Last week was a big one for the chief executives of AustralianSuper and Cbus. Their funds announced record-setting returns for the financial year and the next day they both took another hammering from a Commonwealth parliamentary committee. The House of Representatives Standing Committee on Economics, chaired by Tim Wilson, a Liberal MP, is often enlivened…

While Japan has long been anathema to western investors, a series of corporate governance reforms are fueling renewed interest in the country. Japan’s status as a technologically advanced country with a happy, healthy population has long belied its stagnating economy and uncompetitive corporate landscape that has seen a slow grind downwards for markets since the…

While Asian financials will benefit from the world’s fastest growing middle-class, they also face massive headwinds from fintech disruptors and the looming threat of central bank digital currencies. Asian financials are still an important sector for investors and one that is poised to benefit from the region’s emerging middle-class and greater wealth accumulation in developed…

Super funds have battled with providing financial advice for decades but have not yet found a solution that can make it affordable and efficient for millions of low-balance members. Digital advice – including ‘robo’ – which in theory solves the affordable problem, has also been a decades-long dream for Australian wealth management, a revolution in…

Australia’s second-largest super fund will look to bridge the trust gap between industry funds and independent financial advisers (IFAs) as it expands further into the external advice space. Matt Willis, Aware Super’s head of business development, says the fund plans to build on the advice offering it acquired through its 2020 merger with WA Super…

Jordan Cvetanovski and Steven Glass, former Pengana Capital equities managers, have resurfaced at the helm of their own venture, Pella Funds Management. Cvetanovski and Glass formulated their offering after leaving Pengana in March. They have now recruited two staff and commenced discussions with prospective investors for the new international equities boutique. Cvetanovski will be CIO…

The Your Future Your Super (YFYS) benchmarks will require an all-hands-on-deck approach to a “performance test to be reckoned with”, according to Willis Towers Watson’s Nick Callil. With funds required to inform members if they fail the test – an “unpalatable action for any fund” – and barred from accepting new members into an underperforming…

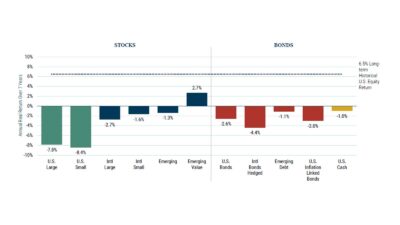

GMO has released its latest borderline-apocalyptic seven-year forecast for stocks and bonds as it warns clients to “concentrate assets where the bubble ain’t”. GMO’s extraordinarily bearish forecasts predict a negative annual real return over seven years across the majority of both stocks and bonds, with only emerging markets value stocks getting a positive, if slim,…

Global stimulus and inflationary expectations mean that listed infrastructure is in the recovery hot seat, but Your Future Your Super presents a homegrown challenge for managers. “We’ve got this perfect storm for listed infrastructure at the moment in the sense that the fundamentals are good and this huge growth thematic is still intact,” according to…

Recently hitting its two-year anniversary, Paradice Investment Management’s emerging markets strategy has been on a “rollercoaster ride”. Co-portfolio managers Edward Su and Michael Roberge have spent the last two years navigating the frenzied market volatility of covid-19, the fallout of mass protests in Hong Kong, and trade wars with China as they pursue opportunities in…