As AustralianSuper continues to grow, Mark Delaney is focusing his attention on the burgeoning private markets space and the problem of culture in megafund land. “Size can creep up on you. You stand still, and all of a sudden you’re bigger than what you think you are. I first started managing pension money 20 years…

Sean Henaghan’s new role at Aurora Capital sees the former AMP CIO turn his gaze to climate change – and the question of what retail investors really want from their money. For Sean Henaghan, a “return to the coalface” of investing has come with its share of challenges. “You’re doing everything. It’s quite amazing what…

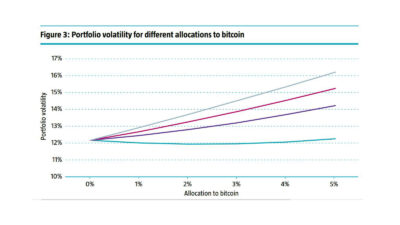

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…

China’s regulatory crackdown is just one piece of the puzzle when it comes to investing in Asia. The real game is geopolitics – and in that area, things are heating up. “I think Asia will probably look better as we move into 2022. I think the remainder of 2021 is really about timing of entry;…

The problem with high expectations is that you have to keep meeting them. And after a year where some funds returned 20 per cent, investors and super members are expecting more, more, more. Investors are relentlessly cheerful creatures. According to Schroders’ latest Global Investor Study, Australian investors (defined here as those expecting to invest the…

The tilt at Sydney airport and the privatisation of WestConnex has showcased the appetite for Australian infrastructure from super funds and offshore investors. The only problem is in meeting it. “The appetite to invest in Australia, as you’re seeing through these mega-privatisations, is huge,”says Nicole Walker, chief commercial officer at specialist alternative asset manager HRL…

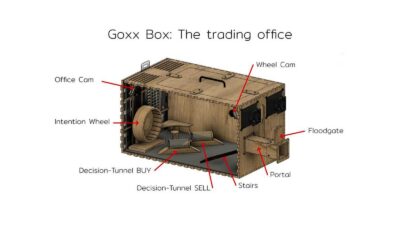

Two case studies this week provide an interesting opportunity to re-examine investor behaviour. As it turns out, a monkey can beat the market. Have you heard the one about the crypto-trading hamster? Mr Goxx is the only employee/inhabitant of Goxx Capital, a specially outfitted cage which allows him to trade cryptocurrencies based on his movements…

While the worst is probably over, emerging markets are still in a tailspin. But the best thing about starting low is that can aim high. For many investors, China’s recent regulatory crackdown has been a waking nightmare. Add on the delta variant, rolling blackouts, and Evergrande, and it’s a little disconcerting to hear Dr Joseph…

Fiona Reynolds, the former CEO of the UN-supported Principles of Responsible Investment (PRI), has continued a barrage of board and executive appointments with a director position at Frontier. Reynolds will join the board of Frontier as a non-executive director as she concludes a nine-year posting as chief executive for the PRI. The move comes as…

September has historically been a bad month for markets, and it could be about to get worse. But then again, talk is cheap. Everybody in equity markets knows that September is the cruellest month, to paraphrase Elliot.Nobody really understands why it happens (theories range from tax-related selling to seasonal behavioural biases) but it happens. The…