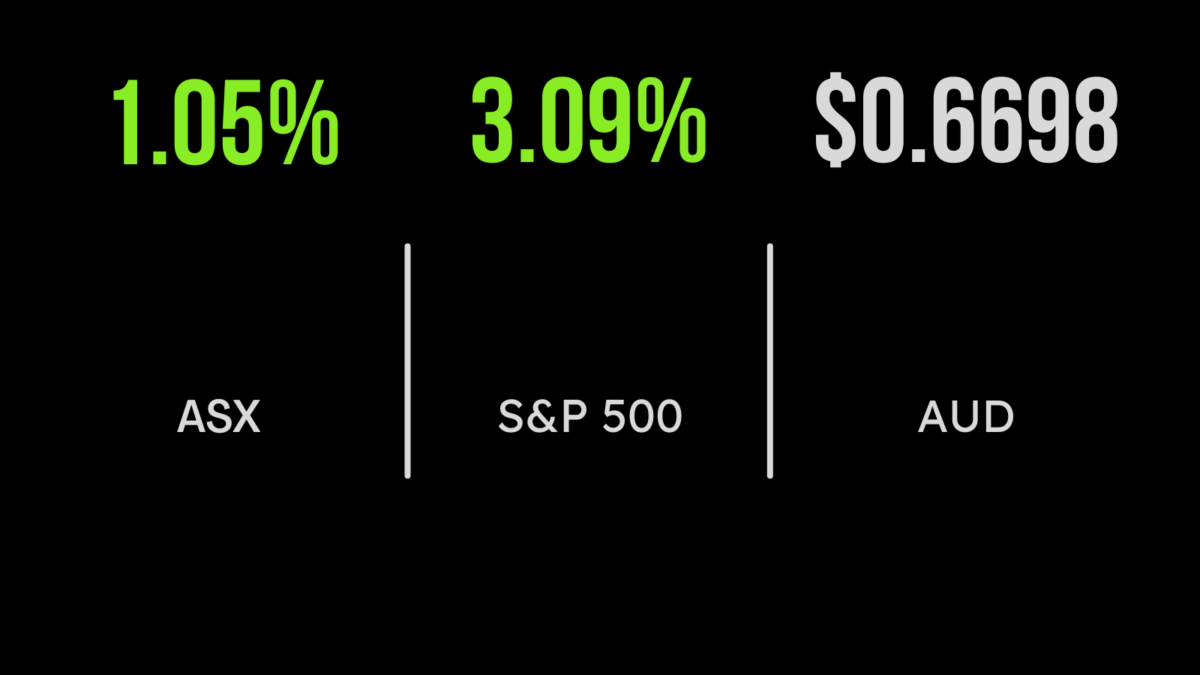

ASX gains on inflation data, energy, materials surge, Temple & Webster jumps

The standout sectors were energy, up 1.8 per cent, real estate and materials, both up 1.3 per cent, with New Hope Coal (ASX: NHC) and Whitehaven Coal (ASX: WHC) `gaining 6.8 and 8.4 per cent respectively, on hopes that the Chinese lockdown policy would be eased in the coming weeks. But the most powerful influence by far was the much lower than expected inflation data, with the 12-month increase in prices hitting just 6.9 per cent. Once again, so-called expert forecasters were predicting inflation of closer to 7.6 per cent for the period, warning the end of the fuel excise cut would see a surge in prices. The result was only slightly higher, from 10.1 to 11.8 per cent, with the monthly increase only 0.3 per cent. Among the biggest positives was a slowing in the price of fruit and vegetables from 17.4 to 9.4 per cent something obvious to those visiting their local supermarket. Ultimately, the result increases the likelihood that the Reserve Bank will slow aggressive rate hikes.

Temple & Webster sales fall, Star hit by money laundering, Rio goes renewable

Online retailer Temple & Webster (ASX: TPW) took some initial steps on a long road to recovery, with the share price gaining 14.1 per cent despite the company reporting a 14 per cent fall in sales for the first half of the financial year. Margins remain thin, but positive, at 3 to 5 per cent, meaning volumes remain as important as ever. Casino operator Star Entertainment (ASX: SGR) gained 0.4 per cent after the company was hit by anti-money laundering proceedings by regulator AUSTRAC. Proceedings were lodged in the Federal Court, suggesting the company potentially allowed laundering to occur through their VIP rooms. Rio Tinto (ASX: RIO) gained 1.7 per cent on hopes that Chinese lockdowns would come to an end, with management also announcing a $600 million investment in renewable energy to power the companies Pilbara operations. Link (ASX: LNK) was hit with a second strike on director pay, with management lamenting the costs of combating a number of recent takeover offers.

Powell commentary boosts Nasdaq, Crowdstrike sinks

Following weaker than expected inflation data in Australia, Federal Reserve Chair Jerome Powell delivered a speech that surprised global markets. In a similar vein to the message in the recent Fed minutes, Powell flagged the potential for rate hikes to slow as soon as December, as the central bank allows the impact of changes thus far to filter through the economy. The result was a 4.4 per cent jump in the Nasdaq, a 3.1 per cent increase in the S&P500 and 2.2 per cent in the Dow Jones. The Dow Jones underperformed after the oil price retreated to pre-Ukraine war levels. The news came as US job openings also fell to 10.3 million and GDP data for the prior quarter was revised higher to 2.9 per cent. Chinese stocks continued to surge higher on reopening hopes, with Alibaba (NYSE: BABA) and Bili Bili (NYSE:BILI) gaining more than 9 per cent each. Cybersecurity company Crowdstrike (NYSE: CRWD) fell by more than 14 per cent after the company said new subscriptions came in below expectations and guiding to a slower growth rate of around 30 per cent, down from in excess of 50 per cent.