Banks, Qantas pace market ahead of inflation data, ELMO jumps on private equity interest

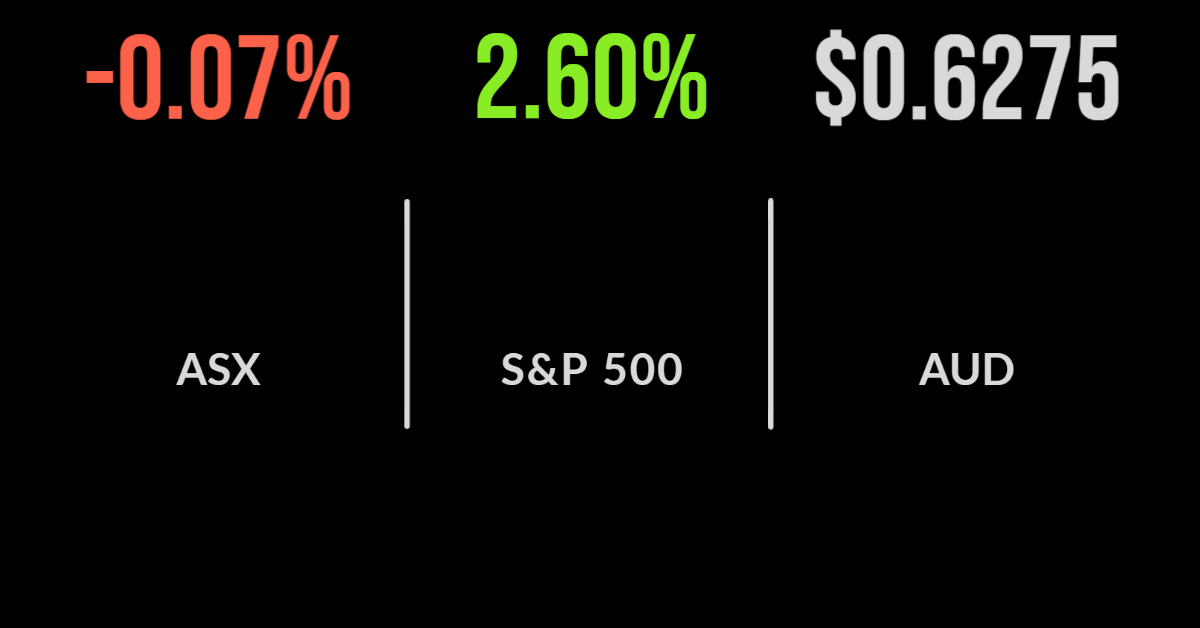

The local market overcame selling pressure ahead of awaited US inflation data to post a small loss of 0.1 per cent.

The financials sector was the standout, gaining 1.4 per cent, with the likes of National Australian Bank (ASX:NAB), up 2 per cent, buoyed by the improving profitability of Bank of Queensland which reported yesterday.

The energy and healthcare sectors were among the biggest detractors, falling 1.9 and 0.9 per cent respectively on concerns of a slowing global economy.

Qantas (ASX:QAN) was the standout on the day, however, after the company upgraded guidance indicating it now expects to deliver an underlying profit of $1.2 to $1.3 billion.

The group has overcame a media nightmare to capitalise on strong travel demand, with a reduction in cancellations from 4 to just 2.4 per cent of flights in August.

The group also indicated they would offer an additional 1 per cent in wage increases with the share price gaining 8.7 per cent on the news.

The company will be back in the black by the end of December.

ELMO Software jumps, Fortescue Future to hit production in 9 months, Medibank hit by hack

HR and payroll solutions group ELMO Software (ASX:ELO) gained more than 28 per cent after the company confirmed they had received takeover interest from private equity group Accel-KKR and a number of other parties; there was little in the way of pricing or valuation.

Fortescue’s (ASX:FMG) Future Industries business is expected to announced its first major clean energy project within the next 12 months as the company seeks to hit their hydrogen production goals, which have been challenged by many in the industry.

Shares in Medibank (ASX:MPL) were placed into a trading halt, with the company confirming some of its 3.7 million members had lost access to their accounts due to a security of hacking issue.

Investment platform Netwealth (ASX:NWL) were 0.6 per cent lower despite the company reporting another $2.9 billion in inflows during the quarter, up 8.1 per cent on June.

Total assets were 4.4 per cent higher to $58.1 billion, with the number of active accounts up 2.4 per cent to 118,464.

Markets bounce as inflation slows, Taiwan Semi profit surges

All three US benchmarks surged higher on Thursday with a slight fall in the inflation rate buoying confidence in the market.

September CPI figures showed an annual increase of 8.2 per cent, ahead of expectations, but slightly down on the prior quarter.

However, core inflation data continues to climb, reaching 6.6 per cent, which excludes food and fuel prices.

Pundits are now forecasting two more 75 basis point hikes before the end of the year.

Despite this, the Dow Jones finished 2.8 higher, the Nasdaq, 2.2 and the S&P500 2.6.

Shares in Taiwan Semiconductors (NYSE:TSM) gained close to 5 per cent after the company reported a nearly doubling of profit on the back of a 50 per cent increase in revenue despite supply chain pressures.

Shares in Netflix (NYSE:NFLX) also gained close to 3 per cent after confirming the new ad-supported platform will be priced at US$6.99 per month in the hope of attracting new customers once again.