points or 0.8% on concerns that the economic recovery may have peaked.

The S&P 500 fell 0.3% but the Nasdaq gained 0.1% to a new record despite 7 out of 10 constituents falling.

Investors are once again returning to the FANG and ‘defensive’ tech stocks with Apple (NYSE: AAPL) up 1.6%.

Chinese tech stocks also continued their recovery from regulatory concerns as both exports and imports jumped far more than anticipated with JD.com and Baidu both up over 2%.

Bitcoin faces one of its biggest tests this week as the highly touted rollout of the digital currency as a means of payment in El Salvador begins. It started on a rough note with the currency falling 17% to open the week.