Super funds are an accumulation wonder of the world, but when it comes to retirement they’re in the same leaky boat as every other defined contribution system. BlackRock wants to bail it out.

Perpetual will use Charles River Development’s Investment Management Solution for its front-office operations as it prepares for an “evolving investment management landscape”.

It’s not just FOMO. Truly innovative business models are helping push stocks higher, says Capital Group, and for some of them there’s a lot more growth to come.

TPA is an “uncommon and demanding” approach to running an investment organisation, according to the Future Fund, but a rewarding one – as long as institutions that take it up know that it’s not a transformation that should be embarked upon lightly.

A significant chunk of the world’s largest institutional investors are doing what the market tells them and moving faster on asset allocation changes and investment decisions as uncertainty spikes.

It’s picked up hundreds of billions in custody assets from the NAS exit, but BNP Paribas wants to lock them down before it goes hunting for more – with private markets and its offshore presence at the top of the pitch deck.

Australia’s superannuation system hasn’t seen the end of consolidation, according to Mercer, with megafund mergers on the horizon and the number of small funds likely to drop precipitously.

Investing with a manager when they’re winning is usually peak risk, but that’s what a lot of funds do. Meanwhile, passive investing remains “the elephant in the room”, even as it allows for greater freedom to invest in alpha-generating assets and strategies.

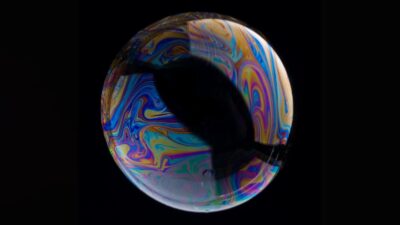

In the first half of 2022 the market fell almost as much as it did when Europe tumbled into World War Two. Then it reversed course – and famed bubble spotter Jeremy Grantham says a new artificial intelligence bubble is the cause.

Australia’s biggest super fund has slashed the headcount in its Melbourne-based global equities team as it prepares to build out a new crew in its rapidly expanding London office.