ASX struggles, Sydney Airport deal lifts travel stocks

Markets weaker on tech, healthcare, BHP sells coal, Sydney Airport deal done

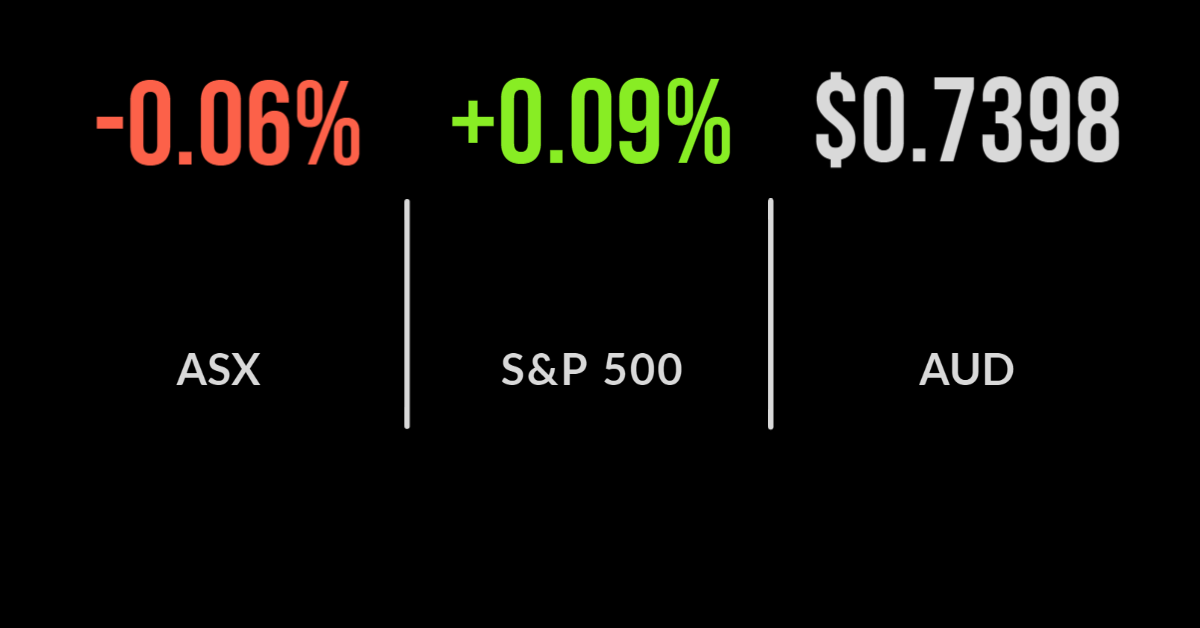

The S&P/ASX200 (ASX: XJO) experienced a rare loss on Monday, falling around five points or less than 0.1 per cent as a selloff in the technology and healthcare sector offset gains in energy and mining.

Healthcare fell by over 1 per cent with CSL (ASX: CSL) a major detractor, pulled lower by surging global bond yields.

On the positive side was BHP (ASX: BHP) which gained 0.8 per cent and contributed to a 0.6 per cent gain for the mining sector after the company agreed to sell two coking coal assets in Australia to Stanmore Coal for US$1.2 billion.

Sydney Airport (ASX: SYD) surged by close to 3 per cent, reaching $8.46 after the board backed a $23.6 billion takeover from IFM investors.

The deal will occur at $8.75 per share, with a small arbitrage on offer due to potential competition concerns, with Uni Super set to transfer their 15 per cent interest into the consortium’s holding company.

The news, along with border reopening’s boosted Flight Centre (ASX: FLT) and Webjet (ASX: WEB) which were both around 5 per cent higher.

Shares in diversified property trust Stockland (ASX: SGP) fell by 1.5 per cent after management announced they would be selling over $1 billion in retail and retirement assets to double down on residential property development, as they seek to capitalise on an expected surge in immigration.

Incitec closure as Alcoa signs new deal, API backs Wesfarmers bid

Fertiliser producer Incitec Pivot (ASX: IPL) has decided to close their Brisbane-based fertiliser plan for good, blaming high gas prices and an inability to negotiate for the decision; shares were broadly flat.

On the opposite side of the country, global aluminium giant Alcoa reportedly agreed to a new power deal that will see the Portland smelter continue operations for the foreseeable future.

The board of Australian Pharmaceutical’s (ASX: API) recommended shareholders accept the $1.55 bid made by Wesfarmers, with shares moving 3.7 per cent higher and finishing at $1.54 per share.

The new owners will seek to leverage their extensive supply chain experience to further expand the footprint of Priceline stores and diversify their earnings base.

Hotel bookings website Siteminder (ASX: SDR) has overcome a difficult travel environment to post a strong gain on listing, finishing at $7.0 per share a 40 per cent gain on the gloat price.

Economist forecasts may well be tested in the months ahead after the RBA released data that showed credit card debt has fallen to the lowest level since 2003, reaching just $9.31 billion in the September quarter.

Stimulus packages and excess savings have been used to pay off high-cost debt, with the question whether this will be reversed as lockdowns end.

US marks gain, longest winning streak in two years, AMD spikes, gold rallies

All three US benchmarks gained on Monday, with the Dow Jones leading the way up 0.3 per cent as energy, mining and smaller companies were at the centre of the rally.

The market has found confidence in the recent strength in jobs growth, even dealing with news from a member of the Federal Reserve that they believe rate hikes may be warranted before the end of 2022.

Congress finally passed Joe Biden’s US$550 billion infrastructure bill, which despite being watered down significantly offers a positive outlook for the construction and key infrastructure sectors.

The crypto sector has been caught up in the new legislation with the White House seeking to force digital exchanges to report in a similar way as traditional broking house and pay additional tax.

The Nasdaq gained 0.2 per cent behind a strong rally in chip maker Advanced Micro Devices (NYSE: AMD).

The company gained close to 11 per cent after confirming their products would be central to Facebook’s (NYSE: FB) new metaverse businesses and had been adopted by every major data centre provider.

Gold continued its recent rally, reaching its highest price in two months as investors seek hedges from booming markets.