ASX marches on, healthcare, consumer drive market, Woodside selling up

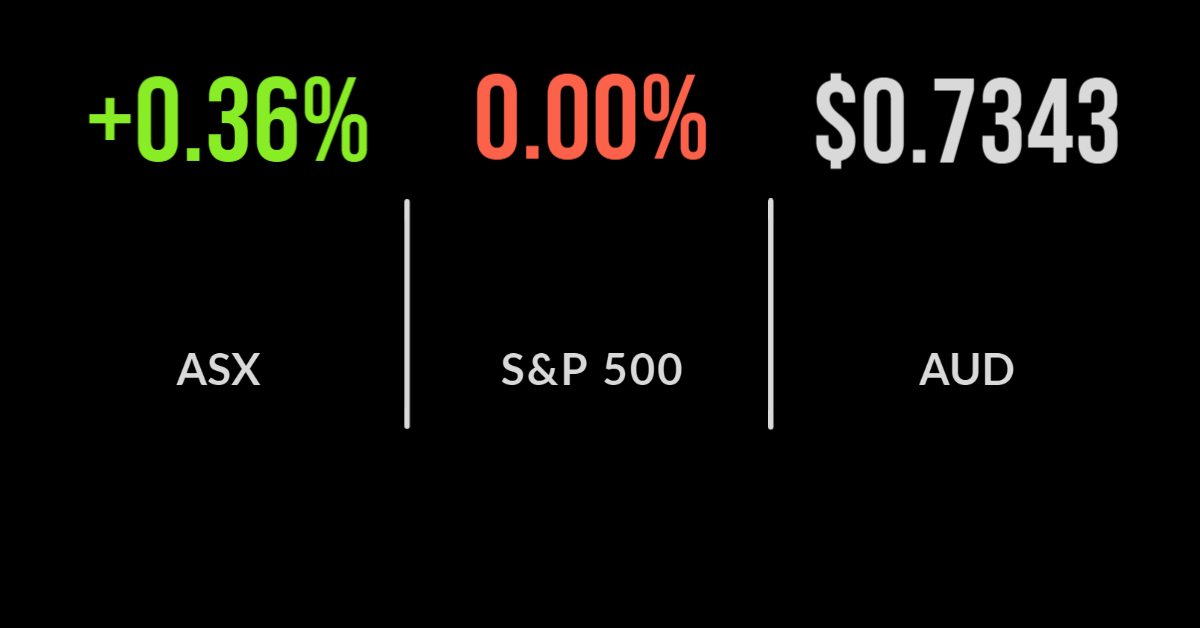

The S&P/ASX200 (ASX: XJO) gained another 0.3 per cent to begin the week, benefitting from broad-based strength.

Each of the consumer discretionary, healthcare and technology sectors gained more than 1 per cent with experimental group Mesoblast (ASX: MSB) leading the market by finishing 12 per cent higher.

The company delivered a positive update on their “new weapon” a treatment aimed at combatting heart failure, after a Phase 3 trial was completed in New York.

Agricultural business Elders (ASX: ELD) delivered another strong update, reporting a 40 per cent increase in profit to $151 million for the year.

Management remain confident of a strong market for end commodities, with beef prices expected to be elevated as a shortage of supply is met with surging demand as restaurants reopen.

Cost cutting contributed to a 38 per cent improve in earnings and supported a final dividend of 22 cents per share, a near doubling of 2020; shares were close to 1 per cent lower despite the news.

Platinum Asset (ASX: PTM) shares also fell by more than 2 per cent after the company withdrew their decision to grant the CEO additional performance options.

Chinese economy recovers, Woodside sells Pluto, Incitec expands, Telstra switches to AI

The Chinese economy appears to be navigating strict pandemic policies with both the industrial and retail sectors growing ahead of expectations in October.

Experts had predicted 3.1 and 3.5 per cent, with industrial output jumping 3.5 per cent and retail sales nearly 5 per cent as confidence grows.

Shares in Woodside (ASX: WPL) gained 1.1 per cent after announcing the sale of 49 per cent of the Pluto Train 2 gas joint venture to Global Infrastructure Partners.

The sales allow management to avoid the US$5.6 billion that will be required to develop the asset in the coming years as they focus on the tie up with BHP (ASX: BHP).

Incitec Pivot (ASX: IPL) gained close to 4 per cent after the fertiliser manufacturer delivered a 91 per cent increase in first half profit to $359 million.

The result was driven by a booming second half and recent investments in technology, with mining explosives seeing a significant ramp up as commodity prices continue to rally.

The dividend was increased to 8.3 cents per share and follows the closure of their Queensland-based facility in an effort to cut costs.

Shares in Telstra (ASX: TLS) also rallied close to 0.8 per cent after the CEO confirmed the group had entered a joint venture with data and analytics firm Quantium, which is owned by Woolworths, to expand the use of Artificial Intelligence within their business.

Global markets flat, infrastructure bill set to pass, Boeing orders jump

Global markets opened the week on a negative note, with the technology sector dragging them lower as bond yields in the US topped 1.6 per cent, the Nasdaq was flat despite a weak start on Monday.

Both the S&P500 and Dow Jones fared comparatively better also finishing where they started as US earnings season enters its final few weeks.

On the positive side was aircraft maker Boeing (NYSE: BA) which gained over 5 per cent after announcing they had seen a surge in demand for their 737 Freight planes from the likes of Icelease, DHL and Emirates as companies seek to ramp up investment ahead of surging demand.

The long awaited but watered-down infrastructure bill is set to be passed into law on Monday afternoon. Shortly before President Biden meets virtually with Xi Jinping in a meeting that is expected to focus on China’s ‘economic coercion’ of trading partners like Australia.

The ECB flagged interest rates will remain low and that whilst prices may take longer to decline than expected, inflation will eventually moderate.

The third quarter of 2021 has seen record dividend payments showing the swift recovery from the pandemic, according to Janus Henderson, with payouts topping US$1.46 billion.