ASX gains as China protests slow, Collins Food tanks, consumer sentiment up

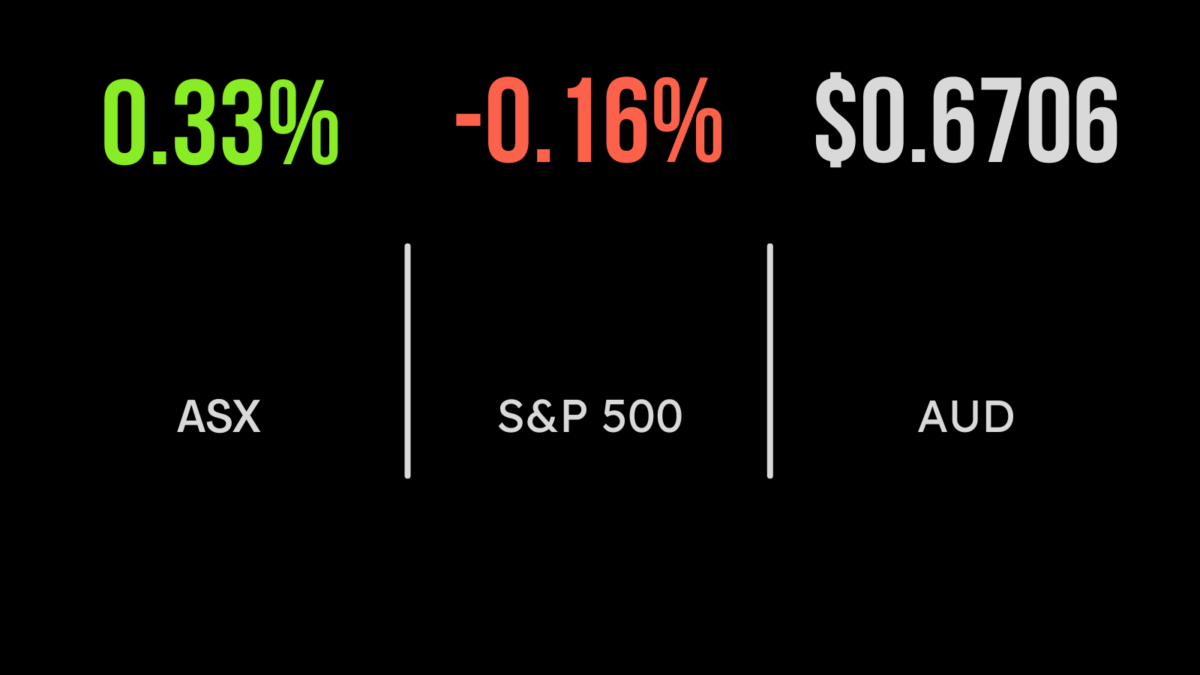

The local market managed to deliver another gain, the S&P/ASX200 adding 0.3 per cent as signs of improvement in China supported a rally in key commodity prices. Rio Tinto (ASX: RIO) gained 3.5 per cent and Fortescue (ASX: FMG) 2.2 per cent after the latter named a new CEO, Fiona Hick, who was previously part of the Woodside’s Australian leadership team. An important meeting of Chinese leaders on lockdown concerns will be held overnight. Shares in Collins Foods (ASX: CKF) fell by 19.8 per cent after the company missed expectations, reporting a profit of just $11 million, less than half of the prior half-year. The profit result came despite a 15 per cent increase in revenue and domestic same-store sales growth of 5.6 per cent, with inflationary headwinds on staffing and input costs impacting on profit margins. The dividend was maintained. On a positive note, consumer confidence rose another 1.8 per cent last week, a third straight gain as it appears the pain of property prices is beginning to subside.

Fisher & Paykel surges, Ramsay did it all could, Brickworks links with Santos

Shares in medical appliance manufacturer Fisher & Paykel (ASX: FPH) gained close to 10 per cent after the company reported revenue ahead of expectations, but still down 23 per cent on the prior year. Traders had been expecting a worse outcome, but still more than 20 per cent better than prior to the pandemic. Profit margins remain under pressure, but such was the strength of the result that the dividend was increased. That said, management refused to provide any real forecasts for the full year. Brickworks (ASX: BKW) has announced a nine-year partnership with Santos (ASX: STO) for the purchase of gas that will see the company lock in a key cost of producing 500 million bricks per year. Shares in gut health testing microcap Microba (ASX: MAP) gained 52 per cent after the company confirmed Sonic Healthcare (ASX: SHL) would purchase a 19.99 per cent stake for $17.8 million. Woodside (ASX: WDS) fell 0.3 per cent after providing updated guidance, production is set to fall between 180 and 190 mmboe, with prices capped by local gas hub indices.

S&P500 lower ahead of Powell speech, China stocks rally

It was another mixed day for US stock markets with the Dow Jones barely breaking even and both the Nasdaq and mmboe falling, down 0.6 and 0.2 per cent respectively. Markets are awaiting an impending speech from Fed Chair Jerome Powell while all attention has returned to China. A meeting of government officials flagged a renewed focus on vaccination which many hope will trigger a loosening of lockdowns with the news sending the Hang Seng more than 5 per cent higher. The likes of Alibaba (NYSE: BABA) and Nio (NYSE: NIO) both gained more than 4 per cent. Cyber Monday has overtaken Black Friday with another US$11.3 billion spent on the last weekend of the holiday, according to Adobe (NYSE: ADBE) though higher prices have been central to the higher net result. Property prices continue to fall in the US, with the Case-Shiller index down 1.2 per cent in September, a third straight monthly decline, while the RoyalBank of Canada (SY) is set to purchase HSBC Canada in a US$10 billion deal.