ASX gains 0.4% as healthcare, industrials and IT lead

ASX powers into close, quality rotation, commodities weaken

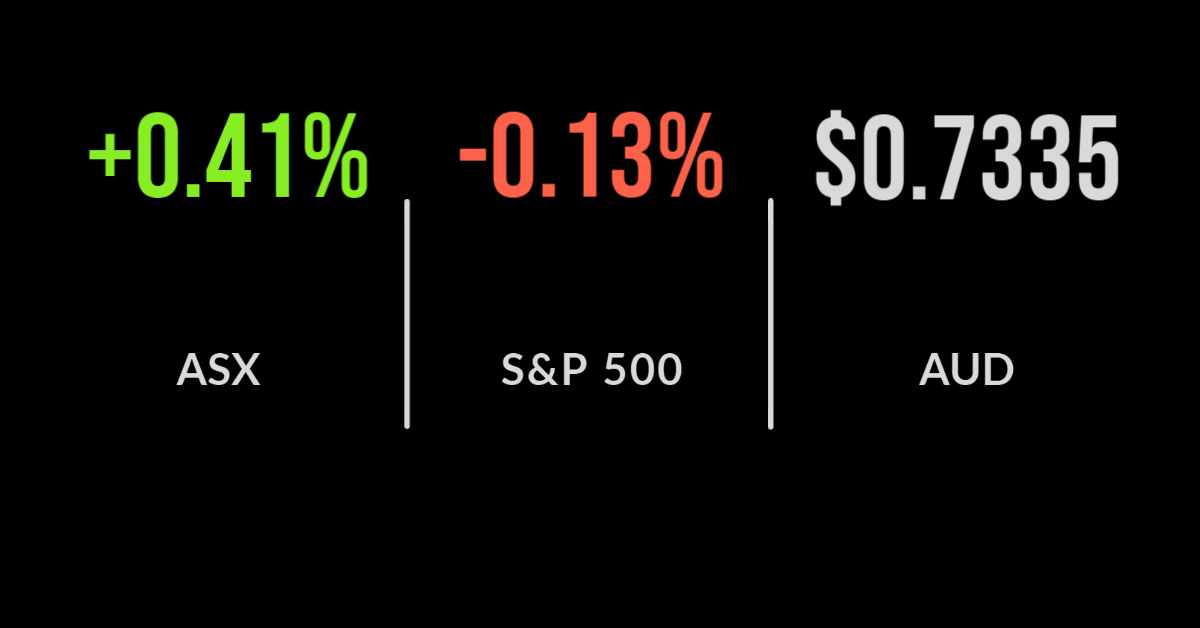

The ASX200 (ASX: XJO) strengthened throughout the day to ultimately finish 0.4% higher following a positive lead from Wall Street.

Quality remains the key as bond rates continue to fall with industrials and tech leading the market higher, up 1.2 and 1.9% with energy and utilities continuing to weaken as the Delta variant closes borders.

Harvey Norman (ASX: HVN) waited until the final day of reporting season to deliver their report, and it was a blockbuster.

Profit jumped 78% to a record $1.18 billion, benefitting from less discounted and the removal of support to franchisees that are now booming.

The group’s underappreciated property portfolio was revalued $291 million higher and now exceeding $3 billion.

Management confirmed they had repaid their Job Keeper receipts given the strong year and also cut the dividend to 15 cents form 18 in 2020, sending shares down 3.2%.

As has been the case across retail, sales in Australia are down 19% in July and August from 2020 levels.

It was a positive day for small cap retailer Cettire (ASX: CTT) with shares 2.8% higher after reporting a quadrupling of revenue to $124 million and narrowing their loss to $300,000.

The company was under pressure from brokers in recent months concerned about the sustainability of sales.

GDP downgraded, Chinese activity slows, two sides of the boom

June quarter GDP is due out this week, with both AMP and CBA economists now predicting a positive quarter or 0.3% despite the lingering impact of lockdowns and closed borders.

They cite strong government spending and construction as keys behind the recovery; only time will tell if these forecasters are proven right or wrong again.

China’s services sector has contracted in August with manufacturing growth also slowing as another round of lockdowns hit the economy; this does not bode well for Australian GDP in the September quarter.

Evidence of the two-speed economy is on show with non-bank lender Resimac (ASX: RMC) reporting an 87% increase in profit to $104 million on the back of a 29% increase in interest income.

The growth is coming from a boom in home loans as the residential construction sector continues to drive the economy, in the short-term at least.

Copper producer Sandfire (ASX: SFR) also reported a record profit, up 132% to $170 million with physical production and inflated copper prices creating the perfect storm. Shares were flat despite the record dividend.

7th straight monthly gain, but markets weaken, Zoom tanks on poor outlook

US markets managed to deliver a seventh straight monthly gain despite a weak finish to August.

The Nasdaq was down 0.04%, the Dow Jones and S&P 500 both down 0.1%.

President Biden confirmed the US had completed their exit from Afghanistan, but it was a sharp weakening of consumer sentiment that hit the market.

Sentiment fell to the lowest since February as stimulus measures tapered off and a spike in cases and deaths due to the Delta variant has impact people’s willingness to spend.

This comes at the same time that European officials are now considering their own tapering program, with the region outperforming due to their management of the latest outbreak.

Zoom (NYSE:ZM) is the latest to be hit by lofty expectations with shares falling 16% despite confirming revenue will exceed US$1 billion.

Management guided to a weaker than expected showing citing the return to schools and gradual return to offices behind the fall.