(Pictured: Doug Hodge) Doug Hodge, a 24-year PIMCO veteran who has spent a lot of time in Australia and the Asia Pacific region, has become the new chief executive of the world’s largest bond manager. He has already participated in video links with other PIMCO executives around the world, including Australia, following the shock resignation last…

(Pictured: Gabriel Radzyminski) Despite the efforts of organisations such as the Australian Council of Superannuation Investors and researchers at Ownership Matters and other proxy advice firms, inertia reigns supreme among shareholders of Australia’s big listed companies, according to Gabriel Radzyminski. Radzyminski, one of only a handful of fund managers who refers to himself as an activist…

(Pictured: Randal Jenneke) Australia has a lot of Aussie equities managers. There are 139 Aussie equities funds in the Mercer survey, for instance, and this does not include hedge funds, insurance and government funds, and funds which don’t pass various requirements for entry to the survey. So, a newcomer, even one with a great international pedigree,…

(Pictured: Ha Thanh Tuan) As emerging markets continue their price recovery, notwithstanding a little stuttering by the Chinese economy, frontier markets, too, are attracting attention again. One of the darlings of Asia prior to the start of the global crisis, Vietnam, is looking more promising. According to a recent newsletter by Asia Confidential’s James Gruber, a…

(Pictured: Graham Hand) Cuffelinks, the free weekly newsletter about investments started by former Colonial executives Chris Cuffe and Graham Hand, has introduced a monthly markets analysis service and opened the doors to paid sponsorship for the first time. The monthly ‘Market Monitor’ section is: “A short review of the economic conditions in major global markets including…

(Pictured: Amanda Skelly) State Street Global Advisors, the biggest provider of exchange-traded funds (ETFs) in Australia, is predicting another year of strong growth in the sector following last year’s 50 per cent increase, which took total ETF fund assets to $10 billion. Amanda Skelly, head of ETFs for SSgA in Australia, told clients last week that…

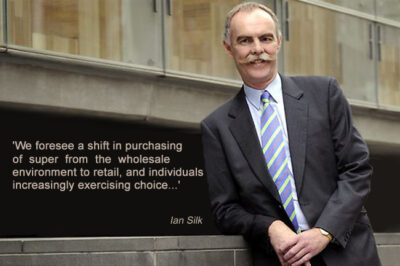

Ian Silk … ‘it’s important we don’t get seduced by size and position in the marketplace’ Belying its size, AustralianSuper, Australia’s largest superannuation fund, is continuing a history of innovation with its current program to insource the management of about 30 per cent of its investments. The fund has become a bellwether for others. Greg…

(Pictured: Nick Hamilton) With the good graces of his former boss, the head of institutional business development for Colonial First State Global Asset Management in Sydney, Nick Hamilton, is heading back to the UK to join a much-anticipated start-up funds manager led by former Invesco Perpetual star portfolio manager Neil Woodford. The UK firm, to…

(Pictured: Damian Moloney) Frontier Advisors, Australia’s second-largest asset consultant, has added the UK and Europe to its research alliance base, complementing a deal with Segal Rogers Casey for North America last year. Alliances with research firms covering South America, Asia, the Middle East and Africa, are in the wings. Frontier and Rogers Casey last year…

(Pictured: Simon Shields) One of the various consequences of the GFC for super funds and other investors is the greater freedom they are now prepared to offer their managers. It is a bit like – but not exactly – a return to the balanced fund era of the 1980s. A new boutique which emerged in…