Aussie market creeps higher. US markets lift.

Aussie market creeps higher

Despite a steady diet of news of war, global slowdowns, China lockdowns, inflation and higher rates, the Australian share market managed to rise on Wednesday, as measured by the benchmark indices.

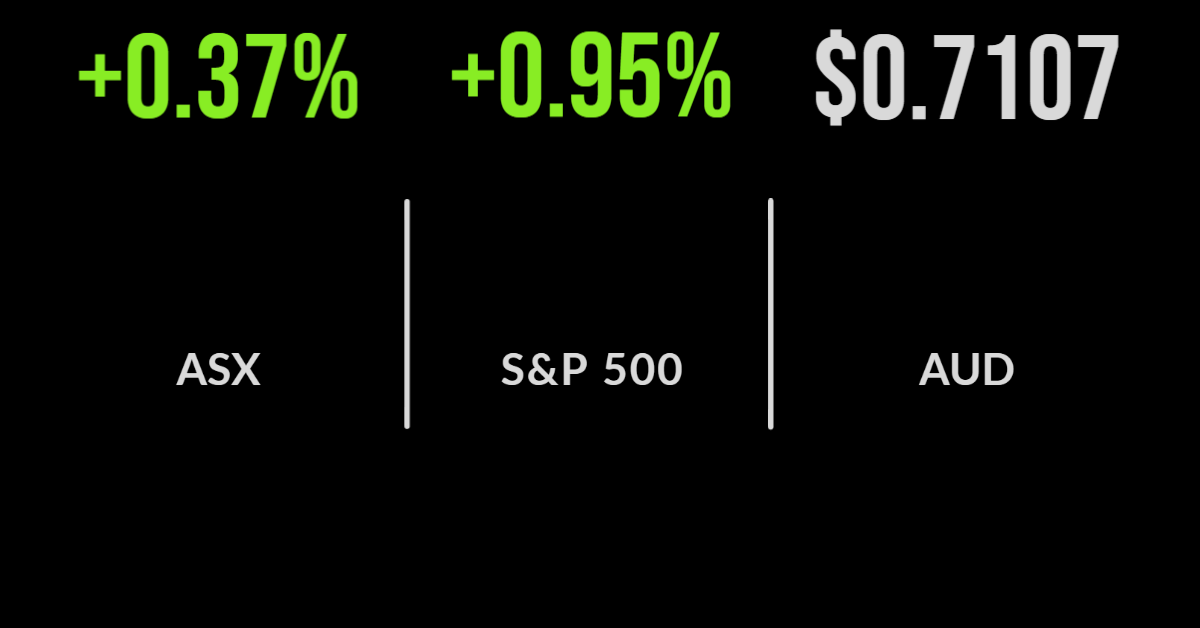

The S&P/ASX200 index added 26.4 points, or 0.4 per cent, to finish at 7,155.2, while the broader S&P/ASX All Ordinaries index closed 18.5 points or 0.2 per cent, higher at 7,391.7.

The gauges were helped by a reasonable showing from the big banks, with NAB up 57 cents, or 1.8 per cent, to $31.66; Westpac gaining 33 cents, or 1.4 per cent, to $23.87; Commonwealth Bank up $1.08, or 1 per cent, to $106.17; and ANZ up 26 cents, also 1 per cent, to end at $25.63.

Telstra lifted 6 cents, or 1.6 per cent, to $3.93; Woolworths advanced 64 cents, or 1.9 per cent, to $35.07; Coles was up 35 cents, or 1.2 per cent, to $18; and Bunnings and Kmart owner Wesfarmers gained 52 cents, or 1.1 per cent, as consumer companies were keenly sought.

Rio, Evolution drive miners

BHP closed at $43.02, down 10 per cent, as its shares went ex-dividend from the demerger of its oil business to Woodside.

Adjusted for that, the stock rose by 1.1 per cent. As for Woodside, which now goes under the name of Woodside Energy Group, it was up 0.7 per cent to $29.18.

Elsewhere in resources, Rio Tinto rose by $1.49, or 1.4%, to $111.96, Fortescue Metals eased 9 cents, or 0.4 per cent, to $20.68, and gold heavyweight Evolution Mining lifted 13 cents, or 3.5 per cent, to $3.82.

Tech did not have a good day, with Afterpay owner Block surrendering $6.31, or 5.5 per cent, to $109.25, Zip Co closing 2.5 cents, or 2.9 per cent, lower at 84 cents, and global share registry giant Computershare posting a bruising 4.8 per cent fall, down $1.14 at $22.77.

US markets lift

Screens ended in the green in the US overnight, where the broad S&P 500 gained 37.3 points, or just under 1 per cent, to 3,978.7; the 30-stock Dow Jones Industrial Average was up 191.7 points, or 0.6 per cent, to 32,120.3; and the tech-laden Nasdaq Composite Index cruised to a gain of 170.3 points, or 1.5 per cent, to 11,434.7.

The rises came on the back of the release of the minutes of the recent Federal Reserve Open Market Committee meeting, which were construed as pointing to more rate hikes that go further than the market anticipates.

The Fed appears to be prepared to move ahead with multiple 50 basis-point interest rate increases.

The Australian dollar is buying 71 US cents this morning.