Our underlying companies in the Legg Mason Martin Currie Global Long Term Unconstrained Fund have shown resilience in terms of balance sheet strength and relative share price performance. However, given the unprecedented nature of the exogenous shock, and the recessionary environment we are going through near term, we have identified a limited number of risks,…

Shareholder activist groups are diverting company management’s time and energy towards narrow environmental and social causes. We explore why active ownership and purposeful engagement can achieve a better outcome for all stakeholders.

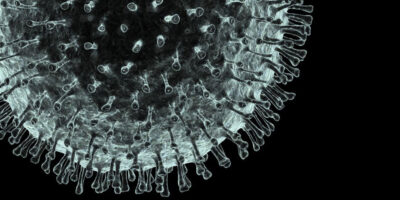

The COVID-19 global pandemic is unfolding quite differently to all other major market events seen through history. Governments globally are facing a delicate balancing act between trying to minimise the health impact of the virus, whilst managing the severe disruption to their economies. The sudden and sharp shock facing the global economy appears without precedence.

Stock markets have crashed, we can be confident of that. History suggests there is no quick recovery from crashes like these, which means lasting consequences for investors.

The world economy is teetering on a knife edge: the Chinese and Indian economies were slowing even before the COVID-19 Coronavirus, and as Australia was recovering from one of its worst bushfires.

The Grattan Institute has released its submission to the government’s retirement incomes review, a review called in anticipation of five annual increases in compulsory superannuation contributions, scheduled to begin in July 2021.

The government’s retirement income review is being told our current tax and benefit treatment of retirement incomes is a mess.

As a business evolves, one of the issues it must deal with is whether its branding adequately reflects product and service expansion over time. This is a question we have had to address at SuperAA (Superannuation Advisors Australia), a business that was launched in 2013 with the aim of offering SMSF audit services and technical support to accounting firms.

The private rental sector has expanded at more than twice the rate of the increase in Australian households in the last two decades. This increasingly diverse form of tenure now houses about one in four of us.

The ETF landscape continues to rapidly expand beyond the replication of major stock market indices such as the S&P/ASX 200 and S&P 500. Today’s investor can choose ETFs across different sectors, based on certain themes or even offering alternative weighting schemes, like yield or value, captured by the phrase smart beta.