ASX falls, but up 1.3 per cent for the week, Santos sinks on exploration, Premier delivers record trade

The week ended poorly for the domestic sharemarket, with the energy sector (down 2.5 per cent) dragging the S&P/ASX200 0.7 per cent lower. Real estate also fell 2.6 per cent with healthcare and communications the highlights, gaining 1.1 and 0.8 per cent. The property sector sold off heavily amid news that global giant Blackstone had seen the maximum level of redemption requests on their world leading commercial property income fund; Charter Hall (ASX: CHC) and Goodman (ASX: GMG) fell 5.1 and 4.1 per cent respectively. Gold miners were once again in favour, as news that US rate hikes were set to slow combined with a weakening of the USD to send the gold price to a multi-month high; Silverlake (ASX: SLR) and St Barbara (ASX: SBM) gained 7 and 10 per cent each. Shares in Santos (ASX: STO) fell 3.8 per cent after the company lost another appeal against a Federal Court order to cease drilling on a gas project in the Tiwi Islands, while Beach (ASX: BPT) fell after Hancock Prospecting increased its offer for Warrego Energy. Retailer Premier Investments (ASX: PMV) fell 0.5 per cent despite reporting record sales on Black Friday and 23 per cent growth for the year to day. Across the week, the materials sector finished 4 per cent higher, while energy lagged once again, falling by more than 3 per cent.

Dow flat but gains for the week, Russian oil price capped, strong jobs growth continues

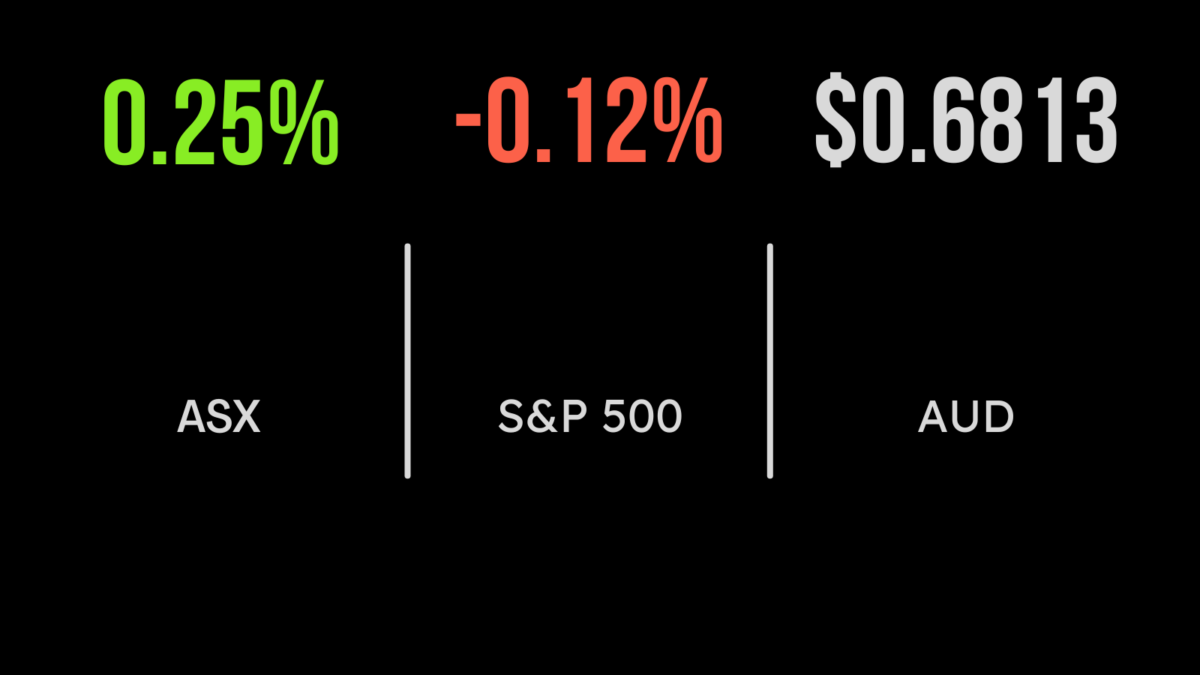

It was a mixed finish for the week, with stronger than expected jobs data in the US contributing to greater uncertainty around the outlook for monetary policy. The Dow Jones gained 0.1 but the S&P500 and Nasdaq fell 0.2 per cent respectively as the economy added another 263,000 jobs, beating expectations of 200,000. This was cause for concern for investors as it suggests the economy isn’t slowing down as much as the Federal Reserve would hope. The unemployment rate remained at 3.7 per cent while wage growth continued to accelerate to 5.1 per cent, near double that of Australia. Robot AI group UiPath (NYSE: PATH) gained more than 12 per cent after the company reported a halving of its quarterly loss on 20 per cent revenue growth and forecasted the strength to continue. The world’s leading producers locked in a US$60 per barrel cap on Russian oil, which is expected to have little impact on the market price given it is broadly in line with the price the country is selling to China and India. Over the week, technology was back in favour with the Nasdaq gaining 2.1 per cent, the Dow Jones 0.2 and the S&P500 1.1 per cent.

November’s unexpected rally, Vanguard hit by ASIC, return expectations upgraded

Just when peak bearishness hit the market, with the forecasts of impending doom hitting fever pitch sharemarkets around the world responded with an almighty rally. Each of the major US benchmarks finished November more than 5 per cent higher, while the Chinese Hang Seng gained more than 25 per cent. The driver? A predictable slowing in inflation and hopes of a similar slowdown in rate hikes. The corporate regulator remained aggressive this week, announcing that one of the world’s largest fund managers, Vanguard, had been hit with a $39,000 penalty for the marketing of one of their ESG-related products. According to the announcement, their marketing may have overstated the extent of the exclusion of tobacco-related companies from their product. Finally, global asset manager JP Morgan, offered an insight into the significantly improved position of global asset markets this week upgrading their expected returns from a traditional 40/60 portfolio. The group now expects annual returns exceeding 7 per cent for the next decade, nearly double 4.3 per cent expected last year.