(Pictured: Stephen Miller) As the fallout from the Bill Gross departure from PIMCO reverberated around the world last week, one of its main competitors, BlackRock, got lucky with the timing of its launch of a fixed income global opportunities (FIGO) fund for Australian investors, just like the one Gross famously managed at his old shop. According…

(Pictured: Doug Hodge) One of Bill Gross’s legacies at PIMCO, the firm he co-founded 43 years ago, is a refurbished room for yoga, pilates and other exercises at Newport Beach head office. Gross was a bit like that and PIMCO, for years, indulged him. While the room’s future is unclear, the occasional US$200 million annual remuneration…

(Pictured: Dennis Sams) Australia Post’s $6 billion super fund has become the fourth in a series of securities servicing contract wins for Northern Trust this year – all involving JP Morgan as the incumbent provider. And in an unrelated move, the fund has made its head of investments redundant. The change of custodian follows a review…

(Pictured: Bill Dwyer) Bill Dwyer, former head of investments at Western Australia’s Government Employees Superannuation Board, has returned to Sydney and taken up a position as senior consultant at JANA Investment Advisers. Dwyer said that after just over five years with GESB, he wanted to move back to Sydney with his young family. He joined GESB…

(Pictured: Nick Niziolek) The emerging markets story is about to get a bit more interesting as China introduces its next iteration of the “Through Train.” The last time this happened, in 2007, the Hong Kong share market jumped 60 per cent before slumping to lower-than pre-announcement levels. Pundits are saying: this time it’s different. The Through…

Index provider FTSE has produced a paper on the potential and risks provided by the 26 frontier countries and 368 stocks that make up the FTSE Frontier Index. Lower volatility than both emerging and developed markets is a surprising plus for the frontier index. The paper, ‘Frontier Markets: Accessing the Next Frontier’, discusses the economic…

(Pictured: Vittorio Lacagnina) QIC has underscored its belief in the growth of global infrastructure investing with the recruitment of Vittorio Lacagnina to head up capital formation for North America and Europe from the firm’s new New York office. Lacagnina was hired from SteelRiver Infrastructure Partners where he was an investment director responsible for global fund raising…

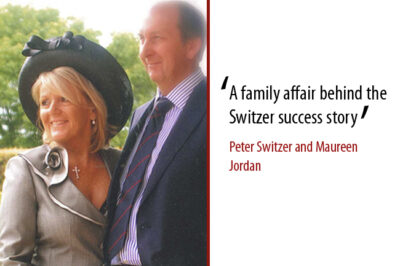

(Pictured: Peter Switzer and Maureen Jordan) Peter Switzer is a well-known commentator and presenter in the financial world, and an important influence on the investment behaviours of SMSF trustees through his financial planning business and SMSF newsletters. His wife, Maureen Jordan, is less well known but just as important in building and maintaining the Switzer brand….

(Pictured: John McMurtrie) by Greg Bright The Link Group, owner of AAS, has confirmed it has progressed its proposal to purchase Superpartners, its main competitor in the super administration market, entering an exclusive heads of agreement. If the deal proceeds to consummation, then the hard work begins. As predicted by Investor Strategy News (ISN July 13,…

(Pictured: Bill Gross) When a 70-year-old portfolio manager can cause such a stir you know he was someone special. Bill Gross, the Warren Buffett of bonds, will, incredibly, join rival firm Janus Capital today, US time. Janus has opened a Newport Beach “office” just for Gross, who famously dislikes travel. Gross’s departure was announced last Friday,…