Aussie market makes it ten of eleven

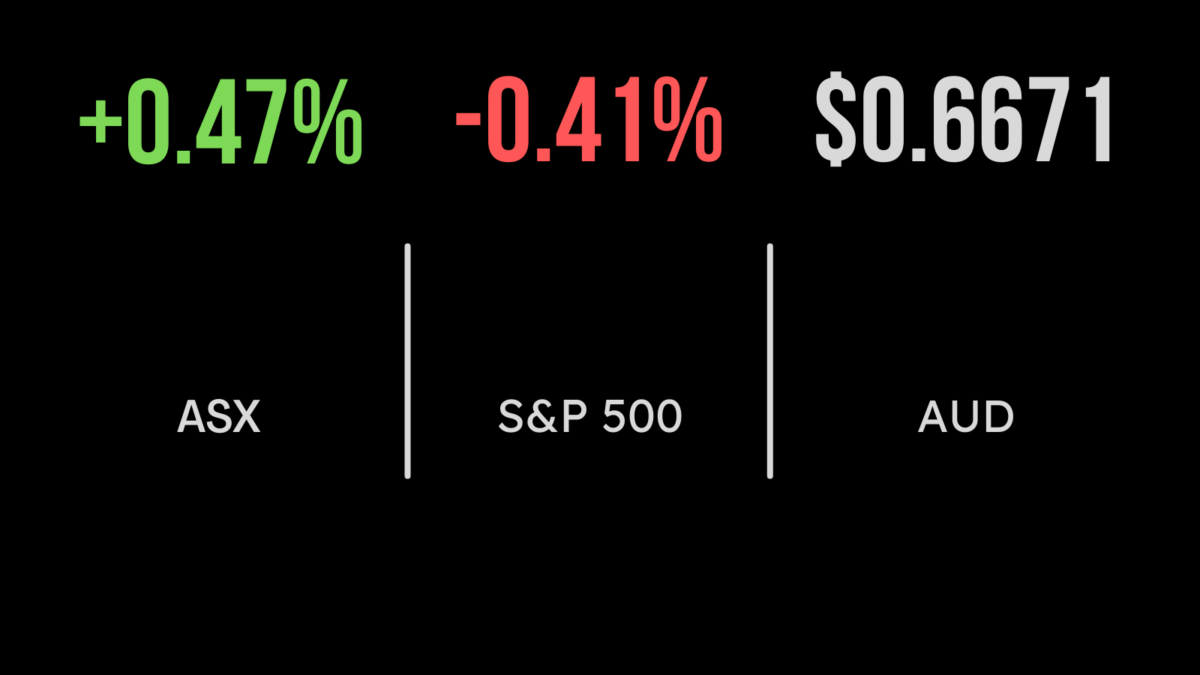

The Australian market did not appear overly concerned about tonight’s US inflation figure, with the benchmark S&P/ASX200 notching its tenth rise in 11 trading days. The ASX200 closed 34 points, or 0.5 per cent, higher, at a five-week high of 7,343.9, while the broader All Ordinaries index finished 34.7 points higher, also 0.5 per cent, at 7,538.9.

Among the mining heavyweights, Rio Tinto appreciated $3.21, or 2.7 per cent; BHP added 86 cents, or 1.9 per cent, to $46.84; and Fortescue Metals rose 36 cents, or 1.6 per cent, to $22.55.

In coal, Whitehaven Coal slid 22 cents, or 3.2 per cent, to $6.73 after it downgraded its annual coal production and raised its cost forecasts on the back of labour shortages and weather disruptions.

Goldminer Newcrest Mining shed 8 cents, or 0.3 per cent, to $29.66, despite suitor Newmont having lifted its takeover offer to the equivalent of $32.87. Gold Road Resources gained 3.5 cents, or 2 per cent, to $1.80; Bellevue Gold rose 4 cents, or 2.8 per cent, to $1.47; and Regis Resources added 5 cents, or 2.3 per cent, to $2.25.

Over to lithium, and producer Pilbara Minerals slipped 15 cents, or 4.1 per cent, to $3.54, and fellow producer Allkem advanced 2 cents to $11.14. Mineral Resources, which mines iron ore as well as lithium, lost $1.46, or 1.9 per cent, to $77.41, while IGO, which produces nickel and lithium, lifted 3 cents, or 0.2 per cent, to $12.58. Of the lithium project developers, Core Lithium gained 1.5 cents, or 1.7 per cent, to 90 cents; Liontown Resources put on 10 cents, or 3.8 per cent, to $2.72; and Evergreen Resources gained 2.5 cents, or 8.3 per cent, to 32.5 cents, in its second day on the ASX, following a 20 per cent rise yesterday.

In energy, Woodside Energy gave back 1 cent, to $34.16; Beach Petroleum eased 2.5 cents, or 1.6 per cent, to $1.52; and Brazilian-based producer Karoon Energy slipped 6 cents, or 2.5 per cent, to $2.35.

On the industrial side, ANZ gained 5 cents, or 0.2 per cent, to $23.61; but its peers all ended in the red: Westpac retreated 3 cents to $22.12; National Australia Bank lost 14 cents, or 0.5 per cent, to $28.11; and Commonwealth Bank weakened 53 cents, also 0.5 cent, to $99.23. Investment bank Macquarie Group gained 69 cents, or 0.4 per cent, to $179.60

Biotech behemoth CSL lifted $2.14, or 0.7 per cent, to $303.89.

In the tech arena, data centre operator NextDC, spiked 90 cents, or 8.1 per cent, to $12.02, on the back an increase in new customer contracts. Payroll software company Xero advanced 56 cents, or 0.6 per cent, to $91.51 and logistics software provider WiseTech was up 28 cents, or 0.4 per cent, to $66.00.

US recession risk high, says Fed

In the US, the consumer price index rose 0.1 per cent in March for an annual rate of 5 per cent, both figures coming in well under economists’ consensus, giving the Federal Reserve a reason to pause on rate rises. But markets were slightly unnerved by the minutes of the latest Federal Open Market Committee (FOMC), which revealed that the Fed expects the banking crisis to cause a recession in the US this year.

The 30-stock Dow Jones Industrial Average retreated 38.29 points, or 0.1 per cent, to 33,646.5, after having been 200 points to the good at one stage. The broader S&P 500 slipped 16.99 points, or 0.4 per cent, to 4,091.95, while the tech-heavy Nasdaq Composite index dropped 102.54 points, or 0.9 per cent, to 11,929.34.

In the bond market, the US 10-year yield was unchanged at 3.4 per cent, while the more policy-sensitive 2-year yield was also flat, at 3.968 per cent.

Gold gained US$11.00, or 0.6 per cent, to US$2,014.70 an ounce, while the global benchmark Brent crude oil grade jumped US$1.72, or 2 per cent, to US$87.33 a barrel, but US West Texas Intermediate eased 19 cents, or 0.2 per cent, to US$83.07 a barrel.

The Australian dollar is buying 66.96 US cents this morning, up from 66.65 US cents at Wednesday’s close.