The sixth report of the Intergovernmental Panel on Climate Change (IPCC) has lit a fire under fund managers – literally. The problem is figuring out what they can do about it. “In order to get to any kind of stable climate outcome, we need to reduce emissions, and we haven’t done that yet,” says Pablo…

The public facing aspects of Your Future Your Super (YFYS) risk creating a “pseudo ‘best in show’, according to new research from Deloitte. The research, titled “New ways to judge the past“, highlights a number of mostly unexamined pain points in the YFYS legislation and regulations – notably around the ATO’s YourSuper comparison tool and…

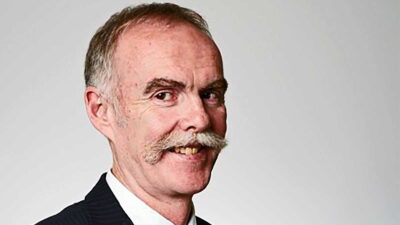

In his final speech to the Australian Council of Superannuation Investors (ACSI), Ian Silk defended the organisation against all comers. But the Morrison Government is unlikely to relent. “To be prudent stewards of capital and to act in their members’ best interests, investors must remain focused on ESG issues in their portfolios,” Ian Silk said…

Rachel Halpern has gone from corporate cop to an adviser to some of the largest super funds in the country, and brings a “forensic approach” to the risks of Australia’s sustainability boom. “The direction that investors are going in is systems level thinking,” says Rachel Halpern, JANA’s newly appointed head of sustainability. “Methods to ensure…

Alexis George, AMP’s new CEO, faces the task of returning Australia’s oldest wealth manager to its founding principles. The question is how deep the rot runs. What’s to say after nine days in the job? Not a lot. Alexis George took the reins just over a week ago and, sensibly, has not hit the ground…

Grey swan risks abound in fixed income markets, with stickier than expected inflation and fresh lockdowns posing a threat to the orthodox view of a global recovery. The great inflation debate has gripped markets as they come to terms with the implications of the massive fiscal and monetary stimulus unleashed through 2020. But while many…

Funds should allow retiree members to request they select a retirement product on their behalf, and create “safety net provisions” for those who don’t, according to new research. New research by David Bell, executive director of the Conexus Institute, Geoff Warren, associate professor at the Australian National University, argues that relying solely on retirees to…

The Standing Committee on Economics is launching a new inquiry into big super. Not everybody is happy about it. Compulsory viewing for many professionals and reporters, the Standing Committee on Economics is infamous for its hardball interrogations of Australia’s biggest institutional investors, and the announcement of a new inquiry will likely have some stakeholders tearing…

The portfolio that drives excess returns over the next decade ‘will likely look a lot different’ than that of the 2009-2019 period as the world enters a new era of outsize economic policy. Private equity giant KKR believes that markets are accepting “the visible hand” of government intervention across areas as diverse as inequality, monopolistic…

The value vs growth competition isn’t a competition, according to Schroders. Value will always outperform because it exploits “the one thing that never really changes”: human beings. Markets have seen a period of very strong value performance since the announcement and rollout of effective Covid-19 vaccines – the so-called “Vaccine Monday” – as markets reappraised…