Semiconductors are ‘the new oil’. The big problem is getting them. “What we’re seeing is an explosion in the amount of data gathering and measurement and functionality across whole swathes of industries,” says Matthew Reynolds, Capital Group investment director for Australia. “Chips are literally going into every device you can think of – not just…

As investment managers turn their eyes to the reputational risks of ESG, the custodians that support them have a responsibility to do the same, according to BNP Paribas Securities Services. “Underneath the whole challenge of ESG, as our clients are looking what it means to be an investor and holding all of those investments, the…

AustralianSuper is no longer the underdog. The question is what becomes of the industry fund culture when industry funds “are the status quo”. As Australia’s first $200 billion+ megafund, AustralianSuper is no longer the upstart born of the 2006 merger of the Australian Retirement Fund (ARF) and the Superannuation Trust of Australia (STA). It’s also…

Despite APRA’s move to name and shame 13 underperforming funds, it’s clear that Your Future Your Super (YFYS) is a work in progress. More needs to be done to make it a true and fair test. Call them the Dirty (Baker’s) Dozen: 13 funds named and publicly shamed for their failure of the YFYS performance…

The negative correlation between bond and equity returns is taken as scripture in financial markets. But Capital Fund Management (CFM) warns that the times may be changing. The negative correlation between bond and equity returns is the (relatively) simple idea that when equities go down, bonds go up, allowing bonds to act as a…

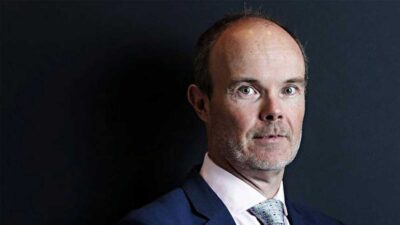

While Australia’s sovereign wealth fund has seen a massive return of 22 per cent, the good times won’t last. China tensions are weighing heavily on Peter Costello’s outlook. Rebounding from a negative 0.9 per cent return during the depths of Covid-19 is no small feat, but Peter Costello, Future Fund chairman, told media on Thursday…

Australia’s direct lending market is set to take off as the big banks withdraw and investors realise the vast opportunities offered by the businesses that form the backbone of corporate Australia. “We want to grow this market, because we believe we’re offering something that’s going to be highly beneficial to investors in Australia in the…

Going it alone is never easy. But it seems that for Dr Joseph Lai, the hardest part of starting his own boutique was picking a name. One candidate was ‘Iora’ – a colourful songbird found across many of the emerging markets that Lai has spent his career investing in. But Lai and his colleagues ultimately…

Magellan will continue to spend big on ventures like upstart investment bank Barrenjoey and fintech Finclear as it diversifies away from its cornerstone global equities business. With investors continuing to question the lacklustre performance of Magellan’s global equities strategy, which has been the focus of (occasionally unfair) media attention for going on a year now,…

Liberal senator Andrew Bragg believes the Future Fund should be made Australia’s default superannuation fund. But national superannuation is a political minefield. In conversation with Simon Cowan, research director at the Centre for Independent Studies, Bragg called compulsory superannuation a “fundamentally illiberal, paternalistic policy” and said that the Australian government should “take its responsibilities more…