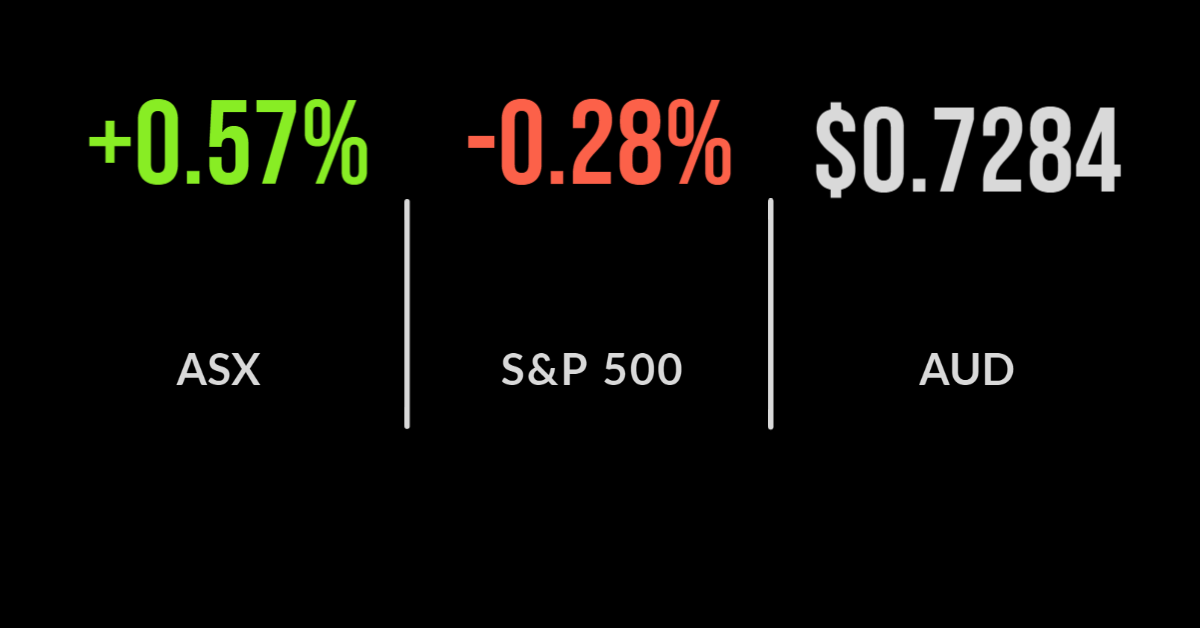

ASX rises 0.6% as banks and energy stocks rise

Financial, travel push market higher, bidding war for Priceline owner

The S&P/ASX200 followed a positive global lead to post a strong opening to the week, finishing 0.6% higher.

Most sectors improved outside of the ‘defensives’ with healthcare, down 1%, and consumer staples underperforming.

Globally, markets were buoyed by a resurgent oil price as weaker supply collides with strong demand across highly vaccinated population, the price reached $78.09 a three year high.

Naturally, the energy sector finished 1.8% higher with financials also outperforming, up 1.5%.

Woodside (ASX: WPL) and Commonwealth Bank (ASX: CBA) were the standouts, up 3.2 and 2.8% respectively.

Shares in Qantas (ASX: QAN) gained 2.8% after announcing their Perth to London flights would be grounded until next April, with departures to be from Darwin due to WA’s strict border position.

Travel stocks recover on NSW guidance, Wesfarmer’s usurped

It was all about the travel sector which had been trading strongly despite closed borders around the country.

Flight Centre (ASX: FLT) jumped 7.5 and Webjet (ASX: WEB) 5.2% after the NSW Government offered more guidance around their reopening plan that would see domestic travel return in the coming months.

The Queensland Government also noted that people should ‘hope’ that borders will reopen by Christmas, something that has significantly boosted sentiment in a struggling tourism sector.

Wesfarmers (ASX: WES) all conquering growth strategy has been hit with a setback after Sigma Healthcare (ASX: SIG) swooped in and delivered a higher bid for Australian Pharmaceutical Industries (ASX: API).

The new deal values the company at $773 million, includes both 35 cents in cash and 2.05 SIG shares, reflecting a 2-cent improvement on WES’ $1.55 per share offer.

The board has entered into due diligence with both suitors, with shares over 3% higher on the news.

Energy, financials rally, tech selloff as bond yields rally, Evergrande defaults

The Dow Jones continued its winning streak, adding 0.2% outperforming both the S&P 500 and Nasdaq.

The tech-heavy indices were down 0.3 and 0.5% respectively as a spike in bond yields sent the 10 year to over 1.5% for the first time since June.

The selloff was broad-based with the likes of PayPal (NYSE: PYPL) and DocuSign (NYSE: SIGN) down 2 and 3% respectively.

It was all about the cyclicals, however, as markets readied for an oil price boom with the energy price and growing shortages boosting stocks, and the financial sector outperforming as high interest rates tend to improve profitability for banks.

Goldman Sachs (NYSE: GS) shares advanced 2.3%. Facebook (NYSE: FB) were slightly higher but impacted by the decision to pause the rollout of ‘Instagram for kids’ given recent concerns around the platforms impact on mental health.

Power supply constraints appear to be a potential drag on growth with shortages of oil and gas expanding across Europe and the US.

China’s Evergrande defaulted on a series of high yielding managed fund investments, whilst bearish New York Fed President Williams raised concerns about a lack of inflation coming down the pipeline.